Revenue recognition is one of the most important accounting metrics for any business. It’s also one of the easiest to overlook in subscription finance and accounting.

Let’s imagine you’ve just made a sale: adding a new account worth $1,200/month for a contract of three years. It’s an exciting milestone for your company, worthy of celebration because you just made $43,200 in revenue, right?

Well…not exactly.

According to standardized accounting principles, revenue should be recognized after you’ve delivered the service to your customer. And, so far, you haven’t really delivered anything to your new customer, except maybe a contract.

Even if you got that client to send you all $43,200 tomorrow, it still wouldn’t count as revenue. Why? Because the revenue recognition principle also doesn’t consider cash in your company bank account to be revenue.

If any of that’s confusing, don’t worry. Everything will make sense when you finish reading this guide on revenue recognition for subscription businesses.

Here’s what we’ll cover:

- How the standardized revenue recognition principle benefits your business

- The 5 step framework all businesses should follow to recognize revenue accurately

- Difference between cash and accrual accounting

- The 5 criteria for recognizing revenue to ensure consistent financial reporting

- Revenue recognition: revenue recognized at point in time vs. over time

- An example of the revenue recognition process for a subscription-based business

Before we dive into that first topic, let’s ensure we clearly understand what revenue recognition means.

What is revenue recognition?

Revenue recognition is the generally accepted accounting principle (GAAP) referring to the way a company records revenue earned.

Why is this principle needed? The term “earned” is relative. You could consider revenue to be “earned” when you have made a sale or after the cash has reached your bank account. The revenue recognition principle standardizes the process of reporting earned revenue to avoid ambiguity or inconsistencies in your accounting.

The principle states that you can only recognize revenue after you’ve met the contractual obligations promised to customers.

Why is revenue recognition important for subscription-based businesses?

Revenue recognition is important because it provides transparency and consistency in financial reporting, which can impact tax liability, share price, and more. It also helps businesses manage cash flow more by giving them a better understanding of when they’ll receive payments.

For subscription-based businesses, revenue recognition is critical. With subscriptions, customers are typically billed in advance for the product or service they’ll receive. If revenue isn’t recognized until after the product has been delivered, there could be a delay between when the revenue is earned and when it’s reported.

Without a standard practice for recognizing revenue, this delay could create problems for financial planning and decision-making based on the company’s financial health. By following the Accounting Standards Codification (ASC) 606 framework for revenue recognition, you can avoid these problems.

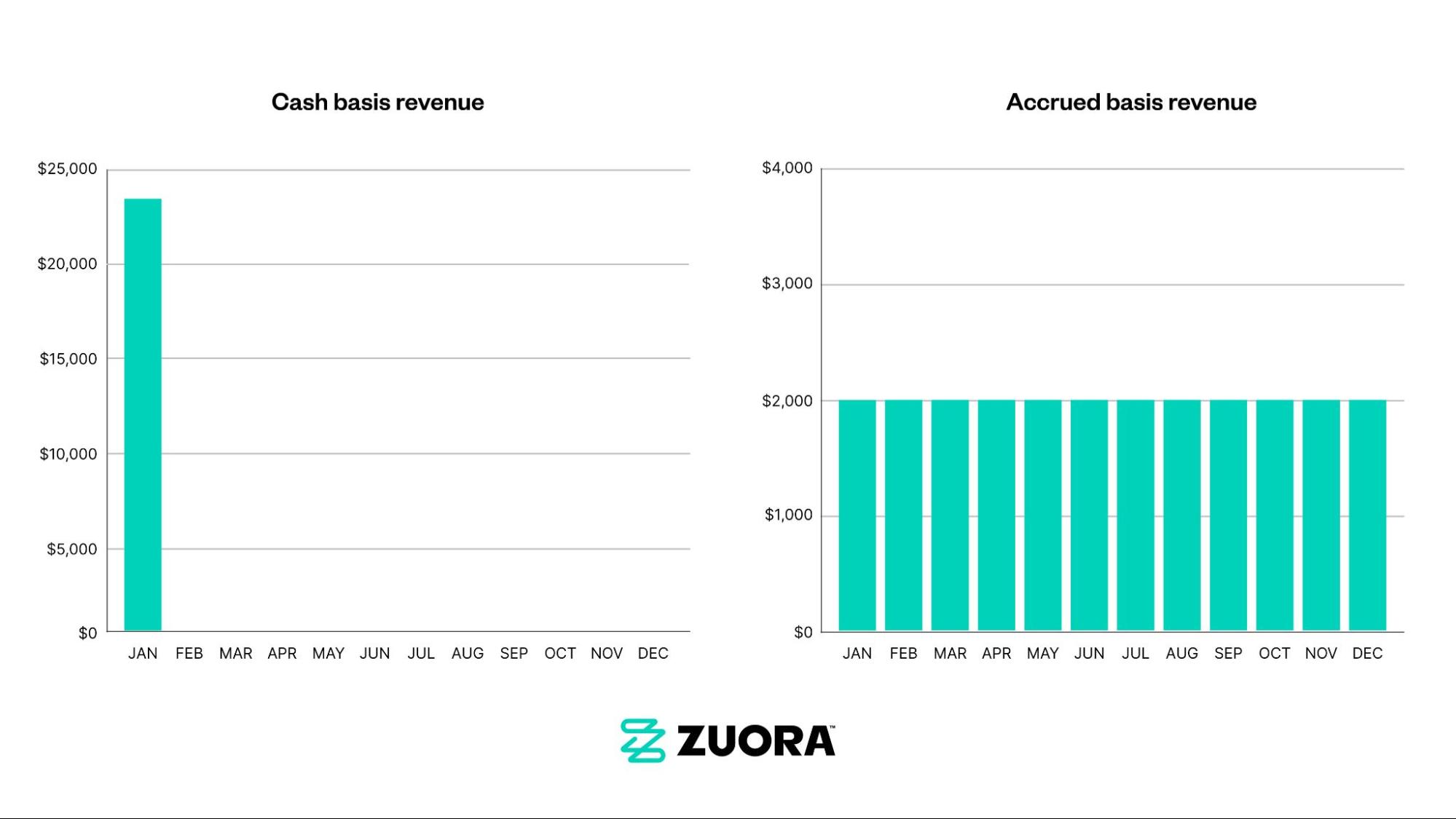

Difference between cash and accrual accounting

The main differences between cash and accrual accounting are:

Timing of transaction recording

Cash accounting records transactions when cash changes hands. Revenues and expenses are recorded when cash is received or paid out.

Accrual accounting records transactions when they occur, regardless of whether cash is exchanged. Revenues are recorded when earned and expenses when incurred.

Matching principle

Cash accounting does not explicitly match revenues to related expenses.

Accrual accounting matches related revenues and expenses in the same reporting period through deferred/accrued accounts. This connects income and expenses to give a more accurate picture of a business’s profitability.

Accounting for assets and liabilities

Cash accounting only accounts for assets and liabilities paid for in cash. Things acquired on credit would not show up.

Accrual accounting accounts for all assets and liabilities when they arise, whether cash changes hands or not.

Financial statement differences

Cash-based financial statements show the actual cash position and flows rather than income and expenses incurred economically.

Accrual basis financial statements attempt to show the real-time economic impact of transactions according to the matching principle and allocation guidelines.

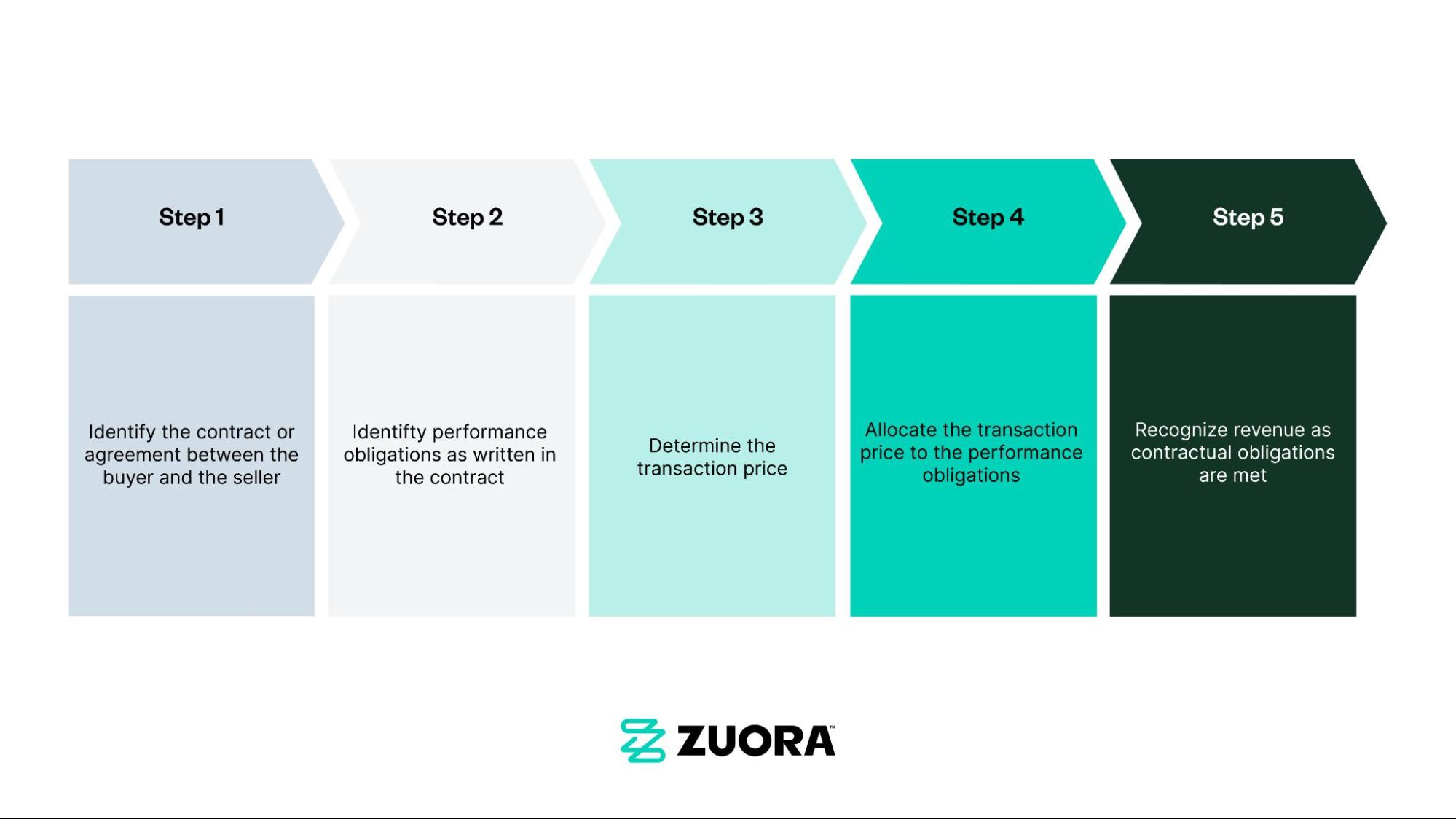

ASC 606 framework for revenue recognition

In 2014, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) standardized recognizing revenue from customer contracts in the ASC 606. This standardized process applies to all businesses, regardless of industry.

By following the 5 step process outlined in ASC 606, you can ensure that your subscription business has a consistent method of recording revenue from customer contracts. This also ensures consistency across financial records.

The 5 critical steps for revenue recognition with ASC 606

The following are the required steps for revenue recognition.

Step 1: Identify the contract or agreement between the buyer and seller

A contract is an agreement between two or more parties that creates enforceable rights and obligations. You’ll need to refer to the sales contract or purchase order between the customer and the business.

For a contract to exist, all the following criteria must be met for a contractual arrangement to exist with the customer:

- Commitment from both parties. The parties have approved the contract and are committed to their respective obligations.

- Identification of rights and obligations. The entity can identify each party’s rights regarding transferring goods or services.

- Identification of payment terms. The entity can identify the payment terms for transferring goods or services. However, the payment doesn’t need to be specific.

- Commercial substance. The contract has commercial substance (i.e., the risk, timing or amount of the entity’s future cash flows is expected to change due to the contract).

- Likelihood of payment/collections. The entity will likely collect substantially all the consideration to which it will be entitled in exchange for the goods or services transferred to the customer.

However, a contract doesn’t necessarily need to be written to be valid—it can be oral, implied, or written. The entity will be considered a liability if a contract doesn’t satisfy all the following criteria.

Step 2: Identify performance obligations as written in the contract

For subscription-based businesses, this is important because it’s not always clear what the customer is paying for. Are they paying for access to content, the use of a platform, or a mix of both? This needs to be clear for revenue to be recognized correctly.

The key is to review the contract, identify the separate goods or services, and assess if they are individually distinct to determine all the different performance obligations.

- A performance obligation is a promise in a contract with a customer to transfer a good or service to the customer.

- The contract should be evaluated to identify each distinct promised good or service.

- A good or service is distinct if the customer can benefit from it on its own or with other readily available resources, and the promise to transfer it is separately identifiable from other promises in the contract. A distinct product or service is standalone and sold separately. They usually are not interdependent or need to be integrated with other products or services.

- Options for additional goods or services represent separate performance obligations if the customer would pay an additional price for them.

- A bundle of goods or services may represent multiple performance obligations if the entity provides a good or service separately outside the bundle or if the good or service is not input to a combined output.

Arguably, this is one of the most important steps of revenue recognition.

Step 3: Determine the transaction price

The transaction price is the amount of consideration (payment) an entity expects to be entitled to in exchange for transferring promised goods or services to a customer, excluding any amounts collected on behalf of third parties.

To determine the transaction price, the entity considers the terms of the contract and its customary business practices. This involves considering:

- Fixed consideration amount stated in the contract

- Variable consideration (bonuses, penalties, etc.)

- Significant financing component – whether payment occurs significantly before or after performance obligations are satisfied.

- Non cash considerations

- Consideration payable to the customer (payments made to the customer)

For subscription-based businesses, there are often different pricing models with differing transaction prices depending on the subscription tier. It’s essential to determine the transaction price for a contract so that you can recognize revenue correctly.

For a subscription business, the transaction price would include the following:

- The subscription fee paid by the customer for their chosen subscription plan and term. For example, an annual subscription costs $10 per month.

- Any one-time, non-refundable setup fees. Some subscriptions charge an initial registration or activation fee.

- The stated subscription price includes any promotional or introductory pricing for initial subscription periods. The regular renewal price would need to be considered as well.

To calculate the total transaction price, you look at the stated prices within the individual customer subscription for the contract or renewal period. Taking into account the consideration the business expects to receive over that subscription term is crucial in determining the transaction price.

Step 4: Allocate the transaction price to the performance obligations

The goal here is to assign revenue to performance obligations (in step 2) that depict the consideration to which the entity expects to be entitled to transfer each good or service. This then sets up proper revenue recognition as obligations are fulfilled. To meet these objectives:

- The transaction price is allocated to each performance obligation identified in the contract on a relative standalone selling price (SSP) basis.

- Standalone selling price represents the price an entity would sell the good or service for separately under similar circumstances.

- Estimates can be used if goods or services are not sold separately. Approaches may include adjusted market assessment, cost plus reasonable margin, or residual approaches if the bundled selling price is highly variable.

- Allocation is based on relative standalone selling prices, so total consideration is divided proportionally.

- The amount allocated to each performance obligation forms the revenue recognized when that obligation is satisfied.

- Estimates of standalone selling prices and the transaction price are updated at each reporting date as more information becomes available and estimates change.

Let’s say a customer has agreed to pay $1,000 per month for access to a platform, and the business has determined that the platform consists of two performance obligations (access to content and use of the platform) of equal value. Then, the business would recognize $500 of revenue toward the access to content obligation and $500 for using the platform.

Step 5: Recognize revenue as contractual obligations are met

As each performance obligation is satisfied, meaning the customer gets what they paid for, revenue is recognized. You may choose to recognize revenue as the contractual obligations are met for each customer contract or wait to recognize revenue from multiple contracts at the end of the month.

Here are the crucial factors in step 5:

- Revenue is recognized either over time or at a point in time when or as a performance obligation is satisfied by transferring control of a promised good or service to the customer.

- Control refers to the customer’s ability to directly use and substantially obtain all the remaining benefits from an asset.

- For performance over time, revenue is recognized based on measures of progress towards completion

- Output methods recognize revenue based on direct measurements of the value transferred

- Input methods recognize revenue based on efforts or inputs toward satisfying the performance obligation

To determine if revenue should be recognized over time, certain criteria must be met:

- The customer simultaneously receives and consumes the benefits provided

- The entity’s performance creates or enhances an asset controlled by the customer

- The asset created does not have an alternative use to the entity

- The entity has an enforceable right to payment for performance completed to date

If those criteria are not met, then revenue is recognized at the point in time that control of the goods or service transfers to the customer.

Essentially, you want to faithfully depict the transfer of goods and services for the amount that management expects to receive.

A subscription business provides customers continuous access to digital content or software solutions over a subscription period, such as monthly or annually.

Since the customer simultaneously receives and consumes the benefits as the subscription company provides access over the contract term, this represents over time revenue recognition.

For example:

- For a 1-year $240 subscription, $20 would be recognized each month

- For a 3-year $300 subscription, $8.33 would be recognized each month

Key considerations:

- Term lengths can impact revenue recognition patterns

- Renewals extend revenue recognition for additional periods

- Subscription cancellations adjust remaining revenue recognition

Revenue recognition: revenue recognized at point in time vs. over time

Point in time revenue recognition

Revenue is recognized at the single, specific point in time when control of the good or service is transferred to the customer. Typically, tangible goods or distinct products are delivered at a specific moment in time. Control is also transferred at a specific time, usually on delivery.

Example: Sale of goods in a retail store or one-time product sales

Over time revenue recognition

Revenue is recognized gradually over the contract term as control of the goods or service transfers continuously throughout the contract period, such as when milestones are reached or a certain time period elapses. Generally, services are delivered in long-term contracts where performance is continuous.

Example: Construction contracts, software subscriptions, long-term services agreements

IFRS reporting standards criteria for revenue recognition

According to the International Financial Reporting Standards (IFRS), the following criteria should also be met before your company recognizes revenue:

- Risks and rewards of ownership have been transferred from the seller to the buyer (i.e., the company must deliver the product to the customer)

- The seller loses control over the goods sold (i.e., the customer must have the ability to use or consume the product or service)

- The collection of payment from goods or services is reasonably assured (i.e., it’s probable that the company will receive payment for goods or services)

- The amount of revenue can be reasonably measured (i.e., the company can calculate the revenue from the sale of goods or services with a reasonable degree of accuracy)

- Costs of revenue can be reasonably measured (i.e., the company can accurately calculate the costs associated with providing the goods or services)

These criteria ensure revenue is only recognized when it is probable that the company will receive payment for goods or services delivered.

Applying these criteria to a subscription-based business, revenue should be recognized once a customer has paid for a subscription. If a customer pays for a year-long subscription on January 1, the company should recognize revenue for that customer in twelve installments, one for each subscription month.

These criteria also clarify how to approach recording revenue during common promotions and offers. If you offer a limited-time trial of your service, the customer can cancel at any time during the trial without paying anything.

Revenue collection isn’t assured until the free trial period ends and the customer decides to become a paying subscriber. You know you can’t recognize revenue during the free trial period even if you have the customer’s payment on file.

Revenue recognition example for a subscription service

The revenue recognition principle provides a standard framework for reporting earned revenue from customer contracts. But what does the practice of recognizing revenue actually look like? Let’s look at an example:

Your business has a subscription service and just acquired a new customer with a three-year contract for $1,200/month. Now, let’s also say that, as standard practice, you charge a one-time onboarding fee of $200.

How do you begin to recognize this revenue?

You can recognize $200 of revenue once the onboarding process is complete. That contractual obligation has been met.

But what about the revenue from that three-year contract? Can you recognize the total revenue you expect to earn from that contract ($43,200) all at once?

Unfortunately, you will not. You first need to deliver the service. Since it’s a monthly contract, you’ll recognize $1,200 of revenue one month at a time as your customer continues to receive access to your service.

Revenue is recognized based on the percentage or stage of completion.

If your customer decides to cancel their contract at any point, your financial statements will still be correct. You’ll have only recognized earned revenue for the months that the customer actually used your service.

Bundling and discounting complicate revenue recognition

Say your company prices software at $800 annually and training at $200 yearly. If you bundle those two services together and sell the software at a discount of $500 while throwing training in for free, does that mean the training has no value in generating revenue?

The current revenue guidelines require companies to estimate the SSP of each offering and allocate the total transaction price of the contract across each offering based on the relative SSP.

Here’s how the above example would play out:

- The SSP for the software is $800, while the SSP for training is $200.

- When you bundle software and training together, 80% of the bundle is allocated for software, while 20% is allocated for training.

- Because the customer paid $500 for that contract, the total transaction price is $500.

- Since the transaction price of this deal was $500, 80% of it ($400) will be allocated to revenue for software, while 20% ($100) will be allocated to revenue for training.

There’s plenty of guidance on how to calculate allocations for bundled deals. But can you imagine implementing such advice for thousands of contracts without an automated solution? This will not only drown your revenue team but also slow down the pace at which you can roll out any changes to pricing and bundling.

Thinking about implementing a new packaging or bundling strategy? Without revenue automation, your pricing and bundling decisions could create a revenue nightmare for your finance teams. So ask yourself:

- Do we have the ability to automate the process of systematically separating (or “exploding”) bundles into distinct elements?

- Do we have the ability to automate the process of determining and applying SSP to each element in a bundle?

- Can we automate the process of allocating the transaction price of a deal across the different elements within a bundle?

What about revenue recognition automation?

Ever heard the term “set it and forget it?” That’s revenue recognition automation in a nutshell. By automating revenue recognition processes, there’s greater consistency in accounting and accurate analytics. Revenue automation empowers businesses by using technology, which realigns finance talent while restructuring service delivery.

By doing this, companies see fewer errors because employees aren’t spending time on monotonous tasks, which after a while can be a field of errors based on the constant back and forth of manual processes.

The revenue automation software buyer’s guide provides a complete roadmap for researching, evaluating, and selecting the right revenue automation software for your company.

Here are some key ways companies can automate parts of the revenue recognition process:

Contract management automation

Software can help automatically track relevant contract terms like payment schedules, rights and obligations, renewal options, etc. and trigger revenue recognition when contractual milestones occur.

Pricing and billing automation

Systems can house pricing policies, standardize billing routines, integrate with billing systems to track invoicing and allocate transaction prices to different performance obligations.

Revenue scheduling automation

Based on contract terms and billing events, recognition can be automated by calculating revenue amounts per schedule and integrating with accounting systems to book entries.

Compliance and reporting

Automated reports can provide contract fulfillment status, transaction price changes, recognition activity, financial statements, and regulatory reporting. This also provides an audit trail for revenue compliance.

Automated forecasting

Analytics around contract backlogs, renewal cycles, expected performance obligation delivery, and past revenue patterns can be used to forecast future financial performance.

Revenue recognition should be a top-to-bottom, consistent, and accurate process as volume and complexities increase. The IRS wants to know how revenue is tracked and valued, and having clean books is critical should you get audited. A company should not rely on its books being kept through a spreadsheet.

Establishing these kinds of best practices that take away the threat of human error, there is a consistency within the accounting practices, which many companies see further economic gains, but also a real throughline that offers a clear look into their numbers across the board.

Related reading: 9 benefits of end-to-end revenue automation

Revenue recognition FAQs

Revenue is the lifeblood of any business, so companies must follow a consistent and accurate method for recording it. The revenue recognition principle provides that guidance. Here are a few of the key takeaways that answer common FAQs about revenue recognition.

When should subscription revenue be recognized?

The revenue recognition principle states that revenue is recognized when you’ve received payment from your customers AND your company has met the performance obligations listed in the customer contract (i.e. you’ve provided the service).

When can you recognize subscription revenue from an annual contract?

If you provide a monthly service, you should not recognize revenue from an annual contract as soon as the customer pays you. Instead, you need to recognize the revenue one month at a time as the customer receives access to each monthly installment of the service.

What are the 5 steps for recognizing revenue according to the ASC 606?

The ASC 606 outlines five specific steps that must be followed to properly recognize revenue:

- Step 1: Identify the contract or agreement between the buyer and seller

- Step 2: Identify performance obligations as written in the contract

- Step 3: Determine the transaction price

- Step 4: Allocate the transaction price to the performance obligations

- Step 5: Recognize revenue as contractual obligations are met

Why is it essential to follow the step-by-step revenue recognition framework?

By adhering to the five-step revenue recognition framework laid out in the ASC 606, businesses can be sure they are recognizing revenue in a way that is consistent and compliant with generally accepted accounting principles (GAAP).

How does the revenue recognition principle help subscription businesses?

The revenue recognition principle is especially important for subscription businesses, as they often have annual and monthly recurring revenue streams. The revenue recognition principle provides a framework for a consistent method for subscription businesses to follow when recording revenue. It also ensures that subscription businesses don’t over- or under-state their sales.

Take the next step toward revenue automation

Ready to take the next step? Zuora Revenue automates revenue recognition for any business model and allows teams to reconcile and report on these revenue streams in real time. Over 90% of our deployments require no customizations.