BENCHMARKS / INSIGHTS

Super Retainers: Early Lessons For Uncertain Times Ahead…

Authored by: Jonathan Brown, Senior Director, Customer Strategy and Harshad Shrikhande, Senior Data Scientist at Zuora

Everyday it seems like more and more economists are predicting a recession for 2023. Such a prospect is causing many subscription businesses to focus their limited resources on driving net retention as a strategy to “weather the storm”.

But, as Gainsight CEO Nick Mehta often talks about, there’s more nuance to retention than meets the eye. A holistic approach, one that balances minimizing loss and maximizing value from existing customers, will be imperative for navigating the economic turbulence ahead.

At Zuora, we’re lucky that our customers are some of the best subscription businesses in the world. Many of which have outperformed on both ends of the retention equation. We thought it might be helpful to take a closer look and offer observations of how these particular businesses have changed over the last 12 months, during some of the most turbulent economic events in recent memory.

Introducing Zuora’s “Super Retainers.” A class of companies that are rising above the macro challenges and achieving best in class growth. In order to be included in this Super Retainer cohort, a customer business had to score in the bottom 30th percentile, relative to all Zuora customers, in overall account churn rate while at the same time scoring in the top 30th percentile in growth of their average revenue per account (i.e. ARPA).

Additionally, in keeping with recent analyses, we were able to break out the observations by industries. The High Tech, Media, and Manufacturing industries all had a meaningful amount of super retainer businesses.

By examining aggregated trends for the Super Retainer cohort, we’re seeing signals of specific strategies that Super Retainers have been executing in the last 12 months.. This blog post will dive in on two of those signals specifically.

Key Takeaway 1: Super Retainers’ subscriber relationships are becoming more dynamic.

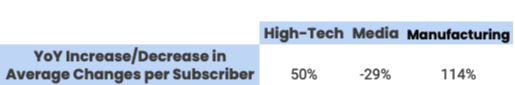

The first key takeaway is that Super Retainers in the High-tech and Manufacturing sectors are seeing an increase in their average changes per subscription. A “change” here could be something as simple as upgrading from a silver to gold plan via a self-service portal, or a more complex change like a sales assisted renewal. Subscription changes can be a big deal because past studies have shown they can correlate to growth. Given that Super Retainers, by our definition outlined above, already have high ARPA growth this finding may seem somewhat redundant. The nuance that’s notable, however, is that the average changes per subscription among Super Retainers isn’t just maintaining, but is accelerating year-over-year.

Specifically, High-tech Super Retainers saw, on average, 50% more changes made to their customers’ subscriptions in the last 12 months vs the prior 12 months. The Manufacturing cohort saw a whopping 114% increase in the same time frame.

As we dug in to try to understand the nature of these trends, some interesting patterns related to offering design and innovation were seen. Specifically, many Super Retainers accelerated their rate of new rate plan introductions over the last 12 months of the study; >20% more rate plans (year-over-year) in some cases. Between these rate plan observations and the trend in subscriber changes, it’s clear that High Tech and Manufacturing Super Retainers have not let off the gas when it comes to overall business dynamism.

Admittedly, we ran out of time to explore other data patterns that might relate to the Media cohort’s decline in changes per subscription but we plan to do some follow-up analysis. Let us know in the comments if you think that would be interesting to see as another blog post in this series!

Key Takeaway 2: Super Retainers are diversifying their payments strategy.

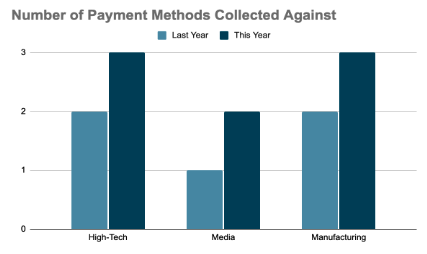

Zuora’s prior research confirms that the forms of payment (i.e. payment methods) offered to customers can be a significant factor in churn & retention. For the Media industry, which tends to be more B2C and international oriented, this is nothing new. For High Tech and Manufacturing, however, this is a bit more notable. The second key takeaway from our analysis is that Super Retainers across all industries, on average, started collecting from at least one more payment method in the last year than they did in the year prior.

“How can we support more payment methods?” is a question we frequently get from our customers in the best of times. If our Super Retainers’ data are any indication, we expect this question will only become more important to our customers in the months and years to come.

Key Takeaways

- Super Retainers in the High-tech and Manufacturing sectors are supporting more changes per subscription.

- Super Retainers across all industries, on average, started collecting from at least one more payment method in the last year than they did in the year prior.

If any of these insights inspire you to take action in your own business, we encourage you to check out The Journey to Usership, Zuora’s framework with data, expertise, and tools that will guide you along the path to becoming a successful subscription business.

Forward-Looking Statements:

This article contains forward-looking statements that involve a number of risks, uncertainties and assumptions, including but not limited to statements regarding the expected growth and trends in the market for subscription businesses. Any statements that are not statements of historical fact may be deemed to be forward-looking statements. Actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in the “Risk Factors” section of Zuora’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on December 8, 2022, as well as other documents that Zuora may file from time to time with the SEC. The forward-looking statements in this press release are based on current expectations as of the date of this press release and Zuora undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This press release also includes market data and certain other statistical information. Information that is based on estimates, forecasts, projections, or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information.

Learn more about the authors

The Journey to Usership

The playbook for modernizing monetizing, and scaling your business

The Subscribed Institute