Strategic Guidance

6 keys to unlock a subscriber-led growth strategy

Building dynamic relationships and retaining subscribers in a rocky economy

Authored by: James Henderson and John Phillips

Across industries, companies are expanding their digital offerings to establish and nurture subscriber relationships. To drive conversion, grow upsells, and increase revenue, modern businesses need to have a deep understanding of their subscribers in order to present targeted offers at the right time along a subscriber journey. But the current economic climate is making customers more likely to churn. In fact, a recent study found that 53% of customers say they would cancel streaming subscriptions or other memberships if they were unable to pay other bills.

How do you win and retain subscribers, even in a rocky economy? To help answer this question, the Subscribed Institute regularly meets with partners and leaders in the industry at events like our Subscribed Executive Summit and Subscribed Live to share knowledge and insights. And we collect and analyze the latest data from hundreds of companies in the Subscription Economy.

The results are clear — the most successful subscription businesses prioritize customer-centric business models and subscriber-led growth (SLG) strategies to increase retention.

SLG is a strategic approach that uses insights about subscribers to grow customer lifetime value (CLV) and continually optimize the complete subscriber experience. In practice, this looks like building digital relationships and nurturing and monetizing those relationships through a dynamic, ever-growing portfolio of digital services that deliver exactly what your subscribers are looking for.

Why is an SLG approach so powerful? 70 to 80% of a company’s annual recurring revenue (ARR) comes from existing subscribers, so investing in initiatives geared towards nurturing relationships and increasing retention is absolutely vital. And when you know more about what matters to existing subscribers, you can more effectively predict the needs and demands of new customers.

Here are the 6 keys to unlock a subscriber-led growth strategy:

- Make customer lifetime value (CLV) your north star metric

- Leverage real-time subscriber intelligence

- Empower internal teams to quickly test, learn, and iterate

- Enable dynamic offer creation to drive conversion and retention

- Offer more payment methods to reduce churn

- Stay relevant by adopting consumption-based models

1. Make customer lifetime value (CLV) your north star metric

Designing a subscriber-first model starts with making customer lifetime value (CLV) your north star metric to determine success, guide decision making, and generate revenue. Customer lifetime value (CLV) measures how much profit you can expect to make from a customer throughout their time as a customer of your business. And CLV isn’t static — leveraging subscriber intelligence can help guide the way you design the subscriber experience, in order to increase engagement and future value.

But product, pricing, and growth teams often rely on a homegrown system to manage subscriber experiences and offers. These hard-coded solutions slow down the ability to respond to changing subscriber needs, resulting in missed opportunities and higher churn rates. Teams are unable to act on a consolidated understanding of each subscriber’s history, consumption, and transactions across commerce, billing, and other systems.

The better you know your customers, the better you can personalize your product, give customers tips for getting the most value out of their subscriptions, and effectively target customers with complementary offerings. In order to do this, you need a subscriber-led growth engine that enables your business to act on a deep data-driven understanding of each subscriber. And there’s also an art to knowing when to prompt customers to take advantage of different options. That’s where customer intelligence comes in.

– Olivier Schwaanhuyser, Strategic Product Owner, Digital Acceleration, NRC

Learn more: The right offer for every user, every time

2. Leverage real-time subscriber intelligence

Accurate, actionable insights are essential to providing a seamless customer experience. Several different data streams can surface these insights:

- Registration. Using registration and intelligent paywalls to capture valuable first-party data is the key to unlocking revenue throughout the subscriber lifetime. Use registration forms to gain actionable insights about users, such as areas of interest.

- Transactions. Every action a customer takes, whether it’s changing their plan, showing interest in a particular offer, or selecting payment preferences, gives you information about them.

- Cross-platform. To truly gain an understanding of user preferences, you need to leverage data about customer behavior on multiple platforms — such as watching sports news on their tablet or listening to podcasts on their mobile device.

- Product interactions. The way customers use their subscriptions can help you tailor their experiences to their needs—or intervene with those at risk for churning.

- Contract information. The type of contract, duration, renewal date, and other details can inform the types of experiences you offer your existing customers.

- Trial periods. By providing trial offers, you gain greater visibility into the type of content a user would interact with if they were a premium subscriber.

It’s not enough to simply collect this information. The next step is turning data into actionable subscriber intelligence that informs customer experiences. For example, by using subscriber activity analysis, The New York Times prioritizes the product features that drive the most engagement and retention. By continually focusing on CLV and delivering relevant experiences to each subscriber, you generate more interactions and increase the likelihood that the subscriber will commit again.

All this feeds back into a powerful data flywheel that you can place at the heart of your transformative growth strategy, a perpetual motion machine that creates greater and greater CLV. Subscribers use the product, you learn about the subscriber, you make an offer that you know is valuable to the subscriber, and you repeat the cycle.

“One of the challenges in our business was understanding data, where to get it and how to analyze it. [Thanks to Zephr] we’re getting better at that and we’re constantly testing and making changes to what we’re doing and trying out different strategies.”

Learn more about data types: What is 0, 1st, 2nd and 3rd party data?

3. Empower internal teams to quickly test, learn, and iterate

Once you have the intelligence about your subscriber, you need to be able to act on it quickly. But this process often gets bogged down due to its dependency on technical teams to bring configurations to fruition. Delays in new offerings can cause churn and lost revenue — especially when competitors are also reacting to the market and looking for new ways to win new customers. The quickest way to determine customers’ willingness to pay is to experiment with offers and find out what works.

Flexible, low-code rules builders are key, putting the power to make changes into the hands of the people who have the ideas and own the KPIs. Empowered to quickly experiment and learn, internal teams themselves can create more targeted offers that are tailored to subscriber needs.

This ability to enable quick changes and experimentation is vital for growth. Companies with more changes in their customers’ subscriptions than the prior year see more growth and reduced churn. It makes sense — giving subscribers more options not only improves their overall satisfaction, but it also allows them to tailor their own experiences. By providing alternatives to canceling, like pausing or making changes to a plan mid-cycle, it becomes more financially feasible for a customer to stay longer and builds loyalty and trust.

– Ken Houseman, VP Product Management, The New York Times

Get started today

4. Enable dynamic offer creation to drive conversion and retention

In a world of endless choices, if the subscription package isn’t quite right, existing and potential customers fall through the cracks in different ways. With customers looking for ways to save money in the current economy, a well-timed discount, bundle, or flexible subscription offer can help retain customers under pressure. And because the formula for the offer is always evolving, you need the agility to adapt.

As part of an SLG strategy, many companies are now choosing to unbundle products. Instead of offering one monolithic product to subscribers, each piece of their product is individually consumable and valuable to different subscribers. This further enables the collection and use of subscriber intelligence with regard to individual product engagement and value. Unbundling also prevents churn, by letting companies create more targeted offers and upsells that they know a subscriber will value. All of this feeds back into your data flywheel, increasing CLV.

As new data and insights like this come in, it’s vital that your business is able to rapidly experiment with variables like pricing, packaging, contract durations, and promotions, to create the offers that will most effectively retain existing customers and prevent churn rates from rising. Curate Dynamic Offers in real-time with different prices, different product bundles, and different messaging and imagery. Target freemium subscribers with time-limited offers, drive upsells with discounted add-ons, and decrease churn through win-back and churn save strategies.

– Shrav Mehta, Founder and CEO at Secureframe

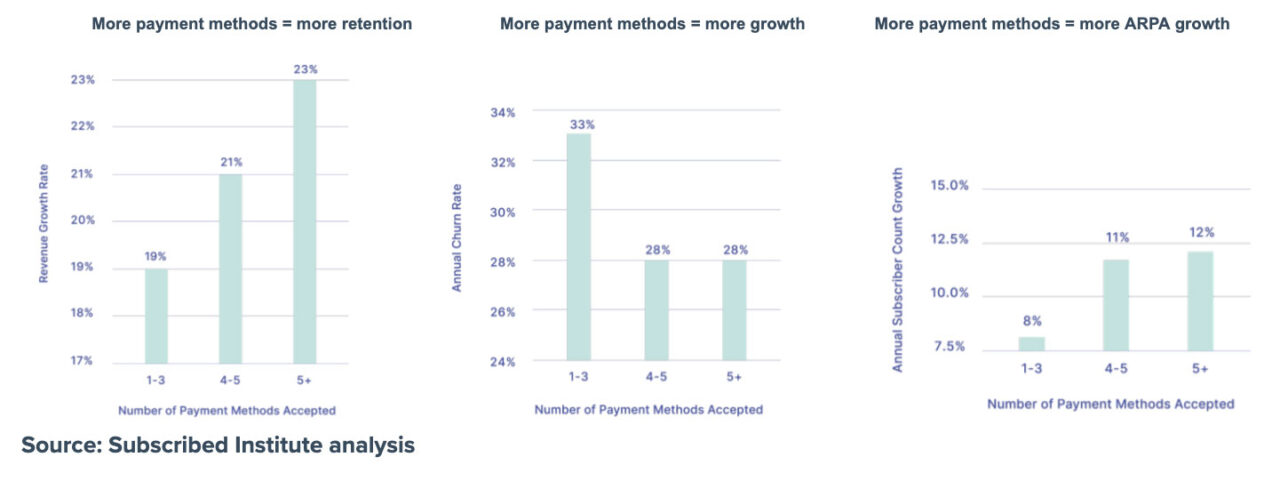

5. Offer more payment methods to reduce churn

Giving your subscribers more payment method options can lead to higher retention rates and more revenue and average revenue per account (ARPA) growth. Why is this important? A large portion of churn is involuntary, with payments issues being the #1 cause.

Managing electronic payments is key to growth and customer retention, but the intricacies of handling multiple payment methods, currencies, and gateways can be daunting. Fortunately, with the right paywall and billing and payments solutions in place, companies can consolidate payment management, identify where they could be losing money, and address revenue leakage before it even starts.

– Curtis Huber, Senior Director, Circulation and Audience Revenue at The Seattle Times

6. Stay relevant by adopting consumption-based models

Consumption models have been on a rise and it’s obvious to see why customers prefer consumption pricing: the price they pay is aligned to the value they gain, it reduces friction to adopt a new service, and they don’t have to be locked in.

Today, more than 45% of the companies that we work with already offer some form of consumption pricing within Zuora’s system, and we continue to see that number grow. 61% of SaaS will have adopted some form of consumption pricing, with another 21% planning on testing in the future.

SaaS companies that offer consumption-based pricing model options do better than non-consumption subscription models in NRR performance. It’s also important to note that the businesses that did better offered a mix of consumption and non-consumption subscription-based pricing models. We believe the positive NRR effect is most powerful when companies offer consumption-based pricing to the customer segments that most need and value them.

The highest-growth companies use a more value-based “per unit” pricing model versus a “flat fee” access model. By unbundling products, modern businesses like The New York Times can offer subscribers smaller, more consumable units that are more likely to meet their needs.

To act on these insights and rollout a consumption-based model for your business, you need the right tools and strategies that can enable you to adopt consumption pricing, turn data into measurable units, accurately rate and bill, analyze insights, and recognize revenue.

– Moshe Sarusi, Director of Finance Operations and Global Billing, Yotpo

Learn more: Stay customer-centric with consumption pricing

Introducing the world's first subscriber-led growth engine

One-size-fits-all approaches to subscriptions no longer work. To curate a customer-centric business model and retain subscribers, companies must develop strategies and implement the technology that can support these initiatives.

Zephr is the world’s first subscriber-led growth engine:

- Create truly personalized subscription journeys. Make CLV your north star metric by curating tailor-made experiences for every customer that deliver powerful subscription relationships for life.

- Capture and enrich user data to maximize revenue. With intuitive features and powerful data collection capabilities, Zephr is a real-time decision solution. Create personalized conversion strategies at all points of the subscription journey, collecting fully GDPR and CCPA compliant data that can be used to drive the value proposition for each potential customer.

- Save time with a low-code rules builder. Build, test and optimize campaigns instantly without having to rely on engineering teams and without the risk of disrupting the site or breaking other campaign rules.

- Quickly generate the right offer for the right customer. Dynamic Offers is a completely new way to think about finding the best offer for every subscriber, by tailoring your selection of products, prices, and messages to create a targeted offer for every customer.

- Seamlessly integrate with the rest of your tech stack. Enable more payment methods and implement consumption-based pricing, billing, and revenue strategies. Zephr automatically plugs in and works with the rest of your Zuora products.

Together with our customers and partners, we are building a future where technology is engineered to meet the precise needs of companies in the Subscription Economy. Where businesses are empowered to monetize and nurture subscriber relationships, to build trust and loyalty with each of their customers by offering exactly what they want, at the right time, at the right price. A world where recurring revenue becomes relationship revenue and customer lifetime value informs our values.

Learn more about the authors

Grow and scale your business

GUIDE

Modern Business Works: A roadmap to successfully achieve transformation

GUIDE

The Modern Business CFO: Strategic value of finance

GUIDE

Use subscriber intelligence to deliver seamless customer experiences

The Subscribed Institute