SUBSCRIPTION FINANCE

Net Revenue Retention: A SaaS Guide to Calculating and Growing your NRR

- What NRR is and how to use it to contribute to your business’s growth

- How to calculate NRR using a simple formula

- Ways to improve your business’s net revenue retention rate

- The difference between net revenue retention and gross revenue retention

Let’s dive in!

What is Net Revenue Retention?

Why net revenue retention matters

View customer satisfaction and loyalty

Strategically acquire new customers

Identify issues related to customer retention and churn

Forecast the financial health and growth of your business

Better determine whether your customers find long-term value in your service

Factors that influence Net revenue retention

Pricing and packaging strategy

How to calculate net revenue retention

NRR Calculator – Excel Template

What Is a good net revenue retention rate for SaaS companies?

How to improve net revenue retention

Ways to reduce customer churn and improve net revenue retention

Invest in customer success team (CS)

Update and improve your product regularly

Ways to increase expansion and improve net revenue retention

Introduce new premium features

Ways to prevent downgrades and improve net revenue retention

Promote the most valuable features

Ask customers why they’re downgrading

Net revenue retention vs. gross revenue retention

Net Revenue Retention and Customer Success (CS)

The Challenges of Tracking Net Revenue Retention

NRR is a customer-centric metric

Impact of NRR of team size, technology and customer marketing

What is Net Revenue Retention?

- Recurring revenue (monthly or annually)

- Expansion revenue (from upsells and cross-sells)

- Revenue lost from downgrades

- Revenue lost from customer churn

Why net revenue retention matters

View customer satisfaction and loyalty

Strategically acquire new customers

Identify issues related to customer retention and churn

Forecast the financial health and growth of your business

Better determine whether your customers find long-term value in your service

Factors that influence Net revenue retention

Customer churn

Customer lifetime value

Gross revenues

Pricing and packaging strategy

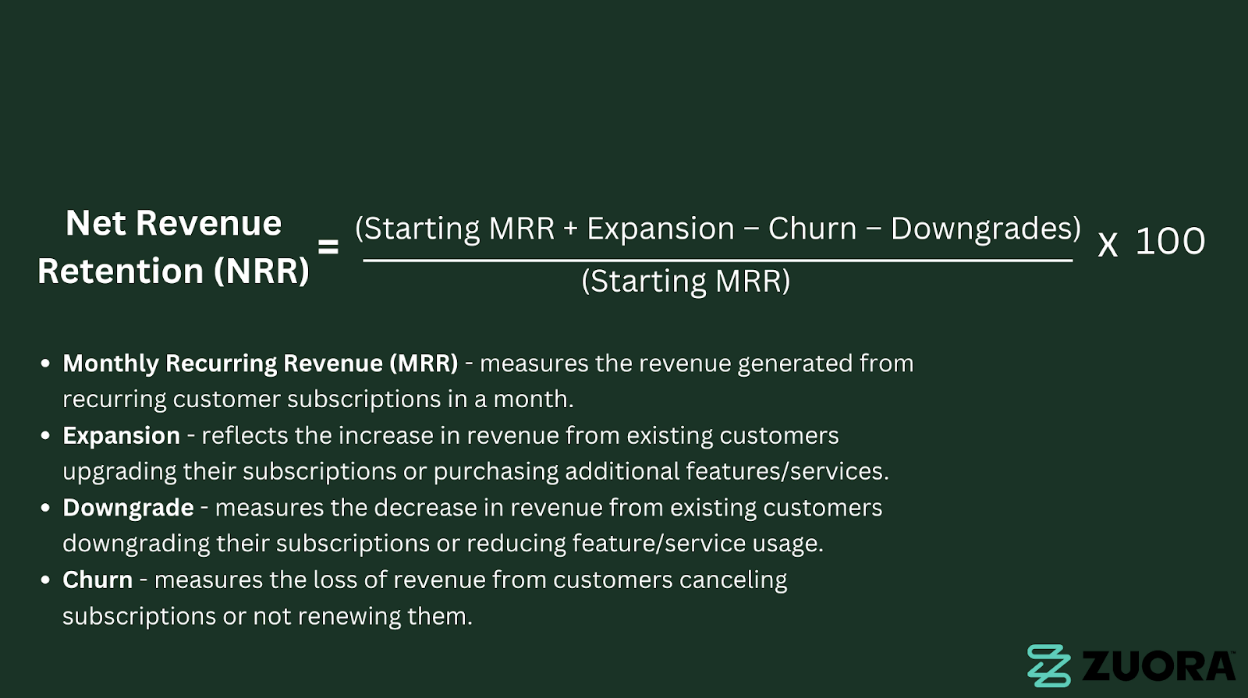

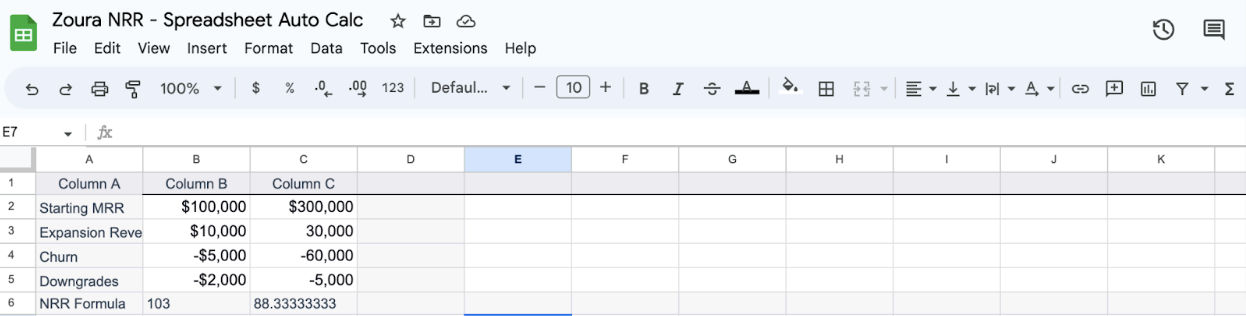

How to calculate net revenue retention

NRR Calculator – Excel Template

What Is a good net revenue retention rate for SaaS companies?

- Snowflake – 169%

- Twilio – 155%

- Datadog – 146%

- Slack – 143%

- Zoom – 140%

- Elastic – 130%

- Crowdstrike – 128%

WEBINAR

Create a Winning Good Better Best Pricing Strategy

While pricing and packaging is one of the most powerful mechanisms to capture new customers, it is also the area that requires the most significant change in mindset. To help, we have developed a 3D Pricing and Packaging (P&P) Framework, embedded in real life examples, specific guidance, and benchmarks.

How to improve net revenue retention

- Reducing customer churn

- Increasing expansion revenue

- Preventing downgrades

Ways to reduce customer churn and improve net revenue retention

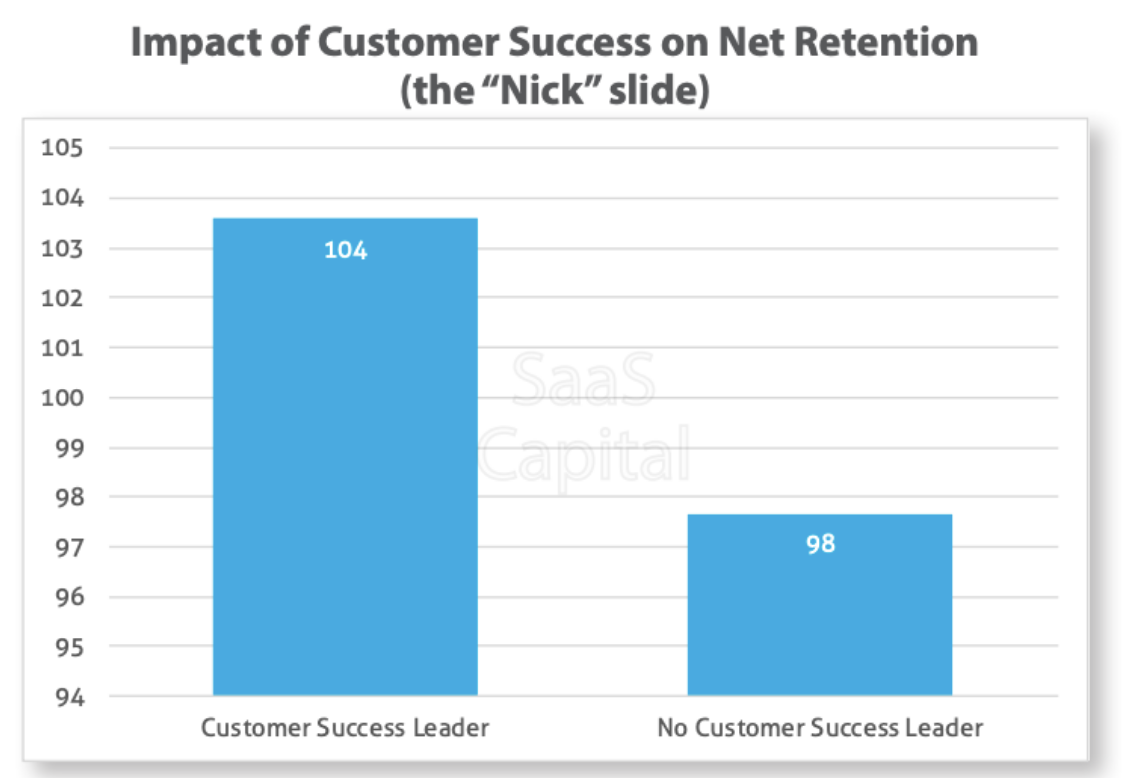

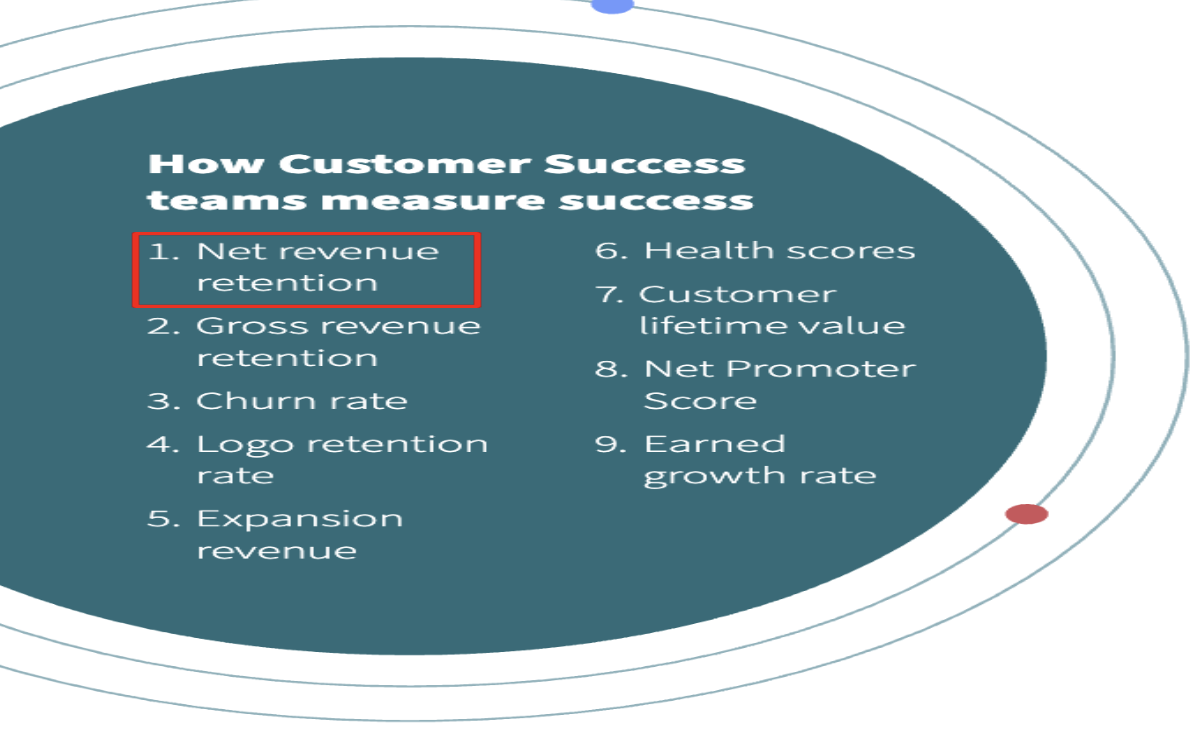

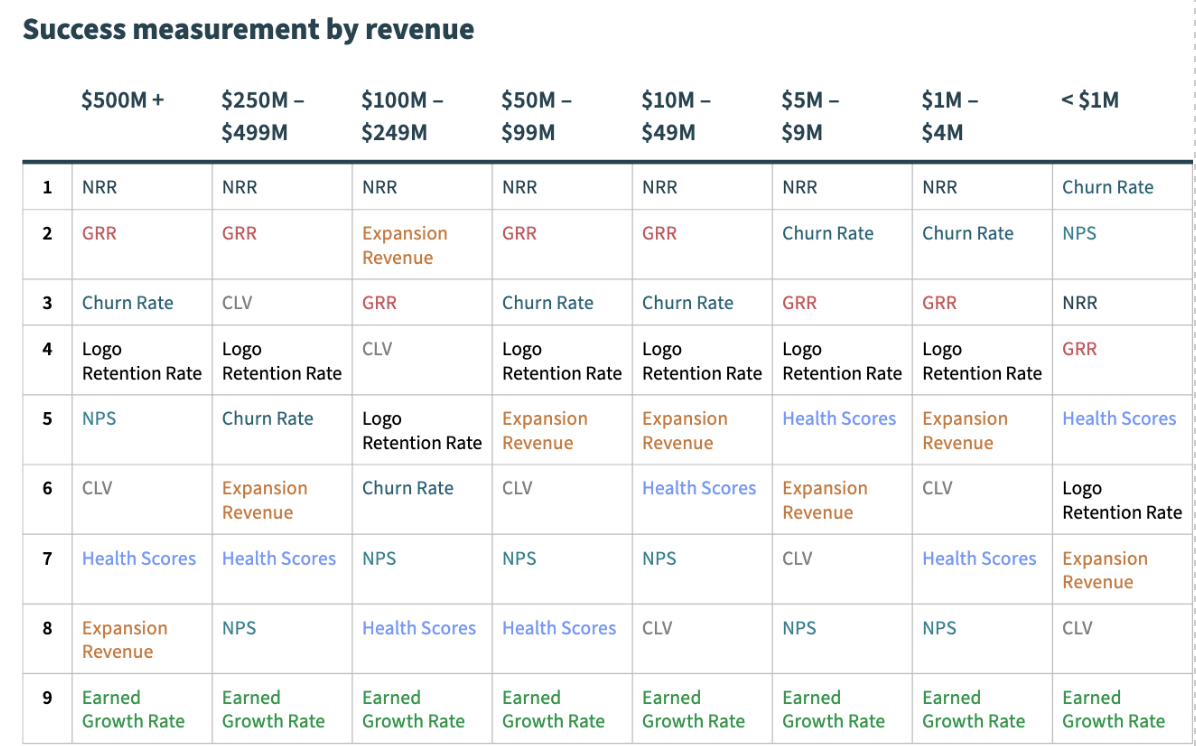

Invest in customer success team (CS)

- CS teams create a positive relationship between the company and ensure customers get the value they anticipated from your company. According to a Gartner study, 15% of customer interaction adds value. Furthermore, it illustrates that customers who experience value-enhanced service are likely to stay. Here’s a crash course on the Key SaaS and Customer Success metrics you should be familiar with.

Improve customer support

- Ensure you have a strong customer support system that is easy for customers to contact using whichever method they prefer. This could include live chat, phone support, email support, a detailed FAQ page, etc.

Offer incentives

- Offering incentives is a great way to keep customers from leaving because it gives them some unexpected additional value. For example, you could offer discounts, freebies, or extended trials.

Increase communication

- Keep in touch with your customers regularly to inform them about product updates, impressive case studies, and new ways to use your service. This could be through your email newsletter or social media updates.

Update and improve your product regularly

- Continue to add value to your service by making product improvements based on customer feedback. The increased value will help customers feel that their return on investment with your service is growing over time.

Ways to increase expansion and improve net revenue retention

Introduce new premium features

- Adding new features to your product is a great way to get customers interested in upgrading. These additional features should reflect your customers’ needs, which can also be found by analyzing customer feedback.

Offer discounts

- Offering discounts on upgrades or add-ons is a great way to encourage customers to buy more from you. For example, you can discount existing customers who have recently referred a friend or signed up for annual billing.

Create bundles

- Bundling your products and services together is a great way to increase sales. Think about how to market your upsells and cross-sells so they complement each other and offer a discount for buying them together.

Give a free trial

- A free trial of the next tier of your service can be a great way to increase expansion revenue. By giving potential customers a taste of what they can get by paying more, you can increase the likelihood they’ll upgrade their subscription. You may also think about a Freemium model.

Ways to prevent downgrades and improve net revenue retention

Encourage annual billing

- When customers pay for a year upfront, they’re more likely to stick around for the long haul without requesting to downgrade. If you aren’t already, consider offering a discount for subscribing to an annual plan.

Promote the most valuable features

- If you can show customers how much they’re getting for their money, they may be less likely to downgrade. For example, ensure your customers know which features are exclusive to the premium plan.

Ask customers why they’re downgrading

- Surveying customers who choose to downgrade can help you identify areas where your product or service is falling short. Then, you can work on making improvements so that customers will be less likely to downgrade in the future.

Net revenue retention vs. gross revenue retention

Net Revenue Retention and Customer Success (CS)

The Challenges of Tracking Net Revenue Retention

- Metric consistency: NRR has different formulas depending on the formula used (e.g., starting MRR vs. ending MRR, including or excluding expansion revenue, etc.). Ensuring consistency in the calculation used across different periods and comparisons can be challenging, specifically when there are changes in business models, pricing strategies, or accounting practices.

- Benchmarking: Due to a lack of standard benchmarks in the industry, benchmarking net revenue retention rates against industry peers or best practices could be challenging. You may have to try to identify and collect relevant benchmarking data and interpret it according to your business’s unique circumstances.

- Frequency of tracking: Tracking net revenue retention rates may require regular monitoring and updates to capture changes in customer behavior, market dynamics, or business strategies. Determining the appropriate frequency of tracking and reporting revenue retention rates can take time and effort, depending on the business’ size, complexity, and available data resources.

Who should own NRR

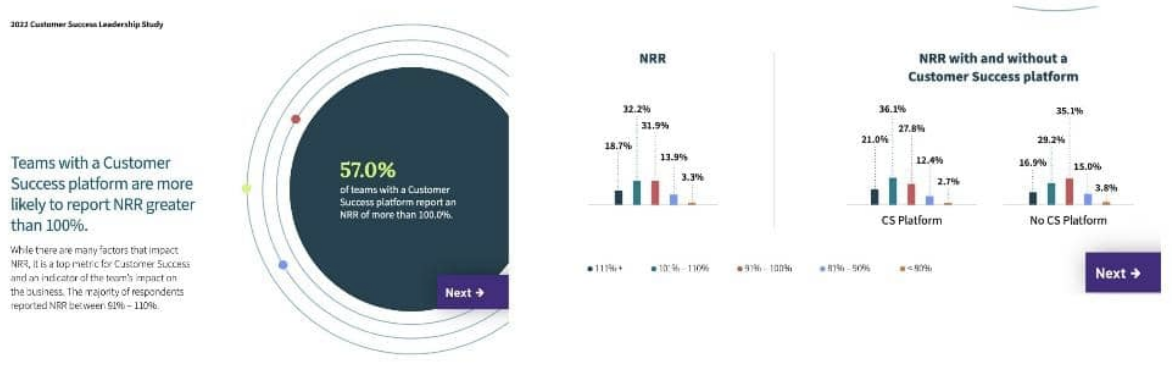

NRR is a customer-centric metric

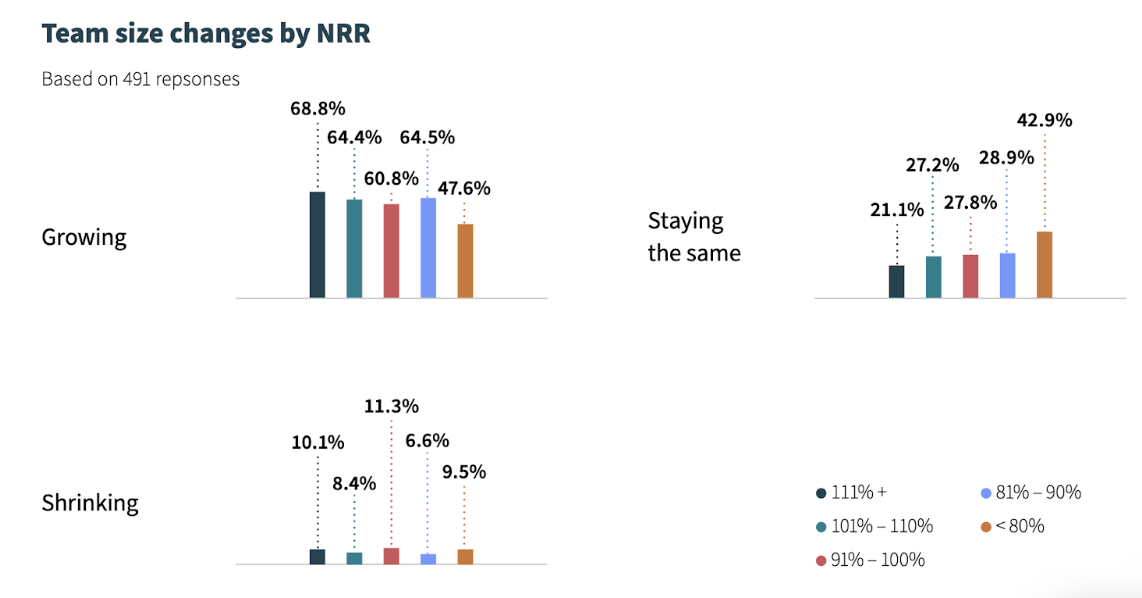

Impact of NRR of team size, technology and customer marketing

Key takeaways

What’s New in Zuora

Did you miss our latest product update? Do you want to know the latest and greatest innovations from Zuora? Check out our quarterly update and learn about what was released recently.

The world's leading enterprises run on Zuora.

With Zuora running in the background, we are well-equipped to deliver sustainable value to our customers, based on dynamically evolving offerings that fit the healthcare industry & care providers’ demands.

– Rahma Samow

Head of Siemens Healthineers Digital Health Global

Learn From the Best

Unlock resources from the leading experts

New Business Models

Knowledge Center

Your journey starts here

Start your free trial

Get your hands on the product and test out Zuora for free