BENCHMARKS / INSIGHTS

Customer acquisition, retention, and expansion: Striking the balance for growth and resilience

From rising inflation and interest rates to layoffs and banking challenges, the technology industry faced significant instability in 2023.

Yet even as new digital transformation initiatives declined and business leaders struggled to figure out the best way to grow, one set of companies significantly outperformed the S&P 500 — businesses that use various monetization models designed to provide recurring growth. Collectively, these companies experienced 10.4% revenue growth in 2023 compared to 6% among S&P companies, according to Zuora’s Subscription Economy Index (SEI) Report.

The question is: how? As a growing number of companies offer subscription pricing for an increasing array of products and services, experts have cautioned businesses about consumer “subscription fatigue.” But despite these warnings, recurring revenue models continue to drive outsized business impact.

The SEI measures the change in the volume of business for more than 600 companies that leverage recurring revenue models of monetization. Composed of anonymized, aggregated, system-generated activity on the Zuora Billing service, the SEI provides insight into businesses that are committed to evolving monetization, defined as how a business matches what it values with what its customers value and uses that to generate revenue.

The 2023 SEI report reveals that while these businesses faced the same challenges to customer acquisition that roiled the rest of the tech sector, their business models allowed them to more easily retain customers and expand revenue per account.

In a macro-environment that demands adaptability and customer-centricity, recurring revenue models are proving inherently resilient because they focus on ongoing customer relationships rather than one-time transactions.

Let’s take a closer look at the data to understand how this works.

Key findings on customer acquisition and retention

Companies in the SEI can achieve recurring growth in three ways:

- New customer acquisition (account growth)

- Customer retention (inverse of churn)

- Expansion (increased annual revenue per account)

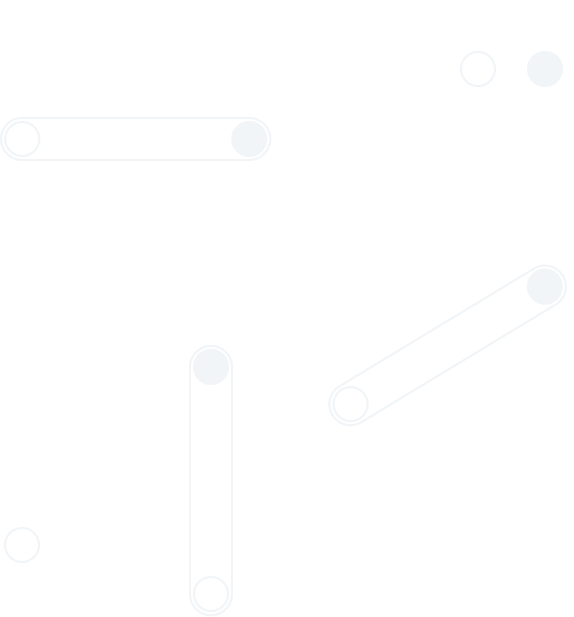

By the first measure — account growth — SEI companies experienced a slowdown in 2023, with customer acquisition rates dropping from an average 2.22% in Q1 to 1.12% in Q4. In this respect, their experience reflects the broader economic climate.

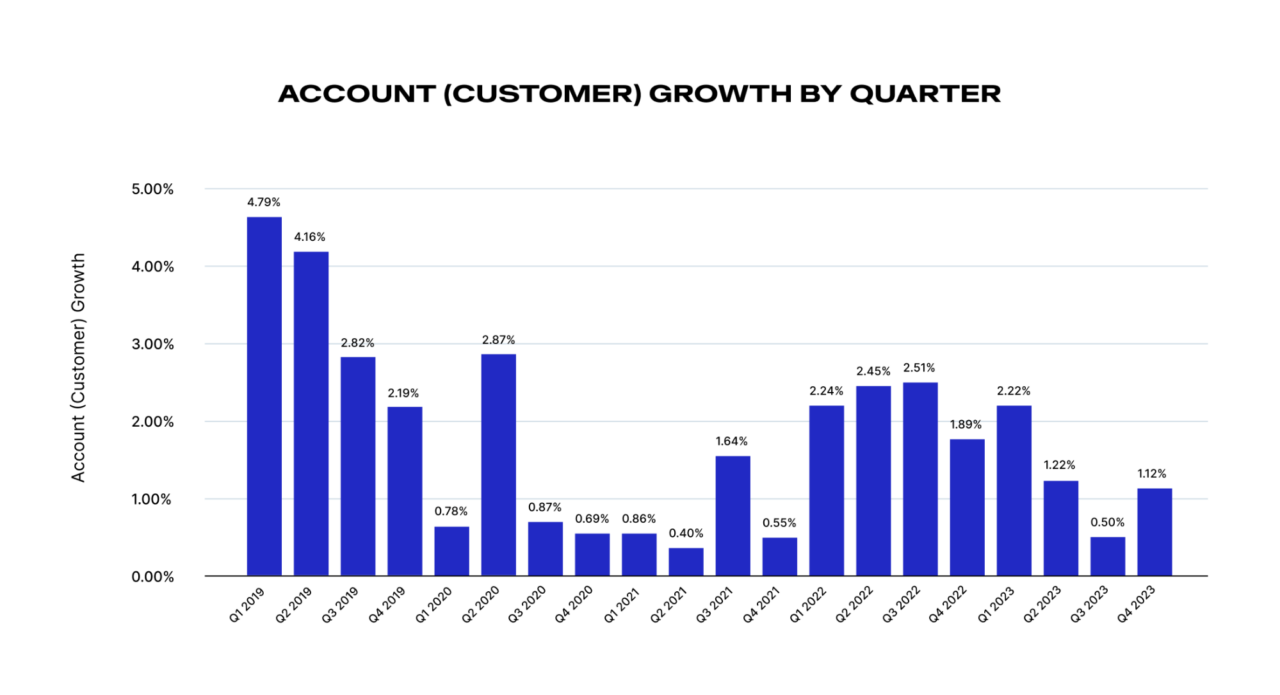

However, companies in the SEI also experienced lower churn. Flying in the face of predictions of a “great unsubscribe,” customer retention improved significantly in 2023, with average quarterly churn rates dipping lower than anytime since 2019.

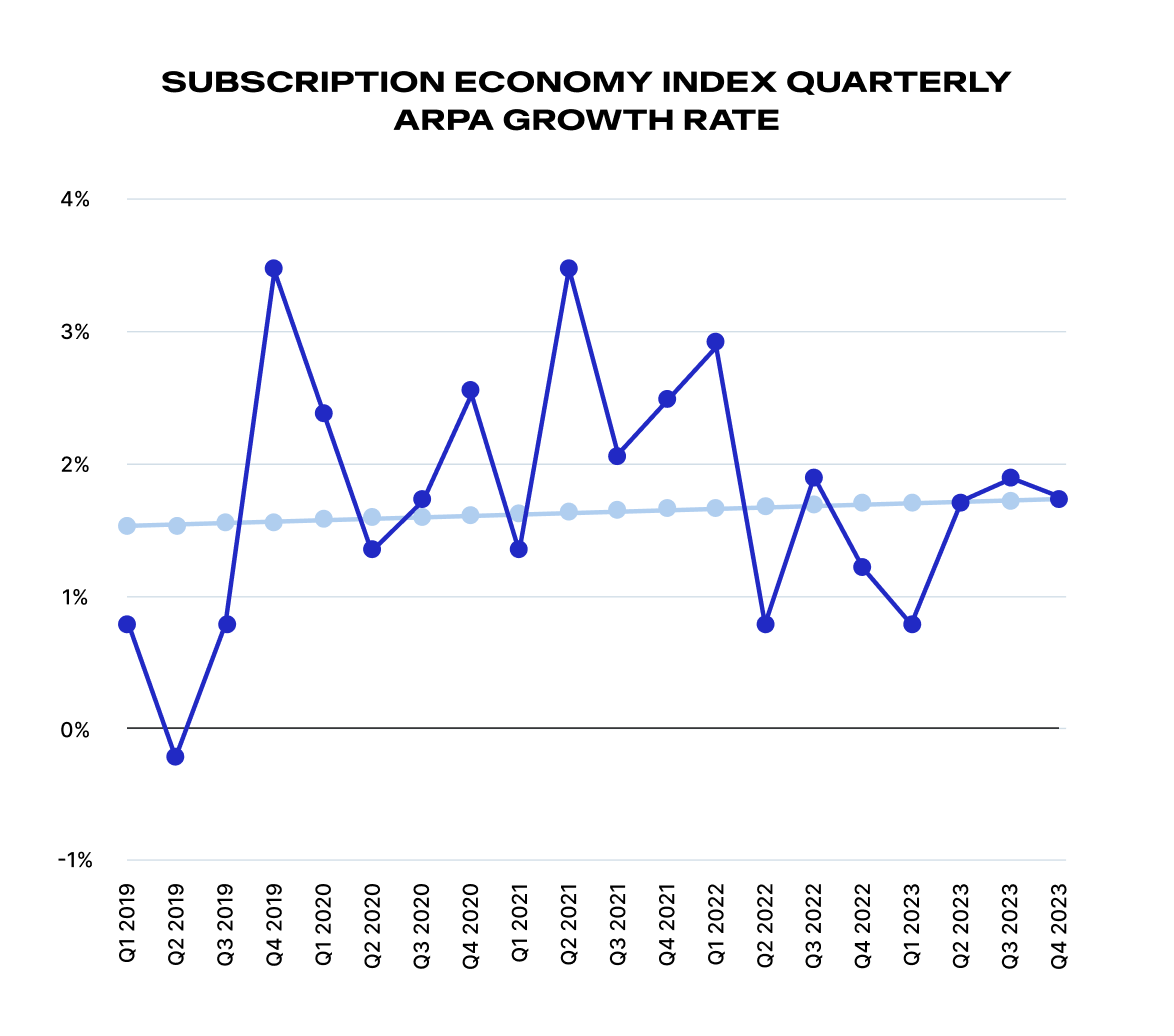

Finally, SEI companies were able to capitalize on low churn rates by increasing annual revenue per account (ARPA), which is on a slight upward trend over the past 20 quarters. In 2023, ARPA growth among SEI companies was 1.5%, up from 1.29% in 2022.

Taken together, these three trends illustrate how companies with recurring revenue business models were able to compensate for difficulty acquiring new customers in 2023 by retaining current customers and expanding revenue per account.

Behind the numbers: Why retention and expansion matter

The key takeaway for business leaders in the current economic environment is that growth matters, but the way to grow is to concentrate on existing customers rather than new business. Because it costs more to acquire than retain customers, growth during challenging times can be achieved by nurturing and growing current customers — and flexible monetization models offer a prime opportunity to do exactly that.

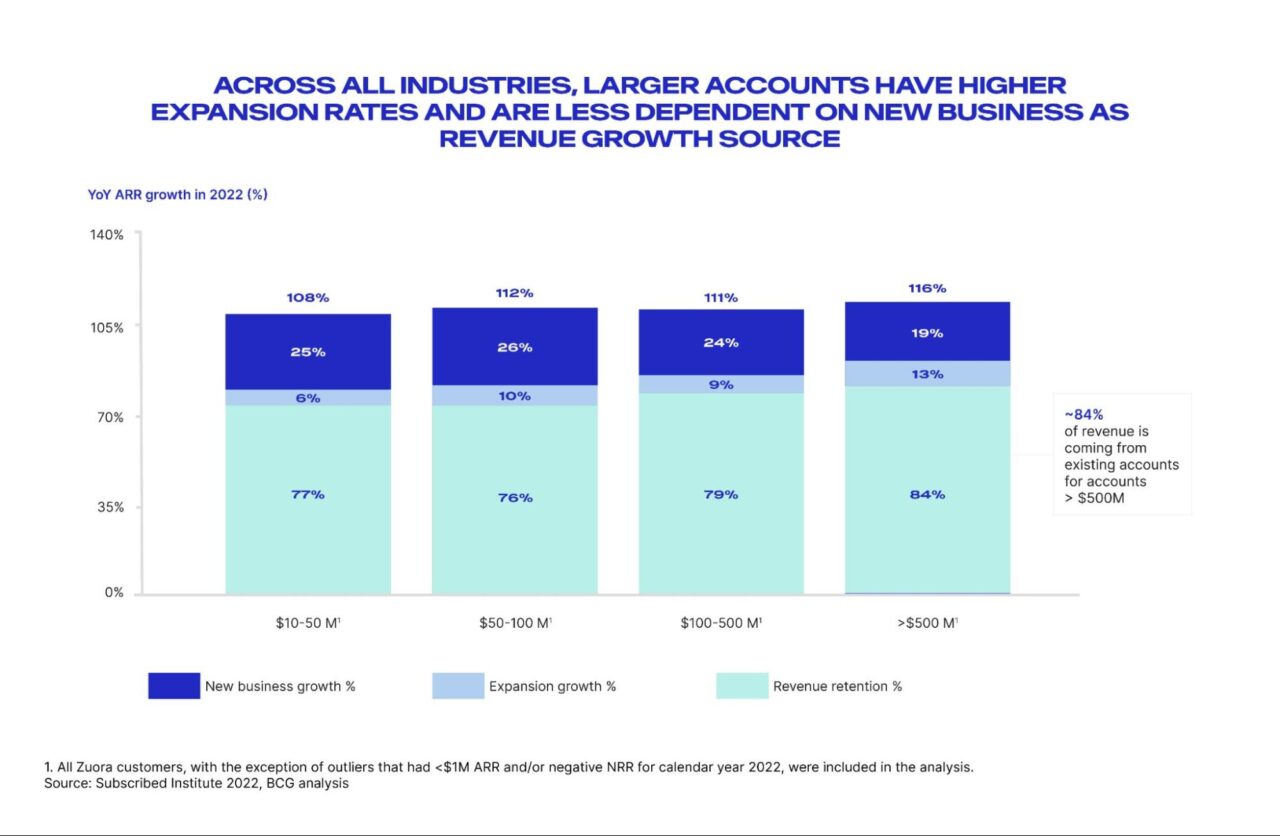

Most annual recurring revenue (ARR) growth comes from existing customers. According to a 2023 report from Zuora Subscribed Institute and Boston Consulting Group, in the case of accounts with greater than 500M in annual revenues, existing customers are responsible for 84% of ARR growth. These accounts have the most significant retention and expansion rates and are less dependent on new business as a revenue growth source.

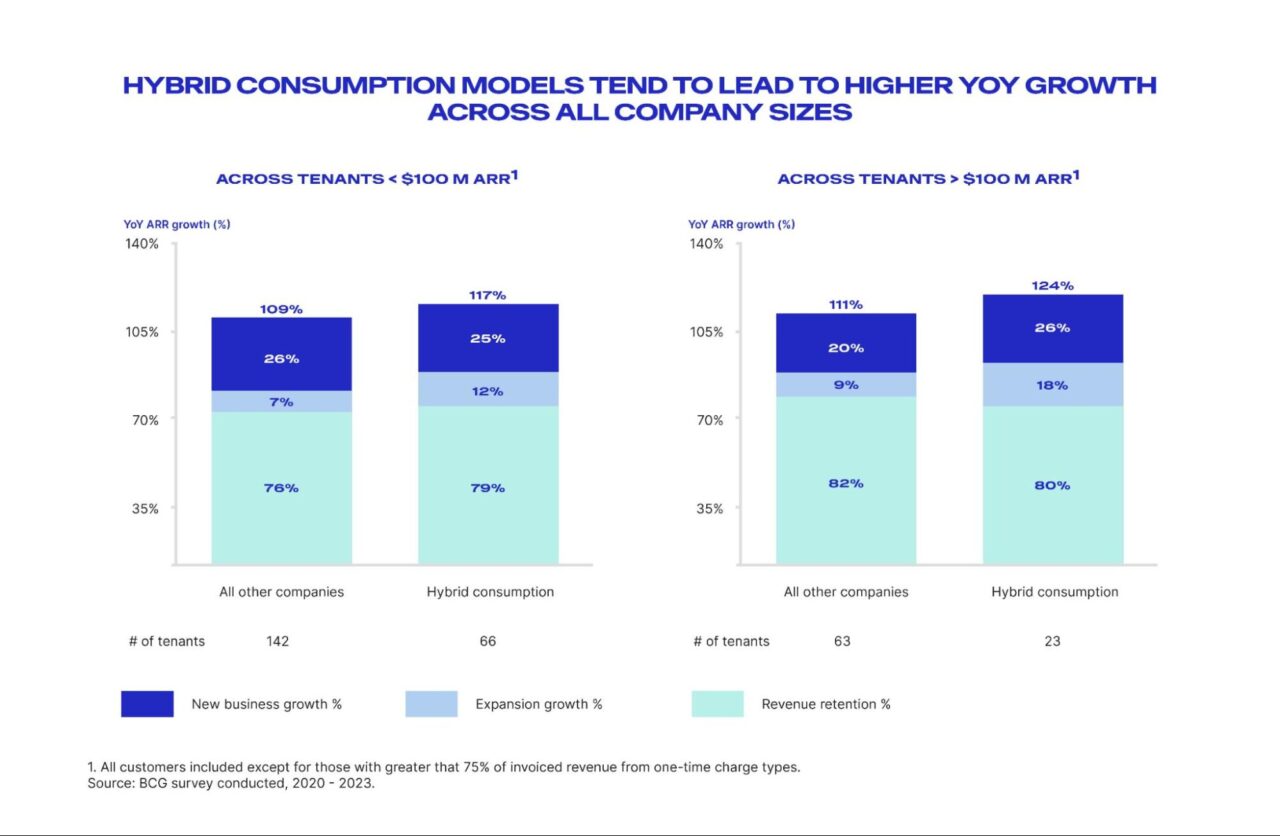

The data also show that a key factor in this growth is the rise of consumption pricing models, which are inherently flexible. Companies with hybrid consumption models (consisting of both usage-based revenue billed in arrears and recurring revenue billed in advance) outperformed all other businesses in the Zuora/BCG study when it came to year-over-year ARR growth.

Other data show that 80% of consumers prefer tiered models with flexible pricing vs. traditional flat-fee subscriptions, and that such offers can help prevent churn.

In addition to its ability to support growth, consumption pricing’s surging popularity is related to the rise of generative AI technologies, which demand new monetization strategies. Not only do generative AI models have marginal costs that can scale with usage, they also enable a reduction in the number of human users, making it difficult to capture value with user-based subscription pricing.

As generative AI continues to expand, consumption pricing models will become an even more important part of customer retention and expansion.

How companies can improve customer retention

The SEI report makes a strong case for recurring revenue models, but it’s not enough to simply launch a new model and hope customers react favorably. Consumers tend to keep subscriptions that provide value, but they churn when they don’t get what they expect. Continuously delivering value, therefore, is crucial to retention.

This means regularly assessing customer experience and adjusting to it, often by providing services or products beyond what customers originally signed up for. For example, if customers are feeling budgetary strain, companies can add more flexible pricing or billing options to meet their needs.

They can also give customers alternatives to churning, such as changing tiers, changing billing frequency, moving from a flat-fee subscription plan to pay-as-you-go billing, or putting the account on temporary pause.

At Zuora, we refer to this strategy of continuously evolving monetization in a customer-centric feedback loop as Total Monetization. Total Monetization is an end-to-end process for creating value and generating revenue that recognizes change in customer demand over time and the need to stay in tune and monetize accordingly.

Total Monetization gives companies the flexibility to retain customers and expand ARPA growth rates even when customer acquisition is slow. It’s the secret to how SEI companies outperform the S&P 500 and it’s what makes them resilient. Growth during challenging times relies on nurturing and growing existing customers, and the recurring revenue models employed by SEI companies are pointing the way to retention for best-in-class growth in any market.

For more information on the growth and resilience of businesses leveraging various monetization models, read the full SEI report.

Learn more about the authors

EMEA Chair, the Subscribed Institute

Principal Director of Subscription Strategy, Zuora

CEO and Founder

Black Winch

The Subscribed Institute