BENCHMARKS / INSIGHTS

How Much Revenue Is Driven by Existing Subscribers?

Authored by: Amy Konary, Nick Cherrier, Harshad Shrikhande

The Nature of Recurring Revenue

One of our core missions at the Subscribed Institute is to identify leading practices and levers of success to assist companies at various stages of maturity in their Journey to Usership™. Whether launching, optimizing, scaling, or leading, success in the Subscription Economy® is predicated on a business’s ability to satisfy its customers—repeatedly!

Customer centricity makes a subscription business different from a more traditional one. While most businesses will claim that they are indeed a customer-centric company, the reality is that many still operate with the core objective of selling units of product or capabilities to customers via the most efficient channels possible in a linear transaction-oriented manner. While repeat customers are always a plus, traditional businesses pass the risk of value realization through product usage to their customers at the point of sale. In other words, how customers use the product and their level of satisfaction do not ultimately impact the company’s revenue—although a poor experience may lead to fewer referrals.

For subscription businesses, however, revenue is realized over time. A firm’s success hinges on increasing the number of paying subscribers and customer lifetime value (CLV). With subscription businesses, there are three core levers for monetization: subscriber acquisition, retention, and expansion (growth in customer value).

Businesses may face a question as they allocate resources: How much do existing subscribers contribute to a company’s revenue?

How Much Do Existing Subscribers Contribute to a Company’s Revenue?

Zuora’s ® Subscribed Institute analyzed data across several quarters from over 891 companies to answer this question. For each company, we identified how much revenue was generated by new versus existing subscribers. The answer: existing subscribers (active in previous periods) generated on average 76% of a company’s annual recurring revenue (ARR), or, more generally, between 70% and 81%.

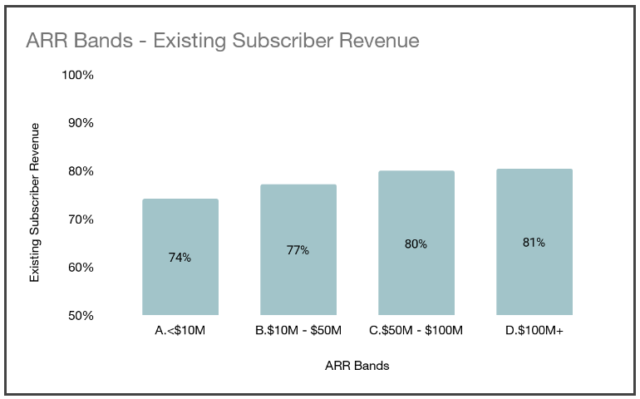

Having worked with many subscription businesses, we suspected the share of revenue generated by existing subscribers to be correlated to the degree of maturity of a business. To test this hypothesis, we classified subscription businesses into four ARR buckets: less than $10m, between $10m and $50m, between $50m and $100m, and over $100m. This analysis (see Figure 1) demonstrates that smaller subscription businesses have a lower share of their revenue generated by existing subscribers (74-77%) than more established subscription businesses (80-81%). In other words, as a company grows and builds a solid customer base, more of its future revenue will come from that customer base instead of new subscribers.

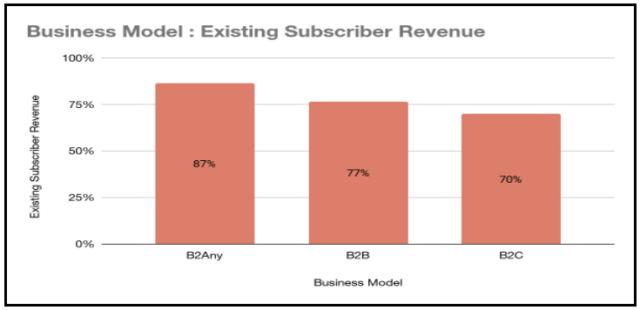

We also analyzed the differences between B2B and B2C (see Figure 2). Businesses targeting consumers tend to have a lower share of revenue generated by existing subscribers (70%) due to higher churn levels and more new subscriber acquisitions than B2B. In reverse, businesses targeting other businesses and consumers (B2Any) have 87% of their revenue sourced by existing subscribers, much higher than those solely focused on B2B (77%).

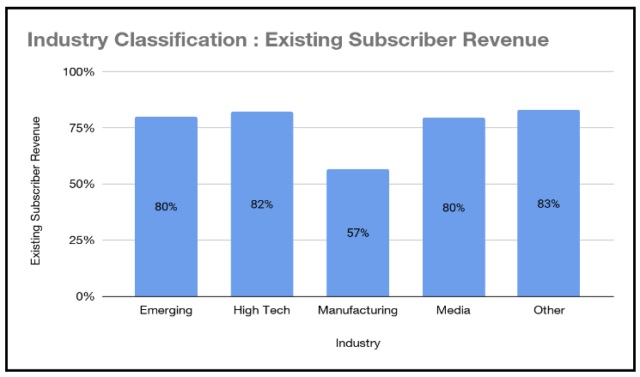

Lastly, we analyzed revenue from existing subscribers by five industry sectors (see Figure 3), and found similar revenue percentages across all sectors except for Manufacturing. In the other four industries (Emerging, High Tech, Media, and Other), existing subscribers were responsible for 80-83% of ARR (i.e., new subscribers drove 17-20%). In Manufacturing, existing subscribers only generated 57% of ARR. We attribute this relatively low share of ARR to the fact many manufacturers are in the early stages of their subscription initiatives and are highly reliant on new acquisitions for revenue growth.

Conclusion

Fast growth is a key objective of subscription businesses. The model itself, based on recurring revenue, is often chosen because it can help companies grow faster than traditional businesses and proves more resilient in times of crisis. This objective is then used to justify resources allocated to bring in new business and supercharge sales and marketing efforts. However, this emphasis should not come at the detriment of existing subscribers.

With 70 to 80% of revenue being generated by existing subscribers, it is essential to resource teams to focus on customer retention and expansion. Growth and demand teams must focus on growing relationships within the customer community. Indeed, successful subscription businesses develop competencies in upsell and cross-sell motions, which require less effort and investment than new customer sales.

As earlier mentioned, as businesses mature on their Journey to Usership™, they will grow their customer base and need to pivot from focusing on new subscriber acquisition to a core strategy that is more balanced with an emphasis on customer retention.

Remember, existing research shows customer acquisition is more costly than customer retention. According to Bain & Co, a 5% improvement in customer retention leads to a 25% improvement in profit. The case for caring for existing subscribers is vital, so don’t neglect them.

Key Takeaways

- Existing subscribers generate 70-80% of subscription companies’ revenue.

- The more mature the subscription business, the higher the share of revenue generated by existing subscribers.

- As subscription companies mature, they need to pivot from focusing on customer acquisition to focusing more on retention and expansion.

Industry Sectors

- High Tech includes providers whose software is accessed via the cloud, and monetized via subscriptions, including traditionally perpetual software shifting to SaaS. This includes SMB SaaS, B2Every SaaS, and Enterprise SaaS Companies.

- Media includes content providers, over-the-top (OTT) streaming media companies, television and radio broadcasters, cable operators, search and navigation services, editing services, and production companies. It also includes publishers of newspapers, magazines, and books, as well as educational content providers, and corporate research providers.

- Manufacturing includes fabrication services, industry specific software providers, industrial design, heavy equipment, and tool manufacturers.

- Emerging includes sectors like Retail, Financial Services, Healthcare, Real Estate.

- Other includes video conferencing, satellite communications, broadband networks, digital infrastructure, fiber networks security, technology, energy, transportation, scientific instruments, construction, management consulting, legal assistance, data services, market research, staffing and recruitment, marketing and advertising, and records management

Forward-Looking Statements

This press release contains forward-looking statements that involve a number of risks, uncertainties, and assumptions, including but not limited to statements regarding the expected growth and trends of subscription-based companies (including companies in the SEI report) and non-subscription based companies. Any statements that are not statements of historical fact may be deemed to be forward-looking statements, and actual results could differ materially from those stated or implied in forward-looking statements. The SEI report and paper also include market data and certain other statistical information and estimates from other parties, including industry analysts and market research firms. Zuora believes these third party reports to be reputable, but has not independently verified the underlying data sources, methodologies, or assumptions. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties and may differ materially from actual events or circumstances.

Learn more about the authors

The Subscribed Institute