BENCHMARKS / INSIGHTS

Retaining customers and growing revenue in the manufacturing industry

At first glance, things don’t look great for the manufacturing industry.

The sector has struggled since the pandemic and, amid broader challenges and uncertainty in the global economy, manufacturing ended 2023 particularly subdued. Output was down, factory employment declined and industry sentiment was gloomy, with trends suggesting further risks to production, labor and prices in 2024. December marked 14 consecutive months of manufacturing contraction — the longest such stretch since 2002 — and while the pace of shrinkage has slowed, the sector seems to have plateaued at lower levels.

But look closer — at the recent increase in construction spending and new jobs overall, and especially at Zuora’s latest Subscription Economy Index (SEI) report, which analyzes the growth and resilience of recurring revenue businesses across different sectors, including manufacturing — and there is reason for hope.

Indeed, manufacturing companies in the SEI with innovative, subscription-based business models are actually finding more opportunities for recurring growth and sustainable success.

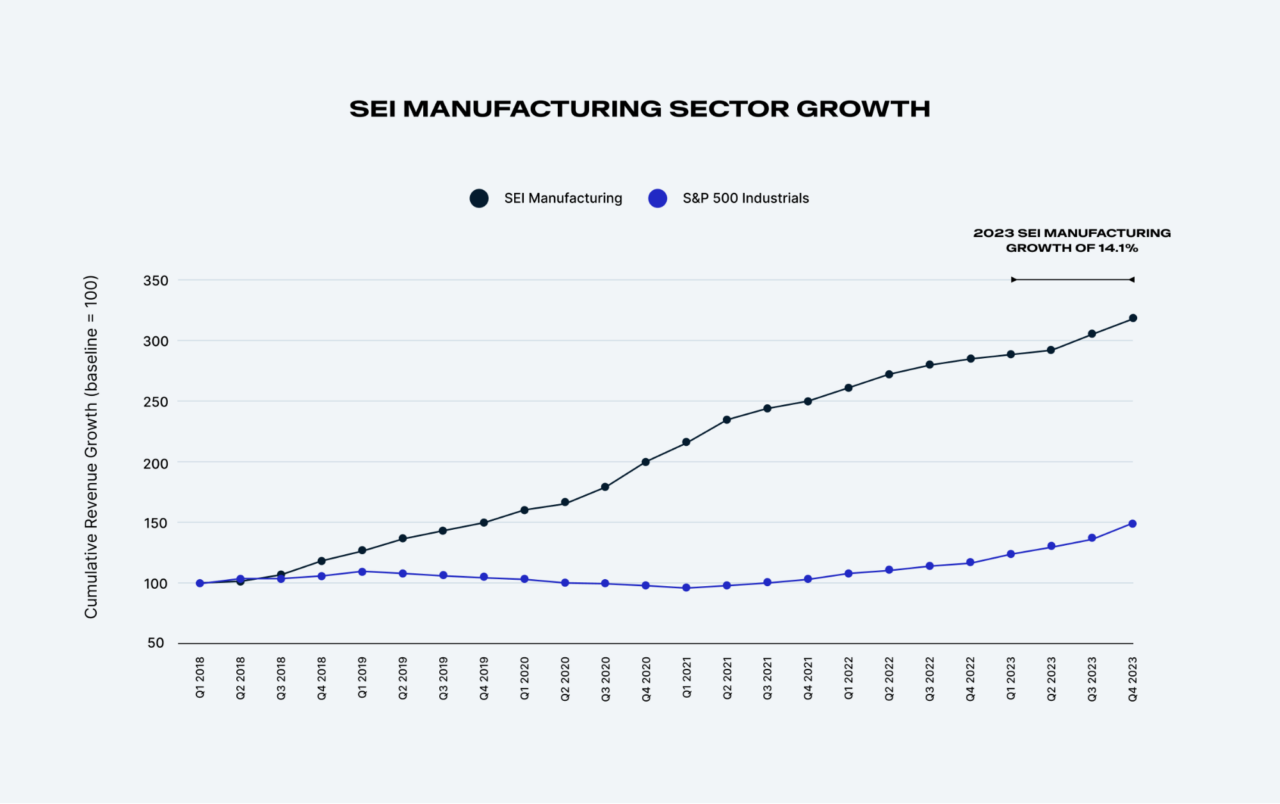

According to 2023 report data, despite market instability and industry contraction, the SEI manufacturing sector grew at an impressive rate of 14.1% last year. In fact, SEI manufacturers are not only performing better than the rest of their industry, but also better than all other segments in the SEI.

And as a whole, the entire SEI cohort — representing recurring revenue business models — reported revenue growth of 10.4%, still far outpacing companies in the S&P 500, which have historically represented more traditional businesses.

But the SEI manufacturing sector isn’t just growing revenue; it’s retaining customers too. In the face of industry slowdown, other manufacturers can learn from these leaders how to expand beyond their traditional operations through subscriptions and hybrid models that align monetization strategies with demand to develop valuable, recurring relationships with customers.

Key findings for SEI manufacturing

Zuora’s SEI report examines the performance of businesses leveraging various monetization models designed to provide recurring growth. Comprising data from anonymized, aggregated, system-generated activity on the Zuora Billing service, the SEI measures the change in the volume of business for more than 600 companies. The SEI manufacturing index includes fabrication services, industry-specific software providers, industrial design, IoT, heavy equipment and tool manufacturers.

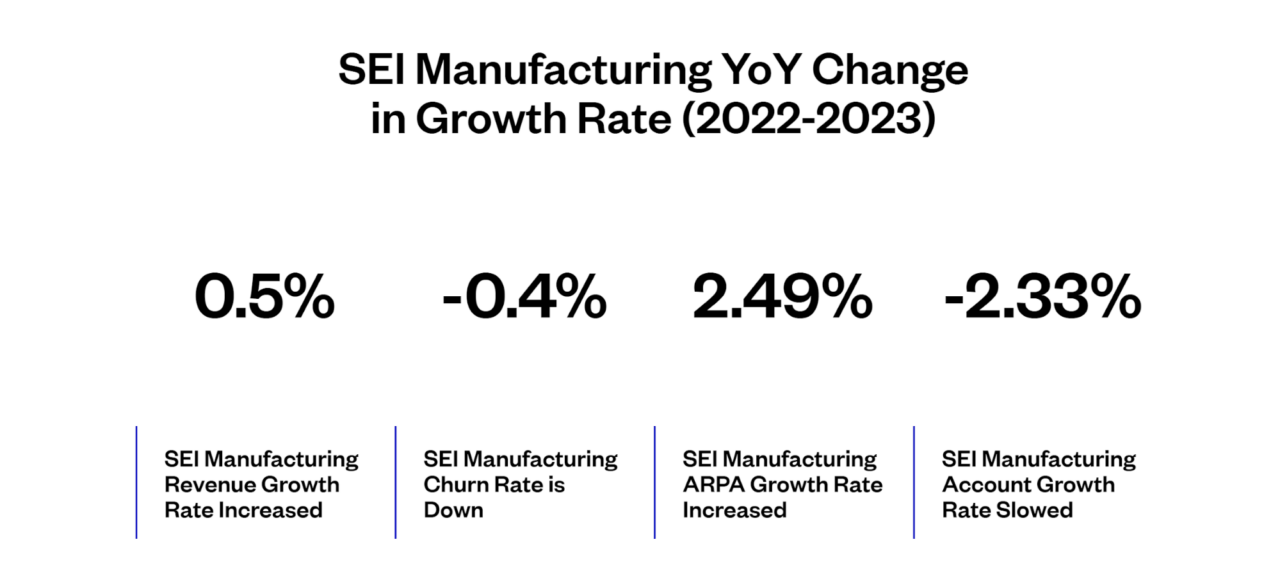

According to the latest report, SEI manufacturing revenue increased year-over-year at an average rate of 0.5%. Furthermore, churn decreased by 0.4%, indicating improved customer retention.

SEI companies weren’t completely immune to the ebbs and flows of the industry or the larger economy, however. Mirroring the SEI as a whole, account growth for the manufacturing sector slowed by 2.33%, meaning that fewer customers added new services.

Still, the data suggests successful manufacturers are leveraging retention as an opportunity to grow with existing customers over time, as annual revenue per account (ARPA) increased by 2.49%. Factors contributing to this growth could include trends like the diversification and maturation of Everything-as-a-Service (XaaS) and Product-as-a-Service (PaaS) manufacturing offerings, which likely don’t face the kind of competition and market saturation that exists in sectors like SaaS.

Shifting from a primary focus on capital expenditures (CapEx) to customer-centric, recurring operational expenditures (OpEx) can also help manufacturers better navigate the uncertain economic landscape. Digital services offered via PaaS or XaaS allow customers to tap into an OpEx budget, which is beneficial in an inflationary environment when the cost of capital is relatively high.

To stay competitive and increase ARPA moving forward, many manufacturers are making future-focused, customer-centric investments, such as:

- “Smart factory” initiatives to leverage advanced technology like 5G, Internet of Things (IoT), data analytics, and AI, especially generative AI.

- Aftermarket services that enhance customer loyalty and can be bundled into an XaaS offering, providing upselling and cross-selling opportunities.

What the data means for the manufacturing industry

SEI manufacturing companies are outperforming the industry as a whole, retaining their customers and seeing revenue growth. That isn’t magic or luck — it requires businesses to rethink traditional models and monetization strategies — but it’s also not hard for other manufacturers to achieve similar success.

Subscription and hybrid models provide reliable, recurring revenue, which reduces the impact of industry changes and economic instability. For many companies, an effective monetization strategy means moving beyond regular subscriptions, exploring a mix of models, and experimenting with consumption pricing or bundling offers to align monetization with demand. This approach fuels more sustainable growth built on strong customer relationships.

Companies can better retain customers by focusing on customer value. This often means providing beyond the original service or product a customer purchased — for example, by including more flexible pricing or billing options to customers who are also feeling the strain of slashed budgets and tight wallets. Manufacturers can improve retention by finding ways to provide their customers with alternatives to churning.

Looking ahead: Total Monetization for modern manufacturers

If recent trends are an indication, SEI manufacturers will likely continue to enjoy revenue growth in 2024. It’s unclear whether the broader industry will experience a rebound or remain confined in the current contraction cycle, though traditional manufacturers are typically more susceptible to economic volatility than companies with innovative business models.

Moving forward, manufacturers must be willing to evolve their business practices and develop new ways to deliver better value to customers. For modern companies, this means considering subscriptions and hybrid business models, as well as usage-based pricing and new technologies like AI.

Manufacturing has long been the engine of progress and remains vital to the global economy. But the industry faces clear challenges today and needs new avenues for growth. Retaining customers is more important than ever, and the SEI report data demonstrates that manufacturers should focus on retention as an opportunity to add incremental value to customer relationships and grow with them over time.

The latest SEI report contains detailed analysis and actionable insights that can help manufacturers become more adaptable, customer-centric and resilient. Access the full report.

Learn more about the authors

EMEA Chair, the Subscribed Institute

Principal Director of Subscription Strategy, Zuora

CEO and Founder

Black Winch

The Subscribed Institute