Table of

Contents

The ultimate guide to usage-based pricing

The ultimate guide to usage-based pricing

01

What is usage-based pricing?

Usage-based pricing is a strategy where customers are charged and billed based on how much of a service or product they use. This could be anything from the number of API calls, gigabytes of data used, kilowatt hours of energy, or outputs from a chatbot.

This flexible pricing approach provides value and transparency to customers and helps build trust and loyalty. Usage models are used across multiple industries, including cloud computing, utilities, and telecommunications, where they allow businesses to scale their services according to customer needs and usage patterns. Usage-based pricing and hybrid models are also quickly becoming the model of choice for AI and GenAI offers, both for vendors and their customers.

Launching a usage-based model can seem like an insurmountable challenge, but this guide will provide the knowledge and strategies you need to successfully make the shift across your business.

Why usage-based pricing?

Usage is fast emerging as the pricing model of choice for companies across industries, especially those developing and launching new GenAI offers. This is because the model provides good alignment with and demonstration of value to the customer.

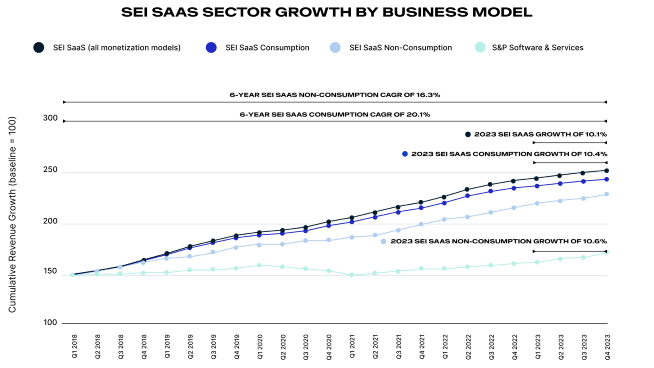

Subscribed Institute research has shown that many of the fastest growing SaaS companies leverage a usage-based model. In fact, the number of companies employing some form of usage-based pricing increased 9% to 26% between 2020 and 2022.

Why are usage models so popular?

Usage-based pricing can be a competitive differentiator and may enable a lower cost of sale and lower barriers to entry. And when used as part of a hybrid model, usage has been shown to contribute to higher year-over-year (YoY) annual recurring revenue (ARR) growth across all company sizes.

Customers are increasingly demanding a clear return on investment (ROI) and lower upfront risk—they want a better picture of what they’re using and how much value they’ll derive from your product. And 80% of customers report that usage-based pricing provides better alignment with the value they receive.

Customers like flexibility when they are first trying a product, which makes simple pay-as-you-go pricing a good option for onboarding new customers. But as they adopt and grow more confident in your solution, they are going to want more predictability. Therefore, customers will expect the nature of how they pay for their consumption of your product to change as their relationship with you grows. As a result, your monetization capabilities will also need to be ready to change to meet customer expectations.

What are the keys to usage success?

To make your usage-based pricing strategy a success—across the business—you’ll need the right strategies and holistic solutions to help you:

- Understand if usage is the right choice for your business

- Mediate, meter, and rate usage events

- Ensure optimal and flexible pricing and packaging

- Streamline processes and reduce headaches for finance

- Continually analyze and recognize usage revenue

The following chapters will equip you as you start your usage journey. Plus, we’ll tell you how to find the right end-to-end usage solutions to grow your business.

Keep learning about usage

Now that we’ve covered the basics of usage-based pricing, it’s time to discover which model is right for your business and and how to launch your own usage-based strategy. Keep reading to learn more.