With so many businesses supporting high-volume B2C-oriented businesses on Zuora, payment fraud is a topic we’ve been helping our customers with for a long time. However, it does seem like the problem has reached a new level recently.

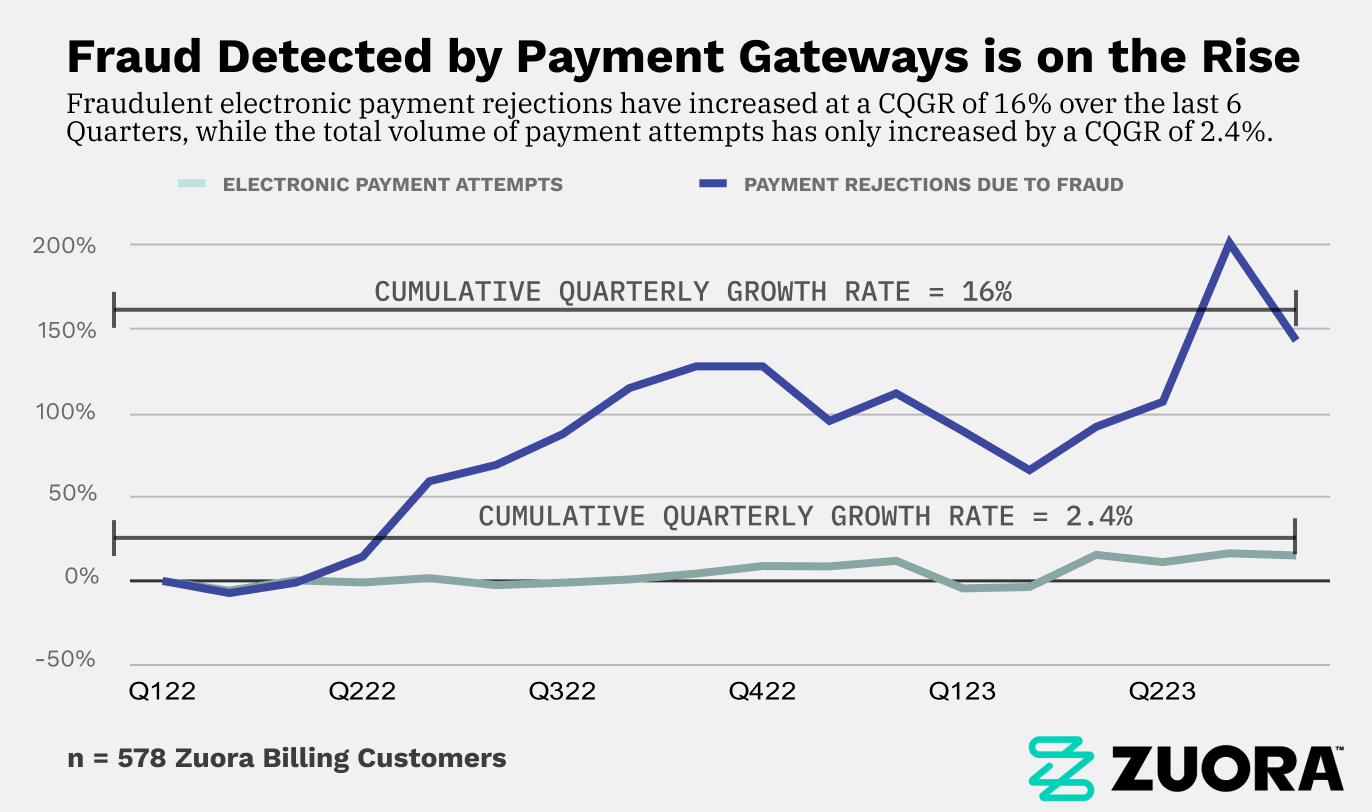

Well, this week’s data insight confirms it, electronic payment fraud is on the rise. More specifically, we observed that the total volume of electronic payment failures due to fraud increased for businesses running payments through Zuora by a cumulative growth rate of 16% per quarter over the last 6 quarters.

This is even more notable given the fact that total volume of payment attempts for those same businesses only increased at a cumulative quarterly growth rate (CQGR) of 2.4%. This would suggest that fraud-specific rejections are becoming a larger portion of all electronic payment rejections as a whole.

While there’s no shortage of many many many other organizations that have their own data about electronic payment fraud, this is a complex topic. An insight like this only scratches the surface.

Given the recency and urgency of this topic, we plan to dig deeper into this in future posts. We’d love your feedback to make sure the insights are as helpful as possible. Let us know in the comments what other kinds of insights around payment fraud would be most helpful and we’ll base future posts off the feedback we receive.

Methodology details

This analysis was isolated to the cohort of 578 Zuora Billing customers that processed an electronic payment transaction in Jan 2022.

We then tracked the growth in total payment attempts and fraudulent payment failures for those same 578 customers over the 6 quarters starting in 2022. Data from new customers that went live after Jan 2022 are not included.

The definition of a fraudulent rejection is based on the reason code data provided from each of Zuora’s gateway partners. Zuora’s product development team maintains extensive mapping and machine learning logic to identify gateway reason codes that indicate a payment is rejected due to suspected fraud. This same mapping data was used for this analysis.

Written by:

Jonathan Brown, Sr. Customer Strategy Director