STRATEGIC GUIDANCE

How Inflation Can Unexpectedly Boost As-a-Service OpEx Models

An economic quantitative point-of-view

Authored by: Michael Mansard, EMEA Chair of the Subscribed Institute and Nolan Hoffmeyer, Co-Founder & Partner of Thematics Asset Management

Inflation has become a pressing concern in boardrooms across the globe, with little sign of abating. The resulting rise in interest rates has made it more expensive for both consumers and companies to invest, leading to a decrease in capital expenditure (CapEx).

Traditional businesses relying on transactional, one-off product sales are facing the challenging prospect of reduced customer demand and margin pressures in the coming years. As a matter of fact, despite continued revenue growth, operating margins for the S&P 500 have come down from a peak of 15.1% in 2021 to 14.5% in 2022 and now stand at 13.5% over the last 12 months (Bloomberg).

However, there is a glimmer of hope in the form of modern business models that offer a solution to this problem. By shifting from CapEx to customer-centric, recurring operational expenditure (OpEx), i.e., adopting modern “X-as-a-Service” (XaaS) business models, companies can navigate the uncertain economic landscape, align with customer needs, and achieve profitable growth even in the face of inflationary pressures.

In this article, we will simply argue the relevance of this shift in business models and substantiate its reality through an analysis of macroeconomic data and correlations, bolstered by eye-opening case studies such as a leading Nordics optic retail business or a global medical leader. Our deliberate focus on this aspect is aimed at providing a nuanced perspective, steering away from the well-documented benefits of such business models, which can be found elsewhere.

Businesses exposed to OpEx spending hold better in inflationary environment

A direct consequence of inflation is the continuous hike of interest rates across the globe—in many instances, at the highest level for the past 15 years (10-Year Treasury Yield). This has created a difficult environment for consumers and businesses alike, discouraging them from investing due to the increased cost of borrowing.

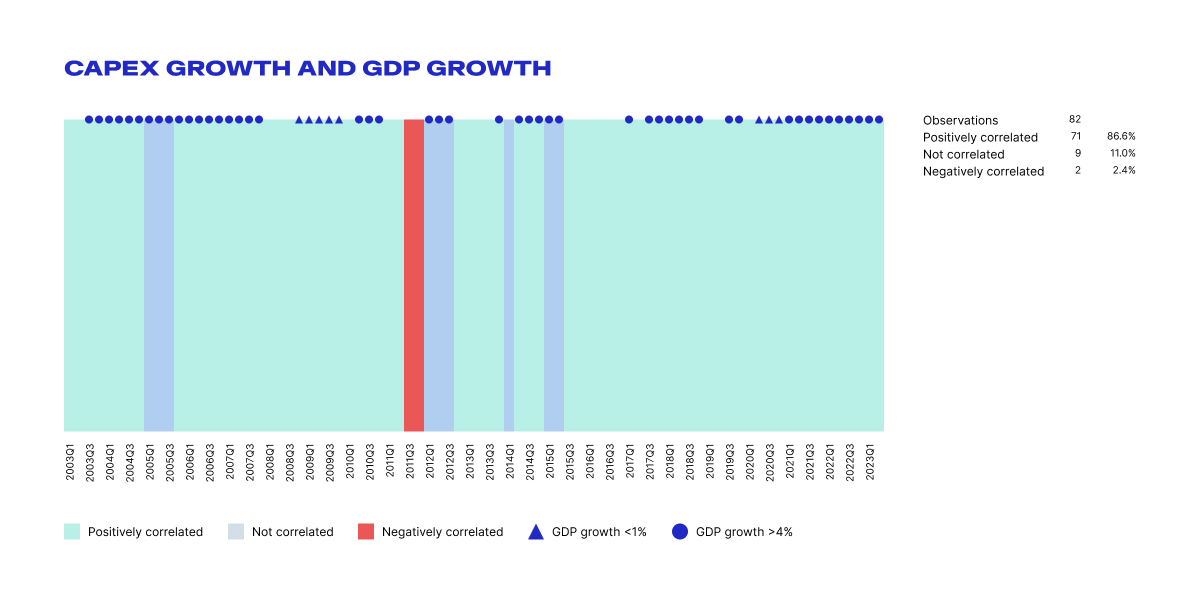

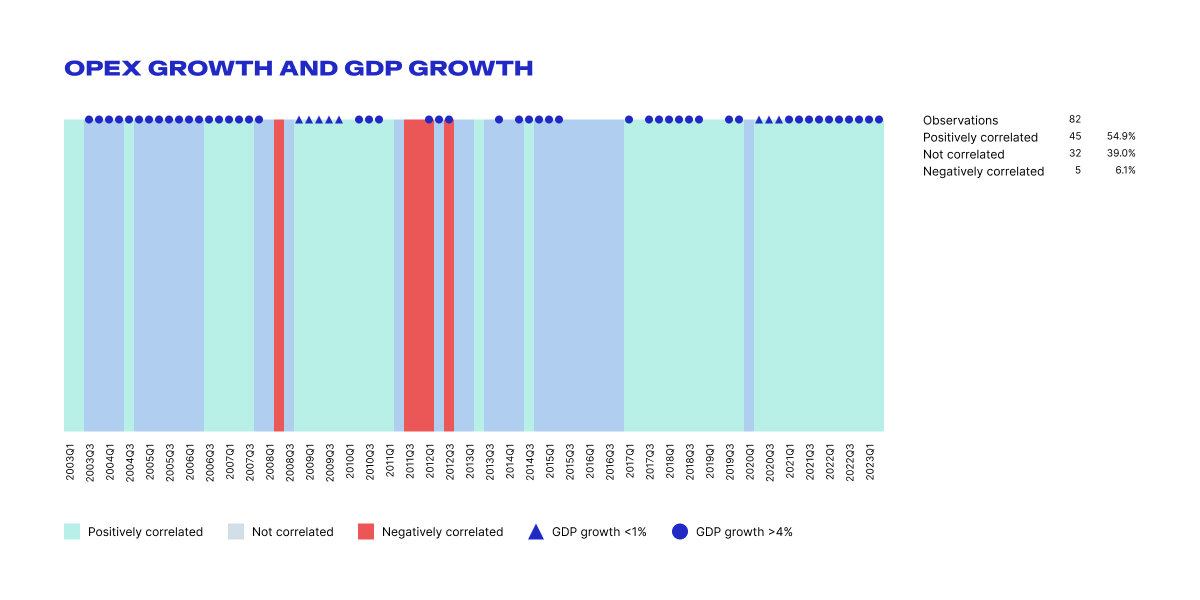

Moreover, uncertainty about the future exacerbates this hesitancy to invest. To establish how CapEx and OpEx are impacted by macroeconomic conditions, we assessed their respective correlations with growth and inflation over a 20-year period (cf. Chart 1 and Chart 2). And the findings are quite compelling.

Chart set 1: 6-month rolling correlation between GDP growth and OpEx or CapEx growth.

Chart set 2: 6-month rolling correlation between inflation and OpEx or CapEx growth.

For both charts:

A value of 1 indicates a perfect positive correlation, where both variables move in the same direction.

A value of -1 indicates a perfect negative correlation, meaning as one variable increases, the other decreases.

A value of 0 indicates there is no correlation, indicating no relationship between the movements of the two variables.

We followed widely accepted practices by classifying correlations from 0.6 to 1 as strong positive and from -0.6 to -1 as strong negative.

Analyses based on U.S. economic data. Sources: Federal Reserve Economic Data.

A six-month rolling correlation over 20 years between GDP growth and CapEx or OpEx growth shows that CapEx is continually positively correlated to GDP growth, meaning that in case of macroeconomic slowdown, it is likely CapEx will slow down as well. OpEx correlation isn’t always positively correlated, implying that macroeconomic slowdown doesn’t always result in OpEx slowdown. In other words, OpEx spending is more resilient.

There’s more to it. Indeed, other correlations show that OpEx is almost permanently positively correlated with inflation meaning that increased inflation wouldn’t result in lower OpEx, but actually rather higher OpEx. This isn’t the case with CapEx. Data from the last 20 years thus show that OpEx is a more resilient spending than CapEx while a higher inflation environment should be beneficial to OpEx as well.

Confirming this analysis, CapEx increased substantially in 2021 and even 2022 as companies were catching up from the Covid period, but it has started slowing meaningfully from mid-2022 and has only grown 3.1% in the most recent quarter. Estimates for S&P 500 companies indicate a stabilization at 3.9% growth in 2024 (Bloomberg, November 28th, 2023). While recent CapEx spending might still seem high, it is artificially supported by the 2 factors.

First, U.S. Bipartisan Infrastructure Law (BIL) that is driving large investment on U.S. soil. Second, adding more fuel to this spending, Big tech companies are also spending massively in their cloud and artificial intelligence infrastructures. If we were to adjust for those two, growth would be much lower.

According to the Biden administration, private companies have announced USD 614bn in commitments as of 2023. To put it in relation, overall U.S. CapEx spending approximated USD $18 000bn in 2022, thus representing a >3% stimulus!

Many of the large CapEx spenders are actually “monetizing” their investment through an OpEx Everything-as-a-Service (XaaS) model. Cloud titans such as Microsoft Azure or Amazon AWS are selling computing capacity based on consumption, helping companies to avoid large CapEx spending by paying on an as-you-go basis. This is also true in some industrial applications such as electric vehicles (EV) or hydrogen infrastructure. Solution providers, such as ZePlug, now offer subscriptions to access their charging station network.

As one company’s CapEx or OpEx is another’s revenue, the trends shown above would hold for companies whose revenue is exposed to CapEx or OpEx. If a company’s revenue is made of other companies’ CapEx spending, it is more likely to decrease during macroeconomic slowdown, margins could decline even further due to factors such as increased competition or further price reductions, while their own costs shoot up due to inflationary pressure. On the other hand, as OpEx growth is more stable and more likely to increase in inflationary periods, revenue exposed to OpEx spending would fare better.

Embracing modern business models: the rise of XaaS models

However, there is a silver lining. Companies still need to invest in digital transformation and new capabilities, and individuals strive to improve their living standards. By adopting modern OpEx-oriented business models, businesses can better align with these needs and consumption constraints, increase perceived affordability, offer their customers shorter return on investment (ROI) periods, and reduce procurement complexities. And thus, grow faster.

Modern business models, such as XaaS, have demonstrated remarkable growth and resilience in recent years. Subscription-based services, in particular, have witnessed exponential growth. According to UBS, the subscription market was estimated to be worth $650 billion in 2020, and it is projected to reach $1,500 billion by 2025, growing at 18% year-over-year. This growth is fueled by various factors, including preference of usership over ownership, digitization, sustainability changes, etc.

Business model paradigm shifts: crises as an accelerator?

During past crises, specific sectors experienced significant shifts toward subscription-based models. The dot-com crisis in the early 2000s coincided with the rise of Software-as-a-Service (SaaS) models. Similarly, the financial crisis in the late 2007s saw a surge in media subscriptions.

In both cases, subscription-based models quickly became the dominant paradigm in these respective sectors. Prominent pioneers like Salesforce and Netflix exemplify the success of these models, with established players such as Microsoft or HBO successfully transforming their operations to adapt.

In fact, in light of the current “polycrisis,” we could predict the acceleration and advent of XaaS offerings that encompass physical products or cater to industries predominantly focused on physical goods. In fact, there are already multiple early examples of what success looks like, waiting to bloom even further.

Success stories: walking the walk

In the B2C space, companies like Synsam, GoPro, Philips, iRobot, or Nuuly have experienced substantial growth and profitability through their subscription models. The Synsam Lifestyle is a eyewear-as-a-service subscription offer that promises “Always the Right Sight,” by bundling regular eye exams with eyewear featuring adapted lenses as eyesight changes, the ability to regularly swap frames, and insurance for peace of mind.

Synsam achieved close to double-digit revenue growth rate in the latest quarter and boasts close to 600,000 subscribers to Synsam Lifestyle. Its subscription service is the largest contributor to growth, despite reaching over 50% of total revenue. The company is still adding 25-30K new subscribers each quarter, claiming that subscriptions are even more attractive in times of larger economic uncertainty as consumers distribute their costs over time.

A stable to decreasing churn is a further testament of its success. Profitability has also been on the rise with EBITDA margins surpassing 25% in Q3 2023, higher than its peers average and similar to leading providers, despite much smaller scale. In fact, Synsam’s eyewear-as-a-service approach led to such marked success, it has inspired business model transformation across the optics retail industry, with many other optic retailers following suit across the globe.

In the B2B realm, traditional hardware companies are also embracing XaaS models as a part of their core business. Signify, the lighting provider which spun off from Philips in 2016, offers all-encompassing subscriptions known as Light-as-a-Service. These managed services provide cost savings to customers, in addition to easy access to lighting design, installation, operation, and maintenance.

Leaders like Cisco, NCR, and Schneider Electric have also progressively shifted major portions of their revenue contributions towards XaaS models and have started disclosing recurring revenue as part of their financial reports. All three companies have seen double digit growth on that part of the business in 2022 and 2023, demonstrating continuous appetite for the model, despite high inflation and uncertainty. For example, Cisco’s Data-Center-as-a-Service market has grown an impressive 9.5 times faster than the traditional capital expenditure model.

Sitting at the intersection of B2B and B2C, Philips is a great example of a company that is riding at full steam on the modern business train. In their 2022 annual report, they confirm that approximately 40% of their revenues are already recurring services, indicating a significant emphasis on generating stable, long-term income.

Philips users can indeed subscribe to a wide portfolio of solutions ranging from Equipment-Monitoring-as-a-Service for hospitals, a portable transducer associated with a tablet/smartphone app for healthcare professionals on the go, Intense Pulsed Light hair removal devices or toothbrush heads, and coaching apps.

Modern OpEx models are becoming more flexible and customer-centric to address the new normal

As these stories clearly show, successful modern recurring OpEx models are those that evolve and enhance their value over time, utilizing customer data for personalized experiences. They focus on building long-term relationships with customers, creating a service that is increasingly tailored and relevant to their changing needs and preferences.

In fact, customers consider subscriptions as a solution to inflation. A June 2023 survey discovered that 4 in 5 consumers consider that subscriptions enable them to maintain an element of normal life and keep track of spending during ongoing economic crises.

The uncertain economic climate exacerbates customer needs for flexibility, which in turn reshapes OpEx models.

- Contract flexibility: customers expect lower barriers in terms of time-bound commitment, clear conditions to opt out, the ability to upgrade/downgrade their select packages, add options, or suspend. Care by Volvo, an all-inclusive, flexible car subscription service offers the ability to cancel a subscription and return the car, or change models, any time after the first 4 months have expired, without incurring an early termination fee.

- Pricing flexibility: customers expect to pay as close as possible to what they use. Haier WashPass, is a unique full-service subscription providing professional laundry experience at home through a dedicated connected washing machine with AI management, automatic refills of their exclusive desegregated detergents, installation, and maintenance—all controlled via the hOn app. The offer is priced based on a 3-tier washing cycle packaging model, with a pay-per-cycle model for overages.

This is why we see an accelerated adoption of flexible contract terms, associated with hybrid pricing models that combine together recurring commitment (often a subscription) with a consumption/usage-based pricing model. In the SaaS space, 46% of companies have adopted either usage-based pricing or a hybrid model.

According to research by the Subscribed Institute in partnership with the Boston Consulting Group, the hybrid model is starting to make its way across other industries as well, with an increase in adoption from 9% to 26% over the last 3 years. According to the Subscribed Institute’s existing research, such modern business practices where you “put your clients in the driver’s seat” tend to correlate with higher growth. And again, it’s true for companies across industries—those utilizing hybrid consumption models outperform all other businesses in terms of YoY ARR growth.

The push towards new business models can change the face of CapEx and OpEx forever

As more companies turn to modern OpEx services with Physical-Products-as-a-Service, it does not mean that CapEx will disappear. As a matter of fact, someone has to invest and retain the property of the underlying asset. Obviously, companies running such modern business models may not be able to infinitely stretch their balance sheet on behalf of their client to hold the “opexified”/servitized assets, let alone financing them.

Providing a balance sheet or financing capabilities is exactly where financial services entities can play a critical role—and are already doing it today through various financing mechanisms. They will, however, need to provide more modern and flexible financing solutions beyond mere inflexible traditional leasing to fully support this important shift and meet both end customers’ and providers’ needs.

Another indirect implication of this situation, simply put, is that instead of millions of economic actors buying or financing their own individual products or assets, they would now subscribe to a modern OpEx offer providing access to a “servitized asset.” The underlying servitized asset, which is a CapEx, might sit in a leasing company’s book. This could mean that CapEx would end up being a lot more concentrated as a result of this transformation. As a result, the distribution and articulation of CapEx and OpEx across the economy could become dramatically different in the next decades.

The recent burgeoning of innovative financing solutions in the XaaS space, particularly in light of tightening credit conditions, seem to go in this direction. Initiatives like those from BNP Paribas Leasing Solutions are offering more flexible, usage-based financing options. Also, on the Private Equity side, considering the substantial amount of “dry powder” (unallocated capital reserved for investments), XaaS’ potential for high returns and resilience could present an appealing asset class for investment or funding.

In short, these financing vehicles, amongst others, could act as a meaningful catalyst further fueling the acceleration of XaaS in the “physical” world.

Embracing inflation: The path forward with OpEx XaaS business models

In the face of uncertainty and inflationary pressures, which are both here to stay, modern business models provide a solution to offset declining CapEx opportunities. By shifting to such business models, companies can indeed achieve profitable growth, enhance customer experience, while navigating current economic challenges with more flexibility.

Based on quantitative evidence and first-hand experience, we predict that the current macroeconomic conditions and polycrises environment will act as a catalyst to further accelerate customer-centric, recurring OpEx XaaS models.

This is especially true for industries where penetration rate of such models is still limited, typically those encompassing durable physical products and equipment. The opportunity and threats are meaningful enough to go past barriers or reluctance, such as the inherent complexity of the associated business transformation, the impacts on working capital, balance sheet or risk exposure.

As the acceleration of the modern OpEx XaaS model will impact industries where penetration is still limited, this could become a driving force on how OpEx and CapEx are concentrated and distributed across the economy. Financial Services will be a critical ingredient in the mix to successfully get there.

Companies launching such modern offerings will need to adapt their models to address the expected need for flexibility, both in terms of contractual experience and pricing models. Counterintuitively for some, such enhanced flexibility is creating more value to share and longer lifetime. At times where customer cost of acquisition are skyrocketing, such an opportunity is not to be ignored.

As evidenced by the increasing adoption of XaaS and the success stories of companies across industries, embracing these models is not only beneficial for business growth but also aligns with the sustainable practices of the modern era. Companies like Decathlon, Haier, or Recygo exemplify how adopting modern business models can be the platform of both profitable growth and sustainability goals. As this has become an important business priority, this provides a further compelling reason to move.

What is the big takeaway? History has consistently revealed that crises often serve as a catalyst for the emergence and rapid advancement of new businesses and innovative business models. The realm of XaaS, or Everything-as-a-Service, should be no different.

A recent McKinsey article highlights that companies that prioritized new business building during the 2008-09 financial crisis outperformed their competitors, achieving three times the revenue growth compared to their peers. Additionally, this period witnessed the rise of numerous successful newcomers, now valued as decacorns. In the words of Winston Churchill, “Never let a good crisis go to waste!”

The authors would also like to express their gratitude to: Mabrouk CHETOUANE (Sr Economist at Natixis) for his macroeconomic in-depth research and Abhay GUPTA (Analyst at the Subscribed Institute) for his additional research

Learn more about the authors

EMEA Chair, the Subscribed Institute

Principal Director of Subscription Strategy, Zuora

Co-Founder & Partner of Thematics Asset Management (Natixis Affiliated)

Fund Manager of Thematics Subscription Economy Fund

The Subscribed Institute