STRATIGIC GUIDANCE

The Car Subscription Race is On, and the Frontrunners will Surprise You

Authored by: Stamos Kanellakis, Michael Mansard

Car subscriptions - We are racing in moving sand.

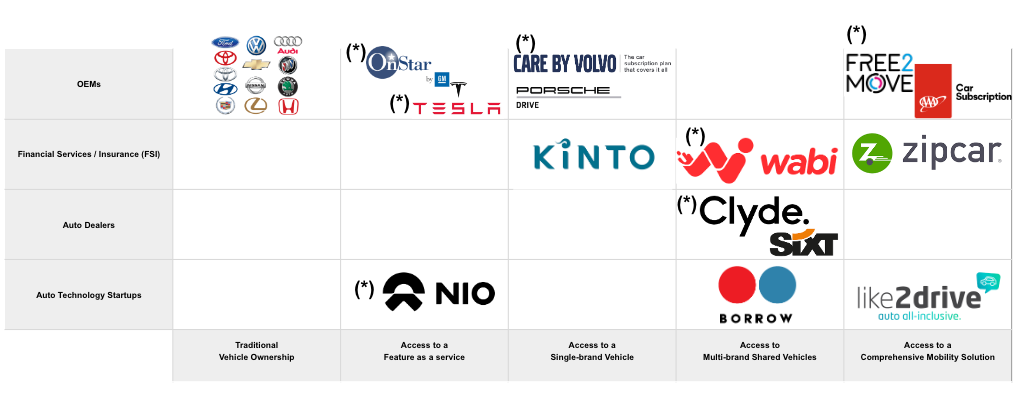

However, supply-chain constraints and chip shortages limit automakers’ ability to monetize connected services advertised to investors as the linchpin of the next growth wave. In the midst of this, many established automakers and startups have introduced car rental subscriptions billed as an alternative to traditional ownership and leasing to fill the gap created by low vehicle supply and high fuel and maintenance prices, as well as rapidly addressing consumer demand for flexibility in uncertain times. The result is an automotive landscape where the wrong strategies can be costly, even for leading brands like BMW (Access), Mercedes (Collection), and Audi (Select). They decided to temporarily pause their ventures and rethink their services and Go-To-Market approaches.

Despite the challenges of getting these emerging strategies and new business models right the first time, automotive executives are setting aggressive revenue targets to be achieved in short timeframes, a clear sign of recognition that car-based software-as-a-service and mobility services will carry a much higher valuation multiplier than the traditional automotive sector. While business leaders are convinced that we are in an era where software and services deliver more value to drivers than the sum of a vehicle’s mechanical parts, pivoting from public relations stunts and attractive sound bites to profitable subscription models in automotive is easier said than done. This is especially true given that there are only a few well-known success stories from which to draw inspiration.

In this article, we will examine which companies are winning (and losing) the car subscription race and why, how startups from non-automotive verticals like insurance and banking are disrupting the new mobility world and the most effective strategies for monetizing automotive services.

Tesla - The Subscription North Star that never was.

Contrary to the widespread perception that Tesla represents the North Star in mobility-related subscription offerings (also known as Car Subscription 2.0), primarily due to its charismatic leader, its early entry in subscriptions, the vast popularity of the brand’s innovativeness, and its widespread appeal to technology enthusiasts and environmentally conscious commuters, the company’s record in launching impactful subscription-based offerings has been underwhelming.

While revolutionizing mobility as a whole, the only subscription-based service Tesla offered in its first 15 years in business was Premium Connectivity for $9.99/month. The package included music and video streaming, internet browsing, live traffic visualization and satellite view maps. In July of 2021, Tesla made news by offering its Full Self-Driving (FSD) capability as a subscription for $199 per month, or $99 for those who have previously bought the now discontinued Enhanced Autopilot offering. Until then, the package that included capabilities such as summoning, autopark, auto lane assist, and traffic light stop sign control, could be purchased for an up-front lump sum of $10,000. Its worldwide take rate stood at just 11% and trending lower, possibly prompting Tesla to try offering it as a subscription. Although we credit Tesla for taking the first step toward subscriptions, the strategy did not, and still doesn’t, abide by leading practices of the Subscription Economy.

First, flexibility sits at the core of subscription models, delivered primarily via packages tailored to subscriber needs, such as pay-as-you-go or functional bundles. An industry-leading subscription model would allow drivers to subscribe to parking assistance capabilities and/or driving assistance capabilities as they saw fit instead of locking every Tesla owner in to every available capability. Such a solution would also “check the box” of another subscription imperative; affordability. By bundling capabilities based on driver needs, Tesla, and for that matter, any automaker, would lower the cost of subscribing to specific features, thus making them more widely affordable. Instead of committing$199/month for everything, one driver could commit $39/month for parking assistance only, while another could pay $69/month for driving assistance only, and so on.

Next, Tesla did not, and still does not, offer a free trial on its subscription services. Free trials are a simple way for companies to showcase how their technologies deliver value and reduce the uncertainty associated with purchases of novel technologies like autonomous driving by allowing customers to experience them before committing to buy. Research shows that driving-assistance capabilities tied to driver and passenger safety can be highly sticky: drivers can quickly get used to them once they discover how helpful they are, significantly increasing their willingness to pay. It also signals that the automaker has confidence in the services’ ability to deliver value. Tesla could offer a 15-day or even a 30-day trial to convince drivers and entice them to subscribe. Since the automaker already has a firm handle on data, the company should use time-sensitive driver engagement tactics to ensure a smooth journey from trial through conversion and retention. However, this hasn’t happened, and there is no indication that it will.

Last but not least, Tesla still fell short on transferability, the ability of vehicle owners to transfer their subscriptions between cars, similar to how you can activate music streaming subscriptions on newly owned devices. To the disappointment of most Tesla owners, a purchase of FSD for a Tesla vehicle does not give owners the ability to transfer the software to a different Tesla, new or used. Similarly, the language Tesla uses to describe a Full Self-Driving subscription suggests that it is not transferable. An FSD subscription is tied to the account owner and the vehicle for which it was purchased; the balance of the FSD subscription likely will not transfer to your next new or used Tesla. On the other hand, GM’s OnStar subscriptions can be transferred across vehicles as long as the new car is equipped with OnStar and the primary driver stays the same (more on GM’s OnStar in the next section).

We can go on and on about Tesla and its underwhelming adoption of subscription best practices. Despite this, automotive executives continue to obsess over every single move Tesla makes in the hopes of quickly replicating it. This slippery slope can lead an entire industry to adopt practices unfriendly to consumers, which would decelerate the attractiveness of subscriptions in automotive for OEMs and customers.

GM - The connected services pioneer and money maker

GM, on the other hand, An enlightening counterexample is GM’s OnStar, which has not only managed to develop a substantial subscription-based revenue stream but is now positioning the offering as a springboard for NexGen mobility solutions. GM officially launched OnStar in 1996 as a dealer-installed device for Cadillac models. After roughly 530 patents and 25 years, the technology is the undisputed leader of in-vehicle connected services, offering a series of features as four bundles ranging from $24.99 to $49.99 per month.

Adopting subscription best practices, including flexibility and affordability, pays off. According to GM, OnStar has 4.2 million paying subscribers and generates about $2 billion in revenue at a margin of more than 70 percent. GM’s research also shows that customers are willing to select multiple services if they are purposely designed and offered in flexible packages or bundles. On average, most customers choose a bundle of 25 different services proving that flexibility drives acquisition and adoption. By 2030, the automaker predicts that 30 million of its vehicles in the U.S. will have connected car technology, leaving it with a serviceable addressable market of $80 billion. GM aims to generate between $20 billion and $25 billion annually via cross-selling, $6 billion of which is expected to come from insurance. The automaker currently has a traditional insurance offering in 46 states and Washington, D.C. As part of GM’s vision to offer a more compelling insurance product to its customers, the automaker is working on a safe driving behavior algorithm in partnership with American Family Insurance and plans to start selling it soon in Arizona, Illinois, and Michigan. The mutual benefit to GM and its customers is twofold. For one, GM won’t have to spend $10 billion yearly on U.S. car insurance advertising, which is more than what auto companies spend on advertising cars.

Secondly, handling insurance directly and using car-generated data will also help GM process claims faster than is the standard in auto insurance. Instead of 18 to 25 days to settle claims, GM predicts the new system will know the extent of damage immediately and settle up fast. Many drivers subscribing to GM’s OnStar for safety will sooner or later consider usage-based insurance that could save them money, generating two recurring revenue streams for GM.

This development, combined with GM’s newly introduced tiered loyalty program, My GM Rewards, positions the automaker to monetize growth opportunities via a broad spectrum of applications. These range from products such as performance tuning parts to recurring fulfillment services, including tire rotations and oil changes, further expanding connected services to address the next wave of driver needs. GM is also positioned to launch entirely new stand-alone services or add-ons to the OnStar “connected umbrella” – an ecosystem delivering continuous value to GM owners. GM is taking its OnStar value proposition a step further by offering the service to non-GM car owners in the form of a smartphone app called OnStar Guardian that customers can try for up to three months for free.

The Journey to Usership

The playbook for modernizing monetizing, and scaling your subscription business

Volvo: The automaker that has cracked the “Car Subscription Nut”

Alongside GM, Volvo represents one of the most successful monetization strategies of automotive subscription services, proving that innovative offerings that adhere to leading best practices can generate significant value. A “Care by Volvo” subscription allows drivers to enjoy all the perks of owning a car with none of the hassles that come with ownership. Operating costs, including service, maintenance, and tire replacement, are covered by Volvo. The service is offered in three distinct packages starting at £669/month, and anyone in the U.K. can subscribe online, deposit-free. Cancellation requires only a 3-month advance notice.

As in the case of GM, the adoption of subscription best practices has paid off. “Care by Volvo” exceeded all expectations in its first year of business in the UK. Since the official launch in September 2020, Volvo has delivered more than 2,500 cars to customers keen on embracing ownership alternatives. The service claims nearly 15% of all Volvo retail sales or 7% of the brand’s total UK new car sales. Even more importantly, the service has led to solid uptake of Volvo’s electrified models, with 33% of the subscriptions being for Volvo Recharge plug-in hybrid electric (PHEV) models.

Last but not least, the service has opened the doors to new markets, with 91% of its subscribers being new to the Volvo brand, with the quick application completion time (the process takes just 39 seconds on average) being one of the key drivers of adoption. Notably, the average age of Care by Volvo customers is 45, 10 years younger than the average new car buyer and nine years more youthful than other Volvo buyers. The statistics above prove that subscription-based automotive services can serve as complementary rather than substitutes, making cannibalization a non-issue when done right.

Wabi and Clyde - The new “tickets to freedom”

Earlier, we mentioned that new entrants in Mobility 2.0 could pose a serious challenge to traditional automakers that are reluctant to introduce subscription offerings. Interestingly, many of the most successful entrants in the world of new mobility are coming from non-automotive verticals.

Santander’s Wabi car subscription service is the perfect example. The startup within this large Spanish multinational financial services firm offers subscriptions for a minimum of 30 days, with flexible cancellation. The subscription covers vehicle taxes, comprehensive insurance, and roadside assistance for the first 1,500 kilometers (930 miles) of driving per month. Vehicle availability is adequate and includes models ranging from ultra-compact to SUVs from the likes of BMW, Suzuki, Opel, Smart, Fiat, Mercedes, and Kia. Pricing varies from €360 to €548 per month depending on vehicle type. Subscribers can switch vehicles at any time via Wabi’s mobile app.

Similarly, Clyde, owned by AMAG, one of the biggest car dealerships in Switzerland, has launched a pure car subscription service under equally attractive subscription terms. The Clyde customer chooses the right car and determines the desired minimum term between one month and 48 months alongside the monthly mileage between 250 km and 4,000 km. A fixed monthly installment covers all costs except refueling. Clyde is the only provider that does not require a registration fee, and the car is delivered free of charge to any place in Switzerland. The entire purchase process is entirely digital. In May 2020, AMAG announced that Clyde exceeded subscriber goals by 50% in its initial pilot phase, confirming further expansion plans.

Essentially, we are witnessing banks, insurers, dealers, and software companies disrupting a large segment and potentially significant revenue pool that traditional automakers thought they had in their back pockets. But, as they say, it is never too late.

Free2move - Is car sharing back?

Stellantis’ Free2move car sharing service recently acquired ShareNow, a similar service initially introduced by BMW. ShareNow will add 10,000 vehicles to Free2move’s free-floating fleet of 2,500, and 3.2 million users to its existing 2 million, reaching a total of close to 6 million customers worldwide. It wants to grow that to 15 million by 2030 with almost $3 billion in annual revenue, up from $42 million in 2021. Although a single automaker owns Free2move, Stellantis’ depth and breadth of models across multiple brands and in many countries could pose a serious alternative to car-sharing first movers like Zipcar. For example, in Paris, Free2Move users can access a Citroen AMI or a Peugeot iOn for 0.39€ per minute or an even more attractive 0.26€ per minute rate for those subscribing to a monthly 9.99€ monthly membership. This acquisition also confirms BMW’s and Mercedes’ shift in strategy. The two leading automakers have decided to focus instead on digital multi-mobility and digital services related to the charging of electric vehicles.

Strategically thinking, Free2move is moving towards achieving critical mass based on larger fleets to drive profitability, which has been a key challenge in car-sharing. It also has a footprint of complementary services, including more than 250.000 EV charging stations. Free2move’s official press release states, “Leveraging Free2moves’ financial discipline and ability to manage a profitable business, this acquisition will further enhance its economies of scale and synergies, contributing to its Dare Forward 2030 ambition of growing the profitable mobility service to net revenues of €2.8 billion with a first step of €700 million revenues in 2025.” As if all of the above were not exciting enough, Free2Move also marks the “grand return” of Citroen with the AMI car in the U.S.

NIO - “Chargeable, Swappable, Upgradable,” and Unstoppable.

While OEMs initially experienced mixed results from launching subscriptions for physical products, NIO’s Battery-as-a-Service (BaaS) service proves that offering what other EVs are missing can be highly successful. The subscription plan reassures electric car owners since the cost of the battery is separated from the cost of the vehicle, and better car resale value since the heavy depreciator (battery) is serviced separately, on a subscription basis, via the company’s 484 battery swap stations.

In short, the subscription solves two unique problems for electric car owners: 1) battery degradation (46% of consumers believe that their battery will last 65k miles or less) and depreciation (battery replacement fees of upwards of $10,000 act as “liabilities” to electric car ownership).

The bundle is offered to all vehicle owners and combines unique services like door-to-door valet and practical driver support like lifetime free roadside rescue. This infrastructure can now expand to support the growth of BaaS, forming a subscription-based services platform and “growth springboard” similar to GM’s OnStar. At the same time, this infrastructure is already in place to support bi-phasic subscription monetization strategies identical to Amazon’s Prime video, as we explain in detail here. Last but not least, NIO’s “platformization” could be interpreted as an effort to “own and protect” car experiences and behavioral data while serving as “safe environments” for testing novel services and products for current and future NIO customers, or better said, subscribers.

But could NIO’s BaaS become the mainstream model in the lucrative market of battery asset management? It has prerequisites. It solves a particular, justifiable problem in an emerging market with significant growth potential, and it uses the most effective strategy to do so; subscriptions. For battery swap stations serving passenger cars, a utilization rate of about 20 percent, or 60 services per day, is the break-even point—profitability increases as utilization increases. At 100 vehicles per day, the net margin per station is about 18 percent, according to NIO. The company will continue to invest in growth and expects to add more than 3,000 new battery swap stations in China by year-end, bringing the total to at least 4,500. From 2022 to 2025, NIO is expected to add 600 battery swap stations annually in the Chinese market alone. Interestingly enough, Vietnam’s VinFast EV Car OEM is entering the U.S. market with a similar Battery-as-a-Service subscription model

Subscribed Strategy Group

There is no “magic.” Leaders are getting the fundamentals right.

So, what have GM, Volvo, Wabi, and Clyde done right? Well, they got many of the most critical-to-success subscription management principles right. Among others, they:

- Were convinced of the future of access-based models (subscriptions and memberships). Firm conviction helps companies face transformation challenges head-on and sustain momentum even when early results fall short of expectations.

- Recognized that connected services needed to be “handled with care” and potentially bundled with other services to deliver the value desired by prospects and existing drivers. A one-size-fits-all strategy rarely works in the Subscription Economy.

- Quickly note that car rentals and subscriptions were merging and realized that it would be easier to sell subscription-based connected services to drivers already “subscribing in mobility” (e.g., car subscription 2.0).

- Understood the power of relationships built as recurring experiences versus just focusing on individual customer touchpoints.

- They followed a phased approach to growth, known as Journey to Usership. They started small, stayed focused, and proved the business case before executing scaling strategies and tapping into new opportunities or scaling existing successes.

Yes, there is an opportunity for starters, and it is substantial.

For laggards like Tesla and most other OEMs, a clear roadmap for accelerating their Journey to Usership has been designed and successfully tested. They can avoid mistakes by applying proven methods and tools and launching viable offerings to generate recurring revenues in new and existing markets. Zuora’s Subscribed Strategy Group has helped improve the top and bottom line performance, including a Top-3 US OEM currently leading the in-car connected services race. We offer the following guidance:

1. Gain confidence in the future of the Subscription Economy.

Becoming a leader in the subscription economy takes resilience. If you doubt that the future of the global economy lies in subscriptions, Zuora’s proprietary research will help you gain the confidence required to take the first steps. The Subscription Economy Index™ tracks the rapid ascent of subscription-based companies worldwide in key verticals and regions. The SEI reports have helped countless executives strengthen their business cases for change and become true subscription champions, achieving more than 6.7% higher growth vs. the S&P 500 Index . Zuora also regularly publishes proven success stories of our automotive clients, including Ford, Stellantis, Jaguar, and LandRover.

2. Reimagine the future of subscription-based mobility while placing your brand at the core.

Although there are frontrunners in the mobility race, most growth is still untapped, with plenty of room for new business models. Zuora has identified three “strategic plays”: 1. Connected Services, 2. Repackage-to-Recurring Services, 3. Product-as-a-Service. Each strategy points to different transformation requirements and services monetization models, detailed in our “Reaping the Recurring Benefits of Industry 4.0 and The Blueprint to Monetize Anything-as-Service.”

3. Choose offerings based on the combination of business impact and complexity of execution.

4. Optimize your packaging/bundling of offerings.

5. Engage drivers with a single-minded goal: Help them extract value via recurring experiences.

6. Collect data and manage performance from the get-go.

7. Deploy a phased transformation based on realistic timelines and expectations

The persistent ones will succeed.

Learn more about the authors

Interested in learning more?

The Subscribed Institute