Things you should know about your ERP revenue module

When it comes to evaluating options for automating revenue recognition, checking out your ERP rev rec module is the logical first step—and it’s a good baseline for determining what solution will most effectively handle the use cases, complexity, and transaction volume of your business.

This choice is often framed as “anti-ERP” or “pro-ERP,” but it may not be so black and white. Rather, the choice is between:

- A revenue module with functionality developed as an afterthought within the legacy ERP systems. This approach can create manual tasks for revenue teams, delay the launches of new products and offers, and require integrated solutions maintained through custom development work. However, these modules may be offered for free or at a low cost and may offer enough functionality for small to midsize businesses.

- Systems and platforms designed for specific capabilities and integrating them through prebuilt connectors, which enables agility and allows revenue teams to focus on analytics and business partnering. This approach enables greater agility and scalability as businesses move upmarket.

Yet time and time again, companies incorrectly assume their ERP rev rec modules can handle their requirements and work to implement them, resulting in unanticipated expenses, resource constraints, control risks, and delays in supporting go-to-market motions, pricing, and products.

These headaches can be avoided when companies do their homework to validate whether the ERP module is the right solution for their current and future use cases.

In a recent survey of finance and accounting leaders, 6 out of 10 said that their ERP revenue modules do not fully support business requirements, even with customizations. This is especially true if they’re growing fast and increasing the complexity of their products and go-to-market strategies. In fact, 68% of revenue accounting team members report not having the right technology to address growing demands from the business

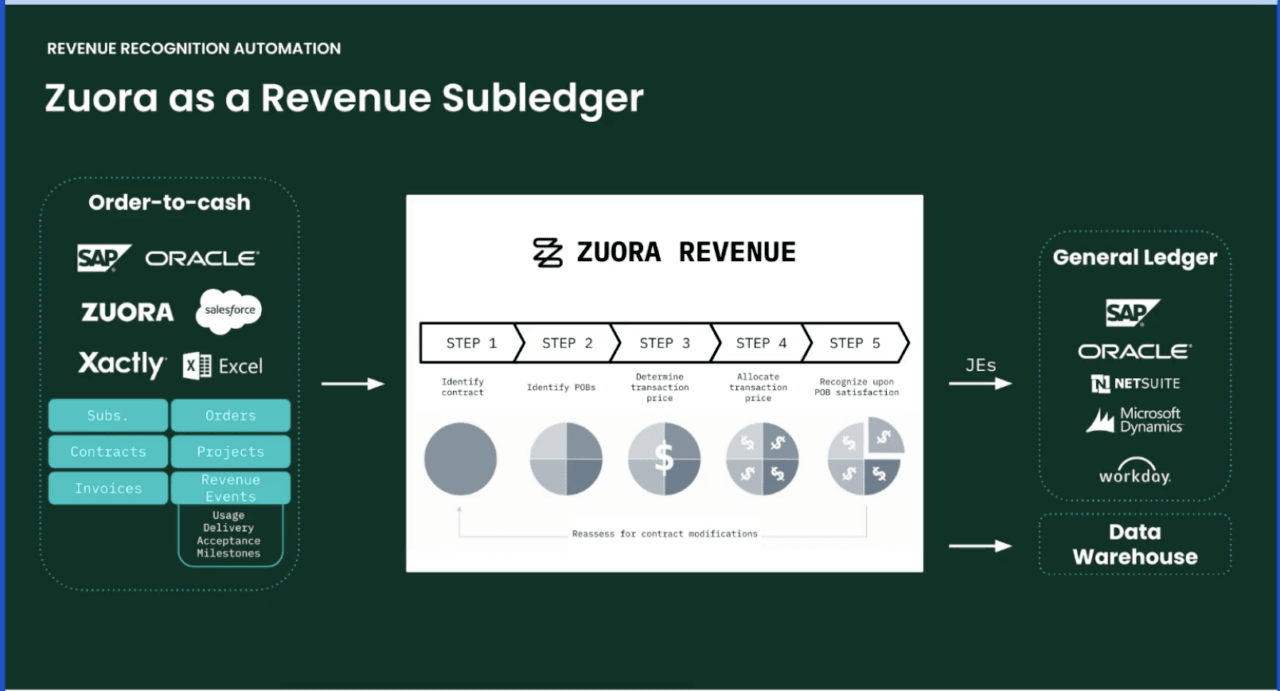

To mitigate the risk these systems can introduce into a company’s ecosystem, many accounting teams are now choosing to employ a revenue subledger built to work alongside their ERP.

As you begin to investigate rev rec automation options for your business, here are 10 questions to ask your ERP vendor about their native rev rec module.

Related: The revenue automation software buyer’s guide

1. What does the product roadmap for rev rec capabilities look like?

A study by MGI Research that ranked revenue automation vendors found a wide range of investment levels across suppliers, including ERP vendors. The report showed that some companies make significant investments with a dedicated team and product roadmap, while in other cases, companies simply don’t have a product team focused on continually developing the rev rec solution.

For many ERP suppliers, rev rec is not their primary focus, so it’s important to ask what you can expect when it comes to the future of the product and whether it will keep up with new requirements of your business.

Look for a solution that provides regular updates, new features, and small improvements designed to make life easier for accounting teams, while ensuring the extensibility, scalability, and security needs of an enterprise.

For example, make sure all use cases, such as consumption rev rec, can be handled with current functionality. At the very least, future use cases should be accounted for on the product roadmap, as your business may ultimately need them.

2. Does the implementation team have subject matter expertise?

Most accounting teams don’t have the internal capability or technical expertise to support complex rev rec system implementations or provide crucial information for a successful adoption or effective implementation.

They tend to need support from rev rec experts that are well versed in operations, process, and system functionality to navigate the “gotchas” while they continue to do their day jobs.

These rev rec experts have done hundreds of implementations and have a library of the best practices across various industries and business models. Their knowledge significantly reduces costly mistakes and delays, both during implementation and on an ongoing basis, especially during end-of-quarter crunch times.

ERP vendors typically lack rev rec specific and dedicated industry expert resources due to their broad focus on the general ledger. In contrast, a market-leading revenue automation solution will most likely offer these resources, providing additional value to your business and its processes.

When you encounter limitations within an ERP or need to update the platform post implementation, you’ll likely need to hire an external resource, if you do not have a dedicated resource within your own IT or business systems organization.

This unexpected requirement to build or customize the ERP is time-consuming and costly for businesses. Often the lack of planning and the decision to use an ERP rev rec tool forces businesses to implement manual “band-aid” processes that undermine the agility and efficiency of the revenue accounting team and, ultimately, causes delays in financial close and reporting.

3. What is the total cost of ownership, including the platform, the implementation, any customizations, and maintenance?

Many companies are tempted by the low cost of an ERP rev rec module, especially if it’s a free add-on or a SaaS subscription for a minimal charge. As a result, they dramatically underestimate the additional cost of implementation,customization, and maintenance.

ERP rev rec modules tend to be a good solution for simple use cases, but business is rarely simple. Vendors, specifically those implementing the ERP, uncover the majority of your business’s use cases after the product is purchased. This results in the company’s specific systems and complex revenue recognition processes not being discovered until it’s too late and the need for unexpected customizations occurs.

These customizations tend to require hiring a contractor or relying on internal IT, finance, and accounting team members who may lack significant knowledge of the system to spend time and resources to make the system usable.

The result of unexpected requirements can significantly expand system implementation costs and timelines. In fact, 65% of revenue accounting team members say that their ERP rev rec modules were more expensive than anticipated when factoring in customizations and ongoing maintenance.

The timeline impacts not only increase the cost and resources available, but any delays during an accounting system implementation have additional cascading effects on the ability to operate the business overall.

From launching new products and growing the business to closing the books and making sure the company is paid, the accounting team is forced to prioritize various business needs under constant pressure to become efficient.

4. How many customer implementations are configurable out of the box, and how many require back-end customization?

As mentioned previously, heavy customizations are often required because the ERP module’s out-of-the-box functionality doesn’t usually support the needs of a growing business. To understand the limitations of an ERP we must first differentiate between a configuration and a customization.

A configuration is an arrangement of elements in a particular form, figure, or combination.

A customization is a modification made to something to suit a particular individual or task.

Oftentimes, revenue accounting teams will work with the implementation team to customize the ERP module to account for specific use cases in their business. Because this use case has been “handled,” the ERP solutions team may say they have the ability to handle your specific use case. Be careful to interpret this as a configuration.

While they have created a solution for the specific use case, this solution may actually be a customization, which we know can increase cost and time to implement and maintain.

In contrast, solutions that are specifically designed to handle various complex rev rec use cases can dramatically decrease downstream expenses associated with implementation and maintenance of the system.

The best way to determine how much configuration vs. customization is required for a solution is to ask for references about past implementations with customers who have similar setup requirements to your business. Customer success stories and references can give you clues about where the gaps are and how much customization a solution might require to meet your needs.

5. What percentage of use cases can be handled with standard functionality?

Beyond out-of-the-box features and customizations built to handle business requirements, many accounting teams must perform manual processes to handle contracts that have rev rec treatment considered “too complex to be automated.” Or, they may have to manually generate reporting for audits and management because the functionality isn’t available within the ERP.

If you’re reading this article, chances are you’re experiencing some complexity in your revenue automation journey. Whether it’s allocating transaction prices across goods and services, recognizing percentage completion over time in different ways, or handling contract modifications, use cases can quickly become complex.

Understanding how much can be done with standard functionality is important, not just for the initial implementation, but also with respect to the type of functionality you can expect down the road.

As businesses grow and evolve and the rev rec standards continue to be updated, revenue recognition will become increasingly complex and require additional software features and functionalities to automate the process.

When an ERP vendor states they can handle a specific use case, it’s important to ask if the solution is part of the product or if it is a customizable set of features deployed or developed at a customer’s request. It’s crucial to understand how much of the product roadmap is standardized and how much of it is a set of functionalities that have been developed for a handful of customers.

It might seem enticing when a supplier says they can do anything you want, but a completely custom solution that’s a great fit today will likely pose problems when you want to scale in the future.

The key is whether the vendor understands software development and what it takes to build and maintain a standardized product, or whether they’re assembling ad hoc solutions for individual customers.

6. How many customers are able to successfully automate 90-98% of their revenue?

When it comes to revenue recognition, it’s important to establish a definition of full revenue automation. Some people think a web of spreadsheets with a customized ERP module gives you full automation, but this is far short of what’s possible. End-to-end revenue automation means 90-98% of revenue is automated in the system with minimal manual interventions required to process transactions.

Ask your ERP vendor how many of its customers achieve this level of automation. And don’t take their word for it—ask for references. Increasing your level of automation can help save time and money, scale your business, quickly launch new products, and reduce audit scrutiny and reputationally damaging risks, such as a material weakness or even a revenue restatement.

In a recent study we conducted, 65% of leaders report concerns about the risk of misstatement because of existing manual processes and control risks. And more importantly. 78% report growing audit costs related to revenue.

Related: The State of Revenue Accounting report

7. Are modern pricing models and rev rec accounting fully supported?

Paying a monthly fee for a SaaS subscription has become a common pricing model that most rev rec solutions can support with out-of-the-box features. But businesses are continuing to evolve and require more flexible solutions to handle various pricing models, especially in an increasingly customer-centric world.

Both customers and companies are seeing greater value in adopting consumption-based pricing models. Common strategies include pay-as-you-go, overage, minimum commitment, and pre-paid with drawdown, among others. These modern consumption-based pricing models, unlike those that sell on a flat-rate monthly basis, require the ability to track customer usage, record revenue, and then predict future usage.

As your business adopts new models alongside existing recurring revenue streams, it’s important to understand whether the ERP rev rec module you’re considering allows you to offer a high level of pricing flexibility to customers.

In addition, it should provide the revenue predictability, future scalability, and usage visibility required for your unique product, customers, and business. Make sure to consider future use cases, not just the ones you have currently.

As the market constricts, companies must be focused on customer satisfaction, which can create a variety of complex use cases. Companies are offering customers pricing and packaging alternatives that introduce variables for revenue teams, which can further complicate the rev rec process.

For example, pricing bundles or allowance of upgrade/downgrade options can create complicated grouping scenarios which may not be fully supported within the ERP rev rec module. Always be careful when making assumptions about what will be supported and ask for a demo or proof of this functionality.

8. Is the rev rec module natively integrated with the rest of the ERP, both upstream and downstream?

Everyone would agree that a critical feature of a rev rec solution is its ability to be integrated with the ERP. But just because a rev rec module is provided by an ERP vendor doesn’t mean you should take for granted that it is the best solution for your business process.

ERP rev rec modules are built upon the ERP and are highly structured and controlled for general accounting purposes. These environments may or may not function like a true subledger and the integration back to the highly controlled ERP may not allow for the flexibility required in revenue recognition.

If the solution does not function like a subledger, it may require revenue teams to utilize additional tools to synchronize the entire revenue process.

Outside of the ERP processes and data, businesses should take a holistic view of the upstream integration capabilities for things such as initial sales data and downstream integration for reporting and revenue analysis.

9. Are there any transaction volume restrictions?

An important factor in ERP rev rec is transaction value and frequency of data access. Some ERP rev rec modules have limits on the number of transactions that can be processed at a given time.

While this may not be a concern in your business today, if you expand to sell in different countries or currencies, or to sell into a new vertical, some rev rec solutions may lack the ability to handle the volume and complex processes required to achieve business objectives.

Not only do ERP vendors lack the ability to process high volumes of sales data, but ERP tools may also experience a lag in the processing time of revenue journal entries. Depending on the volume, pushing through revenue journal entries at the end of the month can take anywhere from three hours to three days to process. This can significantly impact your revenue accounting close timeline.

Make sure you ask your ERP vendor about volume restrictions and processing time so you’re not caught by surprise when trying to meet a deadline. And because this information may get technical, it could be useful to recruit an internal IT resource to vet these requirements, if they are not already part of the normal procurement process. Additionally, as mentioned throughout, ask for customer references, particularly businesses with similar requirements.

10. What standard reporting is provided for real-time revenue position visibility?

Real-time revenue position reporting can make revenue accounting a very demanding job, with multiple stakeholders requesting data on a continual basis. Fielding ad hoc requests from finance, tax, or even investors can be time-consuming, especially when they request specific information that isn’t part of a basic report.

ERP rev rec modules have some standard reporting options, but building custom reports is technical, time-consuming, and not flexible enough to handle unexpected one-off requests or data segmentation.

These systems are generally built for financial accounting, not technical revenue accounting, and therefore tend to lack standard revenue-specific reports (such as SSP). When evaluating rev rec solutions, look for one that has plenty of the pre-built standard reports that you’ll need for revenue accounting.

Accounting teams often find that their ERP rev rec modules can’t support the level of detail that leadership may be looking for, such as SSP, revenue by product, or revenue segment reporting. Remember to think about the reports you need today as well as for future business revenue models.

As you get further into your evaluation, compare your current month-end close and audit supporting reports to the vendor’s standard reports to confirm you will have the required report once implemented. If your ERP rev rec module can’t easily and quickly provide the information you need, you’re setting yourself up to spend a lot of unnecessary time manipulating data and compromising your ability to be a valuable partner to the broader finance organization.

Choose the best solution—the first time

Changing direction midway through an implementation is expensive and time-consuming. Even more costly is a pure rip and replacement of your rev rec tool. It’s imperative to the business’s growth to ask the right questions that help you discern which rev rec solution will meet your needs — now and into the future.

Access the complete roadmap for researching, testing, and selecting the right revenue automation software for your company.

The Zuora Revenue solution

If you’re not satisfied with the answers to these questions you get from your ERP vendor, check out whether a point solution like Zuora Revenue might be a better fit.

Because Zuora Revenue is specifically designed to be a revenue subledger, it solves all of these questions, helping teams achieve 90%+ revenue automation.

“Zuora Revenue was designed from the ground up around the needs of revenue accountants. After just one quarter, our team experienced numerous benefits. The bundle configuration improved the accuracy of our revenue allocations, the customizable grouping rule setup eliminated tedious manual tasks for close, and the user-friendly interface extended us increased functionality and convenience.”

— Tony Zhang, Senior Revenue Manager, Nutanix

A side-by-side comparison of Zuora Revenue with most ERP rev rec modules illustrates why accounting teams across industries are turning to Zuora:

Most ERP rev rec modules

Zuora Revenue

Switching to a purpose-built revenue recognition solution has measurable benefits. Zuora customers achieve up to 92% revenue automation, according to internal analysis, compared to 55% with a leading ERP rev rec module. They also go to market up to 80% faster, spend 50% less time and effort closing their books, and save up to $50k in annual customization costs.

Hundreds of market leaders across the globe, such as Salesforce, Docusign, and Electronic Arts rely on Zuora Revenue. Whether it is Gainsight reducing its average audit time by 50%, or Siemens Healthineers reducing its number of manual tasks by over 60%, or Nutanix saving its team 550+ hours per year, Zuora Revenue customers reap quantifiable business value.