SUBSCRIPTION FINANCE

How to Increase Lifetime Value for Subscription Businesses

What Does LTV Mean?

Lifetime value, sometimes referred to as customer lifetime value (CLV or CLTV), measures how much profit you can expect to make from a customer throughout their time as a customer of your business.

Essentially, LTV tells you how valuable customers are to your business. And, as a subscription-based business, knowing this information can help you make important decisions with confidence.

As a subscription-based business, you know that acquiring new customers is essential to your success. But keeping (and continuing to sell to) your existing customers for as long as possible is just as important – don’t you think?

If you’re nodding your head yes (and you definitely should be), then you probably also know the importance of tracking and measuring the lifetime value (LTV) of your customers. And that’s great!

But if you want to really use this metric to your advantage, you need to also know how to answer questions like:

- What are the 4 key factors to customer lifetime value?

- How does knowing LTV help you make better business decisions?

- What’s the best formula to calculate customer lifetime value for subscription-based businesses?

- What are some things you can do to increase the lifetime value of a customer?

Why LTV Matters for Subscription-Based Businesses

Lifetime value is an important metric for all businesses. But it is especially important for subscription-based businesses. Why?

Because, as you know, subscription businesses rely on recurring revenue models. And this means these types of businesses need loyal customers who will continue buying from them again and again. Tracking LTV is your way to ensure your business is retaining enough valuable customers to support long-term, sustainable growth.

Identify your most valuable customers

With this information, you can strengthen your customer retention strategies accordingly and target to acquire customers with similar qualities. You can only acquire more similar customers if you’re good to your present customers — this is also the view of Shep Hyken, a customer service and experience expert.

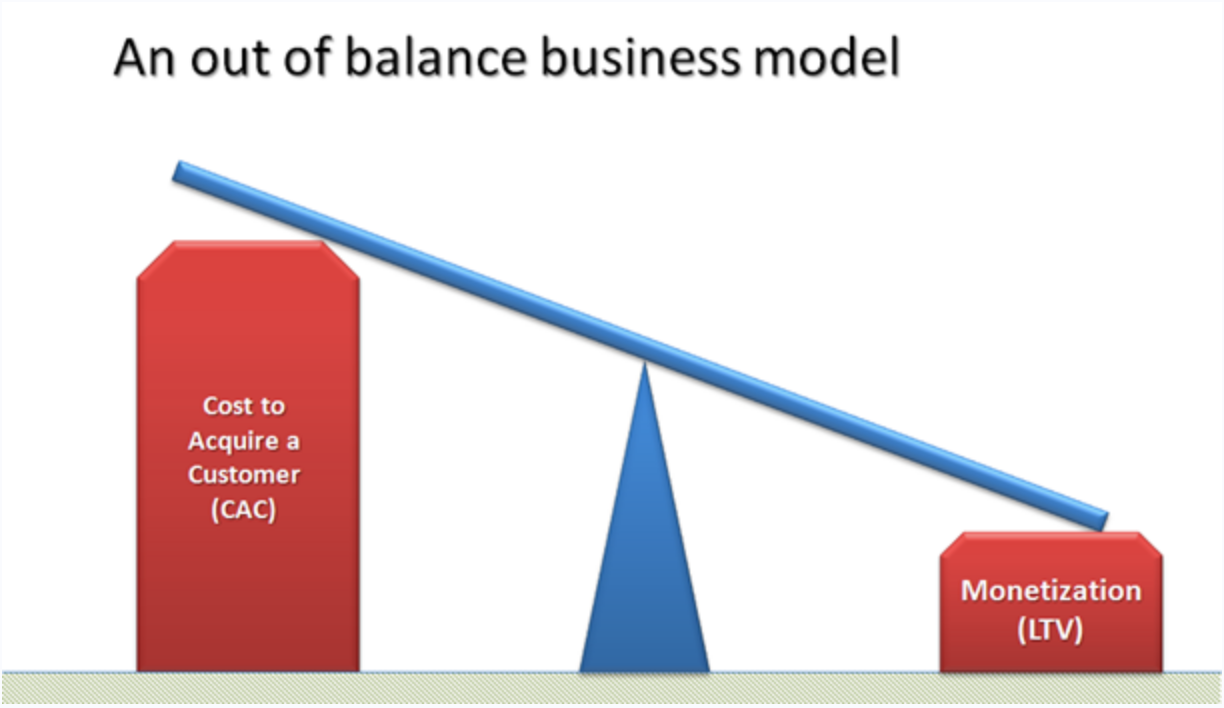

Determine the appropriate customer acquisition cost

David Skok, a venture capitalist, posits that most startups fail because the cost of acquisition outweighs the customer’s lifetime value. And this has led to an out of balance business model that looks like this:

For each of your customer segments, your customer acquisition costs should be lower than the LTV. David believes your CAC should be ⅓ of your LTV to have a balanced business model.

LTV > CAC. (It appears that LTV should be about 3 x CAC for a viable SaaS or other form of recurring revenue model. Most of the public companies like Salesforce.com, ConstantContact, etc., have multiples that are more like 5 x CAC.)

Aim to recover your CAC in < 12 months, otherwise your business will require too much capital to grow.

This means that if it costs you $200 to acquire a customer. For a healthy cash flow, you should plan to make $200 off that customer within the next 12 months for subscription businesses. If it takes more than 12 months to recoup, your business will require more cash flow to grow, which might not be sustainable.

Make better, data-driven decisions on marketing campaigns

You can use LTV to determine where and how to best use marketing to acquire customers. This enables you to allocate more budget to acquisition campaigns with the best LTV and less to the ones with a lower LTV.

Identify issues related to your customer churn rate

Poor customer service, unclear pricing, shoddy user experience, and lack of value can lead to a high churn rate for any business.

By monitoring customer lifetime value, you may find issues with the customer experience that your customer support team can then address. For subscription businesses, it’s important to retain customers as much as possible.

If you’re wondering what your business churn rate looks like, this simple formula from our friends at HubSpot will help you.

Predict future revenue and growth for your business

The higher the lifetime value of a customer, the more revenue growth you can expect.

Of course, to access those benefits, you have to know how to calculate lifetime value for your customers. So, how do you do that? Good question!

We’ll share our preferred customer lifetime value formula soon and why we think it’s better than other ways of calculating LTV (there are several). But first, you need to understand the 4 key factors that contribute to lifetime value for our preferred formula to make sense.

4 Key Factors of Lifetime Value

The potential lifetime value of a customer comprises 4 key factors. And knowing each factor is essential to truly understanding how much value this metric has when making business decisions. So, let’s look at each one.

1: Life Expectancy

Your customer life expectancy, or customer lifespan, is the average length of time a customer will spend money on your service.

To determine this, you’ll want to look at your customer data and see how long each customer spends with your company before they churn. Once you have this number, you can take the average. This will give you a good idea of how long you can expect a customer to stay with you.

Keep in mind that this number may change over time. So, you’ll want to regularly review and update your customer life expectancy.

2: Revenue Expectancy

The value you get from your customers depends on how much revenue you can expect from them. This number could be different for each customer, and it would also change over time.

To calculate it, you’ll need to look at your historical data and see how much revenue you currently have under contract. In your calculation, you’ll also need to estimate how much the revenue could change over time due to things like upsells and downsells.

Once you have this information, you can take the average value to get a good idea of how much revenue you can expect from each customer.

3: Cost Expectancy

Some businesses leave this factor out of their lifetime value calculation but they should not.

Cost expectancy refers to how much it costs to deliver your product or service to your customers. For every subscription product your business offers, you need to estimate its contribution margin. The contribution margin represents the variable costs associated with providing your product and reflects on the profitability of your subscription service.

4: Risk Expectancy

Some businesses also ignore this factor when calculating LTV. But, again, they should not leave this out.

LTV is an estimate of customer value in the future. Risk expectancy helps you make a better guess by considering the money you could potentially lose from your future revenue streams for a variety of reasons. And it’s because of risk expectancy that we recommend underestimating the lifetime value of your customers. Why?

Well, let’s imagine you overestimate the average customer lifetime value at $2,000, and then some unexpected occurrence (say, an economic downturn caused by a global pandemic) results in it actually being $1,400.

Now let’s imagine that, based on the $2,000 estimate, you decided to set your customer acquisition cost at $1,700 per customer. Your overestimate would cost you $300 per customer instead of earning you $300.

How to Calculate LTV for Subscription Businesses

If you do a Google search, you’ll find several ways to calculate customer lifetime value. Some of those formulas include:

- LTV = Monthly Recurring Revenue / Churn Rate

- LTV = Average Revenue Per User x 1 / Churn Rate

- LTV = Customer Value x Average Customer Lifespan

BUT…

We wouldn’t recommend you use any of those LTV calculation formulas. Why?

Because none of them considers cost or risk expectancy. As such, if you use those formulas, your lifetime value calculation will be an overestimate. And, as you can guess, that can be a nightmare for your business finances…

So, what formula should you use instead to calculate customer lifetime value? For a subscription-based company, we recommend this one:

Customer Lifetime Value ($) = Current Recurring Revenue ($) x Gross Profit Margin x Account Retention Rate / (1 + Discount Rate – Net MRR Retention)

For instance, let’s imagine you run a B2C monthly subscription business with the following metrics:

- Monthly Recurring Revenue = $120,990

- Gross Profit Margin = 85%

- Monthly Customer Account Retention Rate = 70%

- Discount Rate = 8%

- Net MRR Retention Rate = 85%

Using those metrics, here’s how to calculate LTV:

- Customer Lifetime Value ($) = $120,990 x 0.85 x 0.70 / (1 + 0.08 – 0.85) = $71,989 / 0.23 = $312,995

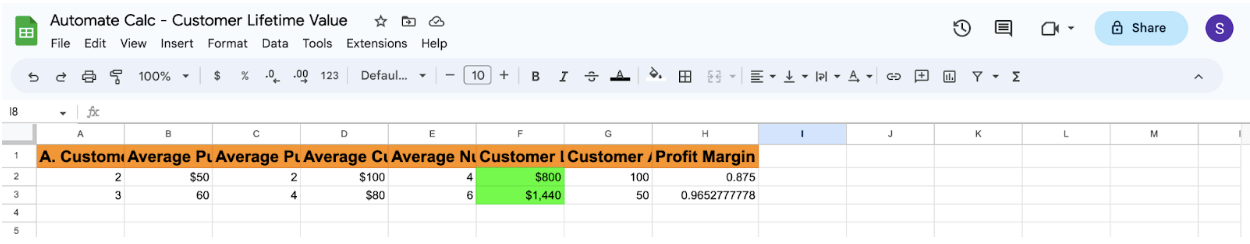

If you want something simpler, we’ve provided an interactive spreadsheet to plug your numbers into.

In this case you need to have figured out the following:

- Average Customer Lifespan = Sum of Customer lifespan / Numbers of Customers

- Average Purchase value = Total Revenue / Number of Purchases

- Average Purchase Frequency = Number of Purchases / Numbers of Customers

- Average Customer Value = Total Revenue / Number of Unique Customers

- Average Number of Purchase by Customer = Total Number of Purchases / Number of Unique Customers

- Customer Acquisition Cost = Total Cost of Sales and Marketing / Number of New Customers Acquired

Profit Margin = (Net Income / Total Revenue) * 100

It’s important to always segment your data to get more accurate data.

Note: You’ll likely need to do this customer lifetime value calculation more than once. Why? Because the LTV will differ among your customer and/or pricing segments.

How to Increase Customer Lifetime Value

As a subscription-based business, if your goal is increasing your customer lifetime value without pushing up your subscription price, then you have to make strategic choices aimed at reducing customer churn; improving customer experience and increasing revenue from existing customers.

With that in mind, here are a few ideas on actions you can take to improve your customers’ LTV:

Start a customer referral program

A customer referral program has two major benefits. First, it incentivizes existing customers to promote your business. Second, data on referral programs shows that referred customers are 18% more loyal, have a 16% higher lifetime value, and spend 13.2% more than non-referred customers!

The following steps outline how to start an effective referral program.

Steps to create a referral program

- Identify your target audience: First, determine which customers are likely to refer others to your business. Then, use the customer data to create a customer persona based on their purchasing history.

- Define your incentives: What reward or incentive will be offered to the referrer and the referred customer? Ensure it’s enticing enough to motivate a customer to participate. However, this shouldn’t come at a detriment to your finances.

- Develop a framework: Highlight the program structure, referral process, and how rewards will be distributed, including terms and conditions, in a clear and easy-to-understand way.

- Promote the program: use multiple channels such as email, social media, and your website to promote the referral program to your customers. Consider offering an exclusive incentive to customers who refer others to your business.

- Measure and optimize: Track the performance of your program to measure its impact on customer acquisition, retention, and LTV. Use this data to make adjustments and optimize the program over time.

Offer perks and rewards to your loyal customers

Your lifetime value calculation will tell you who your most valuable customers are. So, you’ll want to make sure that value is reciprocated! One way to do that is by offering those customers special perks and rewards for continuing to buy from your business. For example, you might offer early or discounted access to new features of your service.

Collect and respond to customer feedback

Knowing what your customers love about your business is nice. Knowing what they dislike about your business is even better because you can use that information to improve your business.

You can do this actively through customer satisfaction surveys; or passively by monitoring social media mentions of your company.

What is more important than collected customer feedback is what you do with it. It is not enough to know problem areas, addressing them is key to reducing churn rate. One way to do this is by creating actionable solutions to major issues, consequently turning would-be subscription cancellers into future referrers.

Pay special attention to customers at the end of a billing cycle

Acting on customer feedback becomes even more important when customers approach the end of a billing cycle. Soon, they’ll have to decide whether to renew their subscription. And you want to make sure they have no doubts about what decision they’ll make.

To reduce churn with those customers, consider sending them personalized messages to ask how likely they are to resubscribe and what factors could influence their decision.

Incentivize annual billing

To renew or not? That is the question every customer faces at the end of every billing cycle. Their response, of course, affects your customers’ lifetime value. This is a question that could negatively affect your customer lifetime value. How come? Because it could lead to the end of the customer’s relationship with your business — especially if your customer is on a monthly contract.

To avoid this potential loss in recurring revenue, make your annual subscription plans as attractive as possible. Of course, offering a discount rate for annual plans is a good idea. You can also offer exclusive access to valuable content from your business.

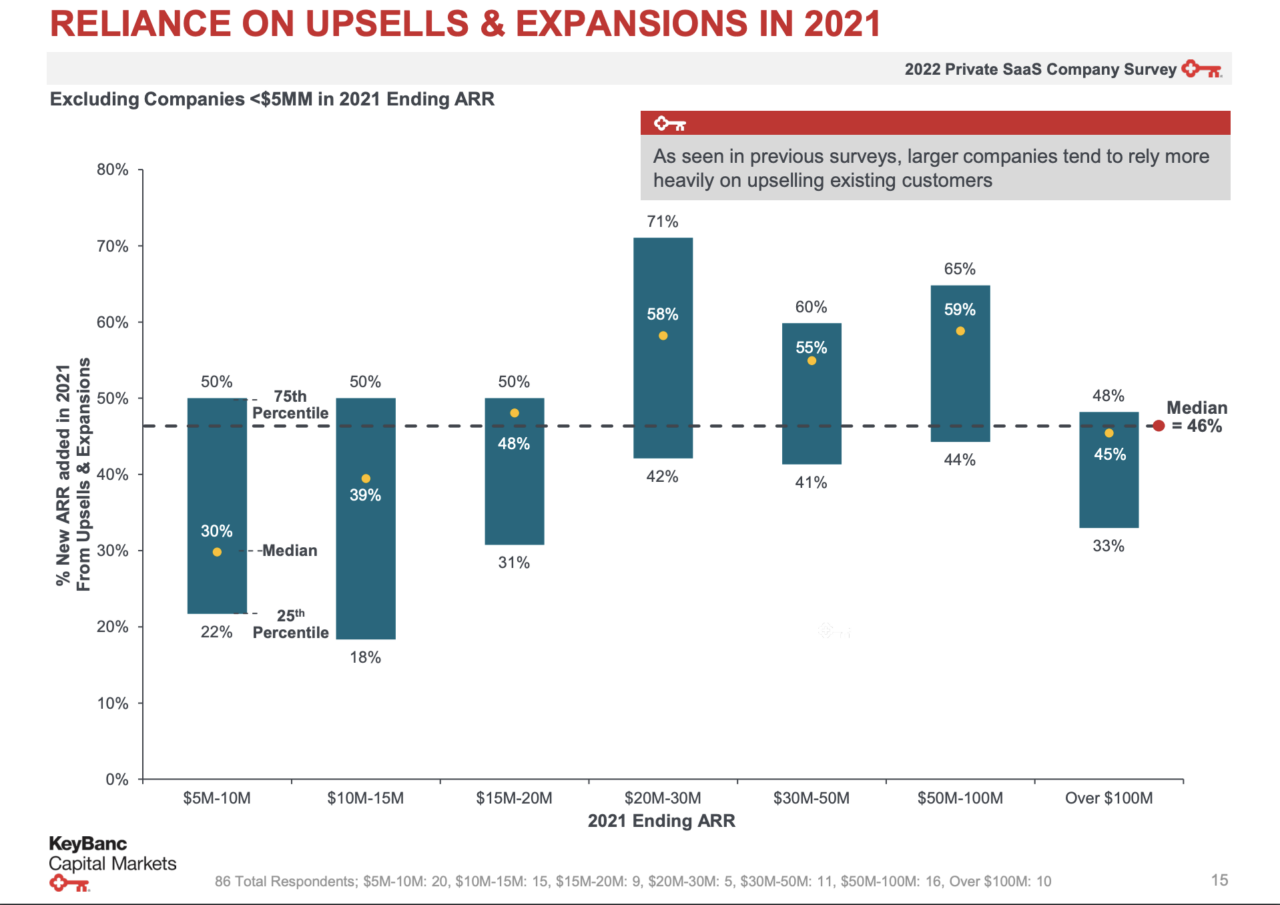

Increase customer spending by up-selling and cross-selling

You can increase your customers’ spending on your business by mastering the art of up-selling and cross-selling. Up-selling refers to offering customers a better version of your service for a higher price. Similarly, cross-selling refers to offering customers a complimentary service for an additional price.

According to a study, the success rate of selling to existing customers is 60-70% while selling to a new customer is 5-20%. Your current customers are the strongest potential buyers for cross-selling or upselling. The customer already has a relationship with you.

For example, if you’re a SaaS company, you can upsell by regularly marketing the additional benefits of your most premium plan to your existing customers. And you can cross-sell by creating and marketing valuable add-ons to your service.

Perhaps, this is the secret recipe for larger companies that upsell to their existing customers, as captured by the 2022 Private SaaS Company survey.

Improve onboarding process

Your onboarding can make or break your customer’s first impression of your product or service.

Effective and smooth onboarding can ensure your customer sticks with you for a long time. Customers who experienced a smooth onboarding process are more likely to be loyal to your brand, which can help maximize your LTV.

To give your customers an effective onboarding:

- Reduce friction in the account setup process through user-friendly actionable steps.

- Provide a detailed product demonstration through videos and step-by-step guides to aid your customer’s understanding of your product and service.

- Offer personalized support through calls or chats to ensure your customer feels valued.

- Set clear expectations for your customer regarding your product features, benefits, and limitations.

- Collect feedback from your onboarding process to measure its effectiveness. It helps you identify areas for improvement and where changes are needed to optimize the onboarding experience.

Offer personalized experience

There’s no better way to meet customer expectations, drive their loyalty, build deep connections, and give them a better customer experience than through personalization of service. It helps you to meet their unique needs and preferences. 70% of consumers spend more with companies that offer a personalized experience, according to a CX Trends 2023 report.

When you meet your customer’s unique needs through personalized service, they’re also likely to recommend your brand to others, which can convert new customers and increase lifetime value. McKinsey’s study Next in Personalization 2021 Report shows that businesses that get personalization right generate 40% more revenue. The same study also indicates consumer rewards this brand has as:

- 76% say they’re likely to make a purchase

- 78% say they’re likely to recommend friend and family

- 78% say they’re likely to repurchase.

Subscription companies that use personalization

The following subscription companies use personalization to retain their customers and improve their lifetime value.

- Netflix: Netflix keeps users engaged over time, through personalized movie suggestions based on customer data.

- Amazon: Through customer data such as purchase history, search history, clickstream data, and customer reviews, Amazon recommends personalized product suggestions, targeted email campaigns, and customized offers to customers.

- Spotify: Through users’ listening, search history and social media data, Spotify makes personalized recommendations of music playlists and podcasts to users.

Ways to improve your business' personalized experience

- Data collection: Collecting customer data such as interest, preference, and past purchases helps you understand products to offer and how to tailor your service to customers’ preferences.

- Segmentation: This makes it easier for you to offer customer services based on their demographic, purchase behavior, and interest.

- Personalize recommendations: Through data collection, you can offer different product or service recommendations based on their purchase history, browsing history and other customers with similar interests.

This extensive blog post highlights 10 ways to offer personalized customer service.

Build your tribe: creating and nurturing raving fans

For a subscription business, there’s no better way to grow LTV than to build loyal subscribers — it could be the difference between a thriving and barely surviving business. This entails creating a strong fan community through newsletters, forums, social media, or in-person events. This will help increase your customer loyalty scorecard, leading to more sales and ultimately increasing your customer lifetime value.

According to a survey conducted by Sprout Social, 55% of consumers learn about brands or companies on social media. Engaging your audience online will create a positive impression of your brand and improve your existing customers’ loyalty. Here are some quick ideas to help you build a loyal tribe for your brand:

- Encourage user reviews and rating

- Ensure customer feedback is heard and duly attended to

- Create content that resonates with your audience

- Organize contests and events on social media to engage your audience

Build customer advisory board

Customers loyal to the brand provide feedback and insights about your product development and marketing initiatives.

Customer advisory boards enable you to gather customer feedback, further improving your product or service to meet customer needs. It also provides you with real customer data, enabling you to provide a tailored experience.

Why is this effective? According to Ignite Advisory Group, companies with customer advisory boards experience a 9% increase in new business after the second year.

Another study from Forrester indicates that 79% of marketers who turn their customers into advocates see an increase in upsell, cross-sell, and enrichment.

Optimize pricing to maximize LTV

Subscription businesses thrive on their customers’ recurring revenue. And pricing is essential for revenue growth — so if you don’t get pricing right, your revenue growth will be stunted.

A study shows a 1% increase in price contributes to 11% profit. Hence, it’s essential that you optimize pricing to maximize profit. Sadly, many SaaS businesses overlooked pricing —

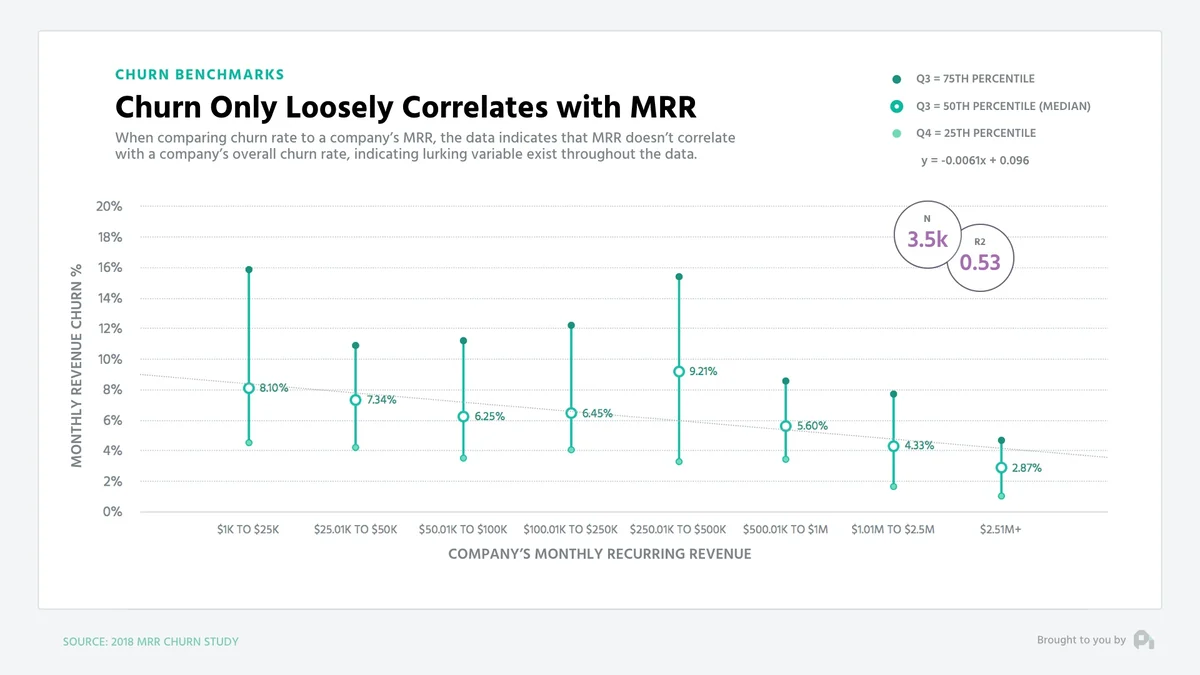

This study finds a correlation between churn and pricing. The reports found that companies with low ARPUs experience higher churn than those with much larger ARPUs.

To increase your customer lifetime value — you need to control or lower your churn rate by increasing your ARPUs through optimizing your pricing.

Optimizing pricing is crucial to driving sustainable growth and improving your business’s lifetime value.

First, determine that your customers are willing to pay for the value you offer through value pricing.

Luckily, we’ve covered everything you need to know about value-based pricing.

Second, use a tier pricing system that accommodates different customer segments to enable you to meet their needs and budget.

And finally, keep monitoring and adjusting your price.

Offer a flexible payment system

For a subscription business where customers pay periodically, a flexible payment system can increase your customer base and, ultimately, your business’ lifetime value. When they struggle to make payments or renew, they may churn and move to your competitor with a more flexible payment system.

For example, while Ahrefs is arguably one of the best SEO tools available, some customers have complained about their payment system.

Give your customers a friendly and seamless UX/UI experience while trying to pay for your product or service. Here are other ways to improve your payment structure:

- Payment methods — use the most commonly used payment platform within your customer base; if possible, offer a wide range of payment methods to accommodate more customers.

- Payment structure — give your customer the option to pay monthly, quarterly, and annually. This way, you accommodate customers who can’t afford large upfront payments and are flexible in managing their finances.

- Auto-renewal options — eliminate the stress of going through a tedious payment process which can increase their loyalty to your brands.

- Upgrade and downgrade options — Offer customers the option to upgrade and downgrade their subscription based on their financial capacity. This improves customer retention because customers who can no longer afford the premium price may choose to downgrade instead of churn.

Start strong, finish stronger: Working with a new customer

Many businesses have only a good start but need better finishing. And this has contributed to increasing the churn rate. Building a lasting relationship with your customer should be a must for a subscription business.

To build trust and lasting relationships with your customers, you need to keep up with, if not exceed, the momentum of the first impression throughout their customer journey. This can translate to greater customer satisfaction and loyalty. To make first impressions last beyond the first click, make sure you:

- Set clear expectations about your product or service.

- Provide swift responses to customers’ questions and queries.

- Check in regularly at every step of their journey.

- Invest in customer service training to equip your representatives in handling customers’ concerns.

- Offer additional resources and support to help them make the best use of your product or service.

What are the effects of customer experience on increasing LTV?

Customer experience directly impacts customer loyalty and satisfaction hence it plays a crucial role in increasing your LTV. As mentioned earlier, a positive customer experience increases customer retention, leading to repeated business and ultimately a positive referral of your business to others.

More so, “Customers who had the best past experiences spend 140% more than those who had the poorest past experience.” (Peter Kriss, Harvard Business Review, 2014)

What is a good LTV for CAC?

Customer experience directly impacts customer loyalty and satisfaction hence it plays a crucial role in increasing your LTV. As mentioned earlier, a positive customer experience increases customer retention, leading to repeated business and ultimately a positive referral of your business to others.

How can I increase my LTV and decrease CAC?

To increase LTV and decrease CAC, you need to focus and increase your customer retention. There are many effective strategies for increasing customer retention, including:

- Improving customer experience.

- Providing exceptional customer service.

- Delivering a superior product or service.

- Staying in touch with customers regularly.

Is higher or lower CAC better?

Keeping your CAC lower than your competitors is better. This means you’re able to acquire a new customer at a lower cost. A lower CAC allows for a higher profit margin and likely an increase in LTV.

Is LTV revenue or profit?

CLTV or LTV is always based on profit and not revenue.

The Journey to Usership

The playbook for modernizing monetizing, and scaling your business

If this is your very first subscription offering, take a look at this Monetization Playbook for additional information on how companies in different industries have ventured into their first subscription

The world's leading enterprises run on Zuora.

With Zuora running in the background, we are well-equipped to deliver sustainable value to our customers, based on dynamically evolving offerings that fit the healthcare industry & care providers’ demands.

– Rahma Samow

Head of Siemens Healthineers Digital Health Global

Learn From the Best

Unlock resources from the leading experts

We coined the term “Subscription Economy®” and continue to be a leader in the industry. But don’t take it from us. Learn from our experts, customers, and partners.

New Business Models

Dynamically nurture customers through every journey.

Knowledge Center

Learn how to grow your business in the era of subscriptions.

Your journey starts here

As your customers change how they want to access your products and services, you have to evolve how you do business. Learn more about how our leading Subscription Economy® solutions have helped many of the world’s most innovative subscription businesses succeed.

Start your free trial

Get your hands on the product and test out Zuora for free

Want to Lead Change?

Join our global team in the relentless pursuit of transforming the world’s largest companies.