ZUORA REVENUE

Audit-proof revenue recognition for any business model

Zuora Revenue, The Leader In Revenue Recognition Automation® ranks as the #1 Product for Automated Revenue Management (ARM)

Join our first virtual Modern Accounting Summit with EY, PwC and Deloitte (CPE available)

The world’s most innovative Finance and Accounting teams trust Zuora Revenue

Report

Explore our “2023 State of Revenue Accounting Report”

We have already benefited from significant time savings and cost savings with Zuora Revenue. From contract modifications being calculated automatically to mass updates on data using the solution’s user-friendly interface, Zuora Revenue has been a game-changer for our organization.”

– Anna Lee

Director of Revenue, Gainsight

Reduced its time to close the books by over 30%

Reduced its average audit time by 50%

With Zuora Revenue, we gained the real-time insight we needed to eliminate manual financial barriers, provide a critical level of detail in reporting, and ultimately make informed business decisions.”

– Chris Gomez

Senior Manager, Revenue Operations, Poly

Zuora Revenue was designed from the ground up around the needs of revenue accountants. After just one quarter, our team experienced numerous benefits. The bundle configuration improved the accuracy of our revenue allocations, the customizable grouping rule setup eliminated tedious manual tasks for close, and the user-friendly interface extended us increased functionality and convenience.”

– Tony Zhang

Revenue Manager, Nutanix

Nutanix saved around 550 hours per year using Zuora Revenue

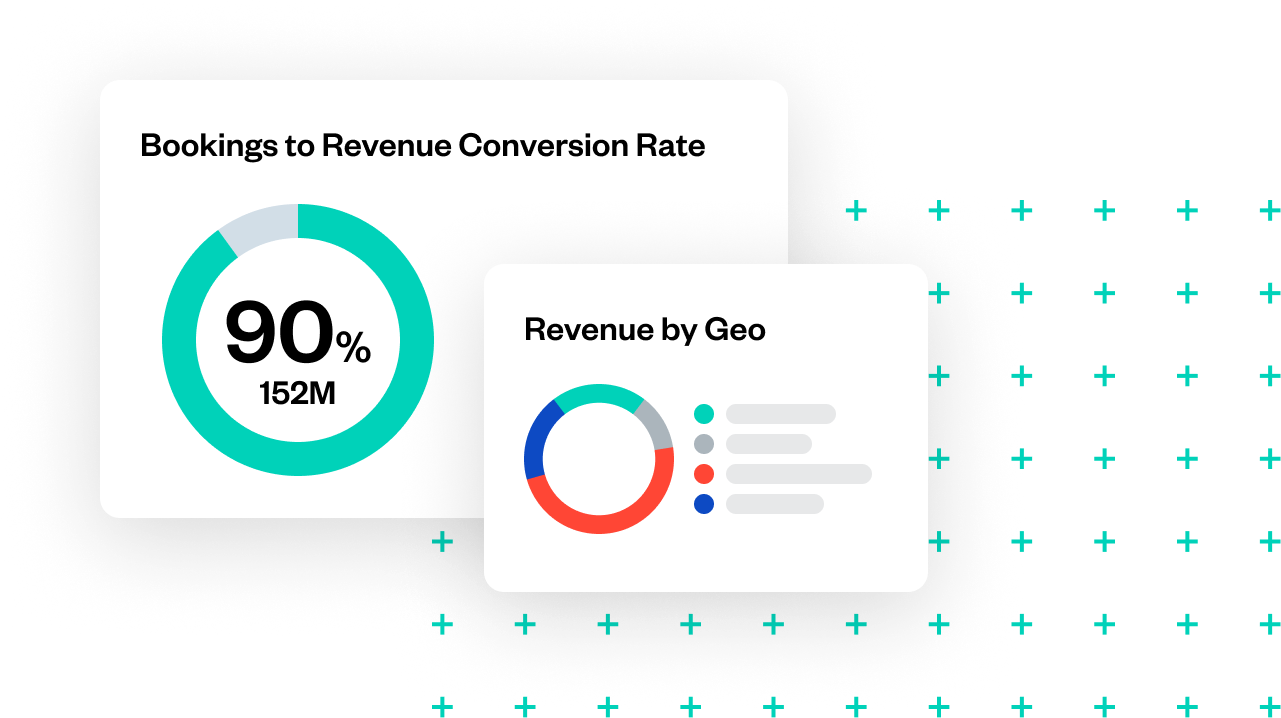

By the Numbers

Automated Revenue Recognition

Fast Close. Painless Audits.

Recognize any revenue stream with minimal costs and risk

- Minimize data consolidation efforts with grouping logic that aggregates orders, invoices, and other data into a single revenue contract.

- Set revenue recognition rules for any pricing model and account for contract changes in pricing, quantity, or terms.

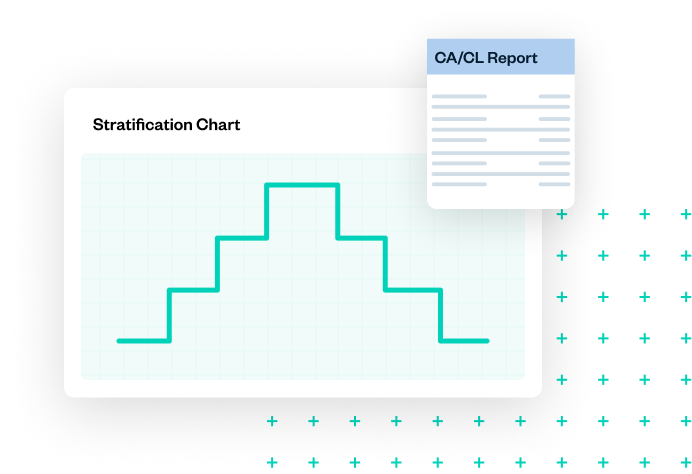

- Analyze historical transaction data to assess compliance rates, establish standalone selling prices (SSP), and automatically calculate transaction price allocations.

- Apply the 5-step ASC 606 & IFRS 15 model to all transactions and prepare disclosure requirements for compliance.

Want to learn more, but not ready to talk to sales yet?

Unlock a continuous accounting process

Forecast your revenue targets in real-time

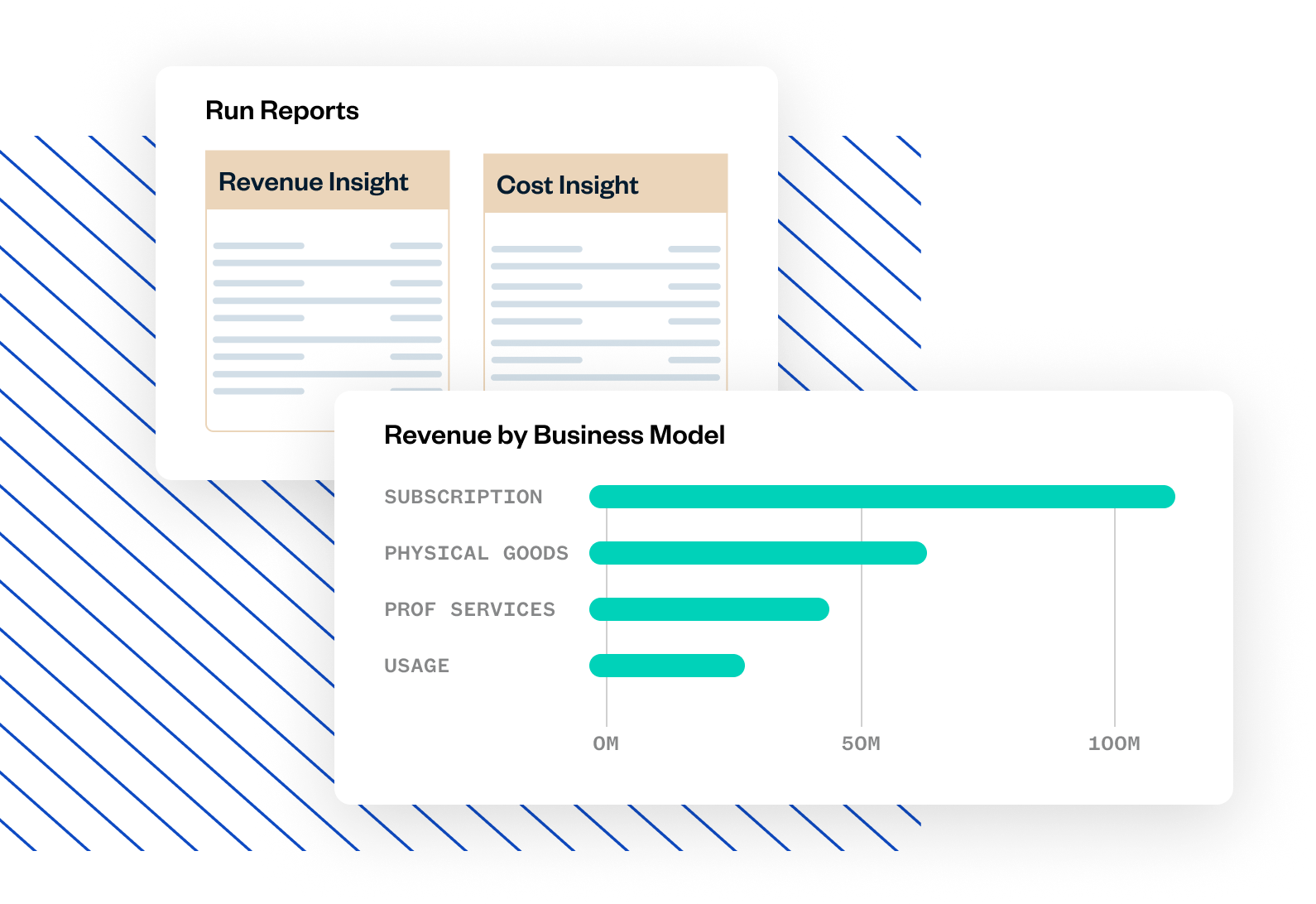

- Say goodbye to manual revenue reporting with 60+ pre-built reports for Revenue Waterfalls, Disclosures, VC Insights, SOX and more

- Get a live view of your revenue recognized by business model

- Get a global view of your recognized revenue from different geographies.

- See your real-time bookings to revenue conversion rate to forecast more accurately.

Resources on revenue recognition for you

REPORT

EBOOK

WEBINAR

Get right-sized solutions.

- Get to real-time revenue recognition in weeks

- Integrate Zuora Revenue into your tech stack effortlessly

- Use flexible, rules-based revenue recognition built for hypergrowth

Top of the line solution for enterprise-grade businesses with complexity and scale.

- Recognize complex bundled offers in real time

- Unlock SSP allocations, contract modifications, and variable consideration out of the box

- Ensure your revenue recognition processes are future-proof from Day 1

Effortlessly Go Live on Zuora Revenue

The Journey to Usership

The blueprint for modernizing monetizing, and scaling your business

Learn From the Best

Unlock resources from the leading experts

New Business Models

Knowledge Center

Your journey starts here

Start your free trial

Get your hands on the product and test out Zuora for free