Preventing Payment Fraud

Payment fraud is becoming increasingly common, causing major impacts on both businesses and customers.

All it takes to see this is the over $40 billion loss incurred yearly by companies globally, or the 14 payment fraud emails per year you’re likely to get if you live in the US.

Businesses need to safeguard their operations from the threat of fraud. Subscription-based business models are just as susceptible to payment fraud — if not more.

This guide will discuss everything you need to know about payment fraud, how it works, the various types, and the best practices to guard against fraudulent payment activities.

What is payment fraud?

Payment fraud is financial fraud, where an entity uses false or stolen payment information to obtain a product or service.

For subscription-based businesses, the risks of payment fraud are even higher and more damaging. Without a solid security and order management system, recovery from payment fraud is painfully drawn out. Understanding some of its key elements and how businesses can brace themselves for impact is imperative.

Related: How to tame electronic payments and revenue leakage

Types of payments

The following are the two types of payments.

Card present (CP)

This payment form requires a physical payment card, such as a credit or debit card. Typically, the card is physically presented by the cardholder to the merchant at the point of sale (POS) or a payment terminal during a purchase.

It’s a normal payment option in traditional brick-and-mortar retail settings, stores, restaurants, and other physical locations.

Card-not-present (CNP)

The other form of payment is card-not-present (CNP), which refers to transactions where the customer doesn’t have to use their credit or debit card for the purchase physically. There’s no swiping or tapping. Instead, CNP payments are conducted in virtual payment terminals.

CNP is the most suitable payment option for online transactions, where subscription-based business models fall.

Types of payment fraud

Credit card fraud

Credit card fraud is a form of payment fraud where an unscrupulous actor gains unauthorized access to the user’s credit card information using deceptive means like ATM skimming. They then purchase, obtain funds, or engage in other financial transactions without your consent.

Debit card fraud

Debit card fraud is similar to credit card fraud in that the cardholder’s sensitive personal information is stolen. This time, funds are moved from the account instantly, and checks not yet cashed will bounce.

Mobile payment fraud

Payment fraud also exists as mobile payment fraud. Here, the fraudster uses techniques to exploit vulnerabilities in mobile payment platforms to intercept a payment transaction and steal payment details.

Identity theft

Not all payment fraud involves financial information. Such is the case with identity theft, where an individual’s personal and confidential information is stolen and misused by the fraudster. Most identity thefts are motivated by financial gain.

Refund fraud

Refund fraud takes payment fraud a step further. The fraudster initiates a refund process for a product they neither bought legitimately, nor for which they’re entitled to a refund. Online retail stores and subscription-based businesses are the usual targets of refund fraud, and successful hits are often with the help of someone on the inside.

Gift card fraud

Gift card fraud involves prepaid cards loaded with a set amount of money, which customers can use to purchase goods and services or share with friends and families to do the same. Gift card fraud can take various forms, the most common being card cloning and number guessing or reselling.

Card testing fraud

Also known as card cracking or “carding”, card testing fraud involves cybercriminals stealing physical credit or debit card details. They then test the validity of these details to gain unauthorized access to funds or make fraudulent purchases.

This type of payment fraud is more concerted, with steps aimed at carefully exploiting weaknesses in each successive payment system and security protocol.

Phishing and spoofing

Phishing and spoofing are types of digital payment fraud involving manipulating individuals or systems. They use social engineering to achieve results.

According to FBI research, phishing was the most common form of cybercrime in 2020. Phishing attacks ranged from 114,702 incidents in 2019 to 241,324 incidents in 2020.

Below are some of the other forms phishing and spoofing can take:

Email phishing

This variant of phishing involves fielding deceptive emails to trick individuals into revealing sensitive information, such as login credentials, financial data, or personal details. These phishing emails look legitimate and will mimic communications from trusted sources, such as banks, social media platforms, online services, or government agencies.

Vishing

Vishing is short for “voice phishing,” where cybercriminals use phone calls or voice communication to con individuals into revealing sensitive information for the financial benefit of the attacker.

Vishing attacks rely on social engineering techniques to manipulate victims into providing confidential information, such as credit card numbers, passwords, Social Security numbers, or other personal details.

Smishing

Smishing is SMS phishing, like vishing and email phishing, but with text messages (SMS). Similar to the aforementioned, smishing attacks use social engineering.

Pharming

Pharming involves redirecting users from legitimate websites to malicious or fraudulent ones, without their knowledge. Unlike phishing, pharming attacks target the underlying vulnerabilities in the internet’s infrastructure, such as domain name system (DNS) servers. This allows them to redirect traffic to fake websites.

Why payment fraud is a growing concern

The threat from payment fraud continues to grow annually, with Experian reporting an increase in losses from fraudulent identities from 51% in 2017 to 57% in 2019. But why is that? Here are a few reasons:

Increase in digital transactions

The increase in payment fraud is in part the result of the proliferation of more digital transactions. As more people buy goods and pay for services online, payment hijacking becomes likely.

Rise of e-commerce

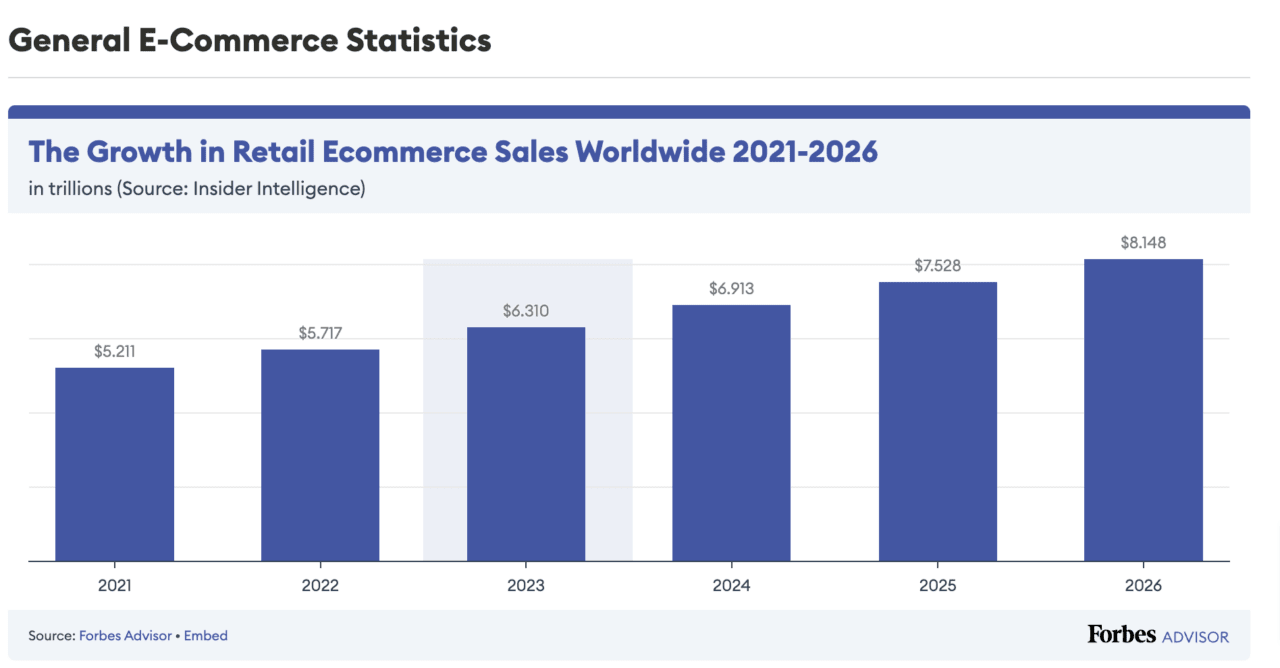

With the emergence of e-commerce in the 1990s, the sector has witnessed steady growth. Presently, the global estimated worth is $6.3 trillion — and expected to hit $8.1 trillion by 2026. Having grown to astronomical levels of profitability , the increase in fraud related to e-commerce is the unfortunate result.

Advancements in fraud techniques

Unfortunately, the same technology that makes online and traditional payments easier also makes payment fraud less detectable. Fraudsters can now detect vulnerabilities quicker, making fake payments easier than ever.

Impact of payment fraud on businesses

Financial losses

Businesses stand to lose a lot financially when under attack from payment fraud. Losses could easily escalate into millions of dollars for large-scale brands, causing bankruptcy in the worst-case scenario. For subscription-based businesses, financial loss from payment hijacking can be steady and prolonged, with little chance of detection.

Damage to brand reputation and customer trust

If customers discovered that their preferred brand was caught in payment fraud, they’d lose trust in their operations. And brand reputation takes a hit. Depending on the scale of the attack and impact, the road to recovery might be drawn out for the company.

Impact of payment fraud on customers

A single payment fraud attack can have far-reaching effects on a business. The impact of the fraud can be long lasting on the business. Here are some of the main impacts of payment fraud on customers:

Identity theft

One way the average consumer can suffer from a payment fraud attack is identity theft. Cybercriminals can steal sensitive personal details from them only to use them for financial gains or other nefarious reasons.

Monetary loss

Payment fraud almost always has the consumer losing some money from their account. Fraudsters will immediately access the money they can find behind stolen passwords and credit card details.

Personal stress and anxiety

Beyond the possibility of losing physical money and personal details, consumers can also lose their peace of mind after a payment fraud attack. Victims are often stressed and depressed about an ordeal.

How payment fraud is detected

Payment fraud can be devastating, but it often leaves a trail. Some systems can help users detect when fraudulent activity has been initiated.

Fraud detection systems

One way to detect payment fraud is through detection systems that monitor payment gateways and channels and notify the appropriate quarters of a breach where necessary.

Machine learning and AI in fraud detection

With the advent of machine learning and AI, fraud detection has gotten a huge boost. AI systems can now process huge amounts of data and predict the occurrence of fake payment confirmations. These models can also identify and stop attacks in much less time than before.

Watch on demand: Payment fraud in the age of generative AI and risks to subscription companies

Roles of banks and financial institutions

Banks and financial institutions are the last step in preventing transaction payment fraud. They seek to ensure proper authorization before a transaction goes ahead. With bank-aided security features like 2FA (two-factor authorization) and KYC (Know Your Customer), payment fraud is less likely to succeed.

Best practices to prevent payment fraud

Preventing payment fraud requires following several best practices to ensure the security of payments for your business.

Secure and encrypted transactions

Businesses and customers alike need to insist on encrypted payment methods for every transaction.

Thankfully, credit card encryption, gateway encryption, and device encryption now exist. Any combination of these security features can ensure that fraudsters find it harder to gain unauthorized access to users’ payment and personal information.

Regular monitoring of accounts

Banks can monitor billing accounts regularly to ensure any fraudulent activities are detected. This also enables them to flag any unusual transaction request someone else might have initiated besides the user.

GDPR and other regulatory compliance

Businesses complying with GDPR can also shield themselves from payment fraud. The regulation lets companies process user data for fraud detection purposes in order to understand their level of susceptibility.

The future of payment fraud and prevention

With the intersection between payment and security technologies, brands and customers want to know the future of fraud detection and prevention.

Emerging technologies in fraud detection and prevention

There’s been consistent research and development of new ways to detect and prevent payment fraud, with newer technologies like behavioural analytics, blockchain, IoT (Internet of Things), Machine Learning and AI.

Government policies and regulations

Government policies have been pivotal in preventing and stopping payment fraud. However, stiffer data protection laws, regulations, and compliance will raise the standards even higher. There might also be a broader government-backed consumer education on the impact of payment fraud security for transactions.

Role of cyber security measures

Expect to see more robust cybersecurity measures to mitigate payment fraud further, such as multi factor authentication, tokenization, and stronger data encryption protocols.

Building a culture of fraud awareness

Training employees to identify and report suspicious activities

Providing training to employees about how to identify and report suspicious activity and fraud adds a layer of defence against payment fraud attacks that rely on deception and social engineering.

Educating customers about security measures and fraud prevention

The culture of fraud prevention also needs to extend to customers through the proper education and awareness of basic security measures necessary at the point of each transaction they initiate.

FAQ on payment fraud

What is considered payment fraud?

Payment fraud includes a data breach in one’s payment information leading to illegal transactions. It also occurs when fraudsters manipulate and take advantage of the loopholes in the system for financial gain.

What are the most common types of payment fraud?

The top three common types of fraud in 2022 are: authorized push payment scams, card fraud, and identity theft.

How do you detect payment fraud?

The best form of payment fraud detection is to understand the nuances of the concept and its techniques in order to stay protected from its devastating personal and financial impacts. Also, keeping up to date with fraudsters’ latest and evolving strategies.

The best practices in this guide are another way to help prevent and detect fraud. While there are various ways to detect fraud, here are some common ways:

- Use an address verification service

- Velocity checks

- Geolocation verification

- IP address analysis

- Machine learning models

- Fraud scoring

- Social media and open source intelligence

- Pattern recognition

- Real-time alerts

- Blacklist/whitelist checks

- Biometric verification

- Check CVV

- Use 3D secure payer authentication

What is an example of push payment fraud?

Authorized push payment fraud, also known as APP fraud or APP scams, is the fastest-growing scam presently. This occurs when a fraudster gains an individual’s or customer’s trust through pretense and convinces them to transfer money into the fraudster-controlled account. 75% of all online banking payment scam is APP, according to Outseer’s 2022 Fraud and Payment Report.

How do you guard against online payment fraud?

First, as a user, ensure the website has an SSL certificate (HTTPS) in the URL before you input your card details — most scam sites often lack it. And for businesses, implement Know Your Customer (KYC).

Explore how Zuora can protect your business from fraud: Overview of Zuora Fraud Protection

What is down payment fraud?

Down payment fraud, or mortgage fraud, is when someone tricks you into making an upfront payment before receiving any promised goods, services, or financial gains. Scammers often leverage their victim’s desires for quick financial gain. It commonly takes the following forms:

- Real estate scams

- Job scams

- Lottery or prize scams

- Loan or financial assistance scams

- Online shopping scams

- Investment scams

- Travel and vacation scams

How to stop fraudulent recurring credit card transactions?

The first step to stop fraudulent recurring credit card transactions is to notify your credit card issuer as soon as you discover the fraudulent transaction. This way, they will deactivate the card and conduct a thorough investigation to ensure you’ve no financial responsibility for the transaction.

Then file a free fraud report at the Experian Fraud Centre — it ensures that your identity is verified before any new card is issued in your name. Regardless of your credit bureau, a fraud alert to one nudges the other two.

Then visit the Federal Trade Commission’s identity theft to file for a report.

How could a scammer get my card details if I’ve never used it?

Fraudsters can get someone’s card details through various tactics and means, even if you have never used it. Here are various methods used:

- Fake websites

- Malware and keyloggers

- Public Wi-Fi network

- Data breaches

- Fake phone calls

- Stolen documents

- Fake apps

- Social engineering

- Mail theft

- Card skimming

To ensure you don’t fall victim to any of the above:

- Don’t use public Wi-Fi for sensitive transactions

- Use updated devices and the latest security patches

- Regularly review your bank statements and transactions

- Keep your physical card safe and contact your card provider whenever it’s stolen or lost

- Don’t disclose your personal information to any unsolicited emails, messages, or phone calls asking for it