Guides / Monetizing Agentic AI: Why CFOs and CIOs Must Lead Together

Monetizing Agentic AI: Why CFOs and CIOs Must Lead Together

Agentic AI is redefining value creation—and making monetization more complex than ever. Traditional pricing models are no match for dynamic, asynchronous, outcome-driven AI behavior. To keep up, CFOs and CIOs must unite to modernize the quote-to-revenue engine with infrastructure built for usage-based pricing, audit-ready revenue recognition, and extreme flexibility. Companies that win won’t just build the best AI—they’ll know how to monetize it.

Key takeaways

- Agentic AI disrupts pricing logic. These systems act autonomously across tools and time zones, making static pricing models like seat-based or flat-rate irrelevant.

- AI monetization is a finance + IT problem. Success depends on unified systems that can track usage, align entitlements, automate billing, and comply with revenue standards like ASC 606.

- Legacy systems can’t support modern models. 97% of SaaS finance leaders say their current infrastructure can’t handle the complexity of hybrid and outcome-based pricing.

Agentic AI Is Redefining Revenue Models. Are Your Systems Ready?

Agentic AI is reshaping how companies create and capture value. Unlike traditional AI tools that assist with single prompts or tasks, agentic systems act independently toward defined goals. They don’t just generate outputs; they take action, execute multi-step workflows, and collaborate across systems, often with minimal human intervention.

From customer service bots resolving issues end-to-end to AI agents negotiating contracts or optimizing supply chains, these digital operators are becoming a new kind of workforce. And while the innovation is breathtaking, the monetization model is anything but simple.

These systems don’t deliver predictable, one-size-fits-all outputs. Instead, they drive results asynchronously, across multiple tools, contexts, and time zones. That makes it far harder to define what customers are paying for and how to track, bill, and recognize it. In this new world, traditional SaaS pricing breaks down.

We’ve already seen leaders like Intercom shift to per-resolution pricing and Salesforce launch Flex Credits, units of value that reflect AI’s dynamic nature. These aren’t just creative pricing models; they’re signals of a new AI monetization standard. Outcome-based models, usage tiers, and dynamic pricing are the new norm, and they’re pushing finance, accounting, and IT systems to the brink.

Here’s the truth: SaaS is entering a whirlwind era of monetization experimentation. There will be an unprecedented acceleration in revenue model iteration, driven by AI’s unpredictability, evolving buyer expectations, and competitive pressure. No one can say exactly where we’ll land, but we can depend on one thing—change will remain a constant, and businesses will need extreme flexibility built into their systems right from the start.

The fact is, these new models demand a new operational backbone. One that can track usage across tools, enforce entitlements, align billing with behavior, and recognize revenue in ways that stand up to scrutiny.

And none of that happens if finance and IT aren’t in lockstep.

Agentic AI moves fast. Keeping up means bringing together the

people who control the pricing strategy and the systems that operationalize it.

That means finance and IT must work as one team.

— Todd McElhatton

COFO at Zuora

The Rise of Dynamic AI Pricing

Agentic AI is accelerating the move from static to dynamic pricing across multiple industries, including transportation, healthcare, entertainment, and of course, SaaS. These are no longer just smart tools, they have the potential to be revenue engines. But successfully monetizing them? That’s where things can get dicey.

Traditional flat-rate or seat-based models break down in this new world. We’ve entered an era where pricing is increasingly tied to activities or outcomes, behaviors that don’t fit neatly into a monthly invoice. And while product teams may be driving AI innovation, monetization is a finance challenge with systems implications that fall jointly on the shoulders of both the CFO and the CIO.

It should come as no surprise that in this era of rapid innovation, many CIOs now co-lead revenue generation. At the same time, a report from Morgan Stanley shows that 60% of CIOs expect their organizations to have AI in production by the end of 2025. These aren’t hypotheticals, they’re budgeted realities. But too many companies are trying to force new pricing into old systems.

In fact, 82% of SaaS finance leaders say hybrid revenue models are already creating significant operational complexity. And a striking 97% of SaaS finance leaders say their current systems can’t support the complex pricing structures their business needs. As more companies move from flat-rate subscriptions to usage and outcome-based models, that gap only widens.

CFOs Architect the Model, but CIOs Make it a Reality

Agentic AI rewires your revenue engine and that brings risks, many of which your company may not be structurally prepared to manage:

- The unit of value isn’t always clear. Is it a resolution, a task, or an outcome? Many AI features don’t map cleanly to traditional metrics like API calls or seats. And customers don’t want to pay for activity, they want results.

- Usage data is often fragmented. Agents trigger actions across CRMs, LLMs, and third-party systems. Capturing clean, attributable usage data is tough. Recognizing it in billing and revenue systems is even tougher.

- Outcomes are extremely hard to prove. Was it the AI or the marketing campaign that boosted conversions? The burden of proof lands on finance and impacts auditability and ASC 606 compliance.

- Behavior doesn’t align with billing cycles. Agents might generate bursts of activity across time zones and asynchronous workflows. That means revenue events lag, and forecasting becomes a guessing game.

If you don’t build systems that can handle this variability, what you think is revenue actually becomes risk.

That risk is already showing up in the data. 71% of SaaS companies say scaling usage-based pricing puts undue stress on their order-to-cash processes, and 95% say it makes forecasting significantly harder.

Modern business models live and die in the quote-to-cash stack. That’s why CFOs and CIOs should both own the transformation. It’s not just about execution, it’s about enablement.

— Karthik Chakkarapani

SVP & CIO at Zuora

Innovation Becomes Risk Without Finance at the Core

Imagine your product team launches an AI-powered procurement assistant that identifies savings opportunities and negotiates vendor contracts. The monetization model? A quarterly charge based on cost savings generated.

Sounds great, until things unravel:

- No consistent definition of “savings.”

- Custom deal terms stored only in contracts, not billing systems.

- Disputed invoices due to unverifiable data.

- Deferred revenue under ASC 606 because attribution is unclear.

- Missed forecasts, board questions, and Finance has no clean story to tell.

And this is more common than most admit. In our latest survey, 94% of SaaS finance leaders say they’ve had to reject custom deals because their order-to-cash infrastructure simply could not support them. The opportunity was there, but the system couldn’t deliver.

The result? You won’t just lose revenue, you’ll likely lose trust as well.

Finance knows what needs to happen. IT knows how to scale it. Without both at the table, your monetization strategy will collapse from complexity and disconnected systems.

— Todd McElhatton

COFO at Zuora

The Strategic Case for a Unified Stack and Unified Leadership

AI monetization can’t be an afterthought. It has to be a core competency, and that starts with finance and IT working together to optimize and modernize the quote-to-revenue process.

Fragmented systems create fragmented accountability. Billing, entitlements, usage data, and revenue recognition must be unified, not siloed.

In fact, 82% of SaaS finance leaders say fragmented ownership across IT and finance teams is a direct cause of operational breakdowns. And 82% say delays in IT system updates hinder their ability to respond to market needs in real time.

Finance must define the monetization logic. IT must enable systems that are flexible, scalable, and composable.

But you can’t bolt this on later. You need to build for it from the start.

You can’t monetize dynamic outputs with static technology and systems. The infrastructure has to move as fast as the AI driving the value.

— Karthik Chakkarapani

SVP & CIO at Zuora

Agility is the New Competitive Advantage

Every AI interaction can be a revenue moment, but only if your infrastructure can keep up.

Winning in this space means:

- Real-time usage telemetry

- Automated billing and revenue rules

- Unified data from quote to cash

- Transparent audit trails

- The ability to run pricing experiments and adapt fast

80% of SaaS finance leaders told us that saying yes to custom deals increases manual work and 97% say their systems can’t even support what the business needs.

If your finance team is still stitching together spreadsheets to explain AI usage, you’re not monetizing. You’re surviving.

The Future Belongs to Unified Leaders with Unified Systems

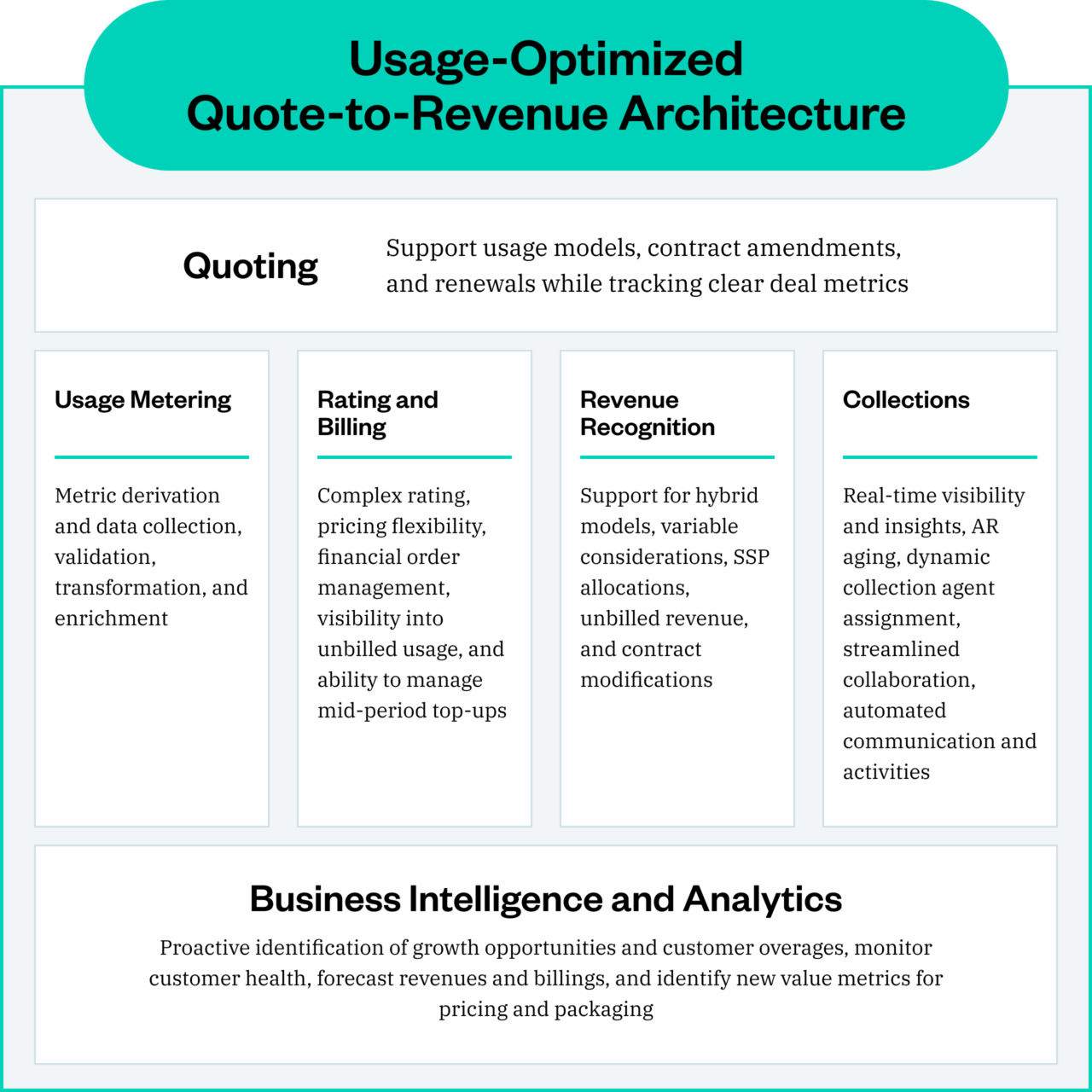

Agentic AI isn’t just a product evolution; it’s a monetization revolution. But without complete, usage-ready quote-to-revenue architecture, even the most innovative AI capabilities risk becoming operational liabilities. Tracking complex usage, aligning entitlements, automating billing, and ensuring auditable revenue recognition requires a single, unified backbone, one that finance and IT design, own, and evolve together.

CFOs bring the monetization logic, compliance requirements, and strategic lens. CIOs bring the technology vision, scalability, and integration expertise. Together, they can build the infrastructure that makes it possible to say “yes” to any pricing model confidently, compliantly, and at scale.

The companies that win in this new AI-driven economy won’t just build the smartest agents, they’ll have CFOs and CIOs in lockstep, supported by a platform that can monetize every interaction in real time.

See how you can get there.

Live Demo: How Zuora Powers Accurate, Auditable Usage Monetization

Frequently Asked Questions

1. What is agentic AI and how does it affect monetization?

Agentic AI refers to autonomous AI systems that take goal-directed actions across workflows. Their unpredictability makes traditional SaaS pricing and billing models obsolete, requiring dynamic and outcome-based monetization strategies.

2. Why is usage-based pricing important for AI-powered products?

AI outputs vary by user, task, and time—making flat-rate or seat-based pricing models ineffective. Usage-based pricing aligns cost with value delivered.

3. How can finance and IT teams support AI monetization?

Finance and IT must co-own the quote-to-revenue process, building systems that enable real-time usage tracking, entitlement enforcement, billing automation, and audit-ready revenue recognition.

4. What challenges does agentic AI create for revenue recognition?

Proving outcomes, attributing value, and aligning behavior with billing cycles create complexity for ASC 606 compliance and forecasting accuracy.

5. What systems are needed to support dynamic AI pricing models?

Companies need composable infrastructure capable of tracking agent actions, syncing usage and billing data, supporting custom pricing models, and adapting rapidly to change.