State of GenAI Monetization Research Report

The 4 GenAI monetization avenues

A data-driven analysis of offerings from 70+ companies

Authored by: Michael Mansard, EMEA Chair of the Subscribed Institute

Methodology: In this ongoing data-driven analysis, we examine the monetization strategies of over 70 companies with GenAI offers. The companies mentioned in this article are not necessarily Zuora customers. Research, analysis, and recommendations based on publicly available information from press releases, articles, and vendor websites as of April 2024.

Explore the insights

Over the past year, Generative AI (GenAI) has rapidly transformed from a novel tool to a pivotal technology, reshaping all aspects of our lives. However, the swift innovation and adoption of GenAI have left companies struggling to develop monetization strategies that truly capture its value.

In this ongoing series on GenAI monetization within the SaaS industry, we are investigating the strategies of over 70 offers currently in the market.

In our last installment we set the stage, examining how companies are racing to introduce and drive adoption of GenAI products, battling to overcome the astronomical costs inherent with the technology, and exploring the value delivered to the customer.

In particular, we focused on the necessity for companies to iterate on their monetization strategies and effectively harness the ever-evolving potential of GenAI. While monetization should involve an ongoing feedback loop of testing and iteration, companies are first tasked with deciding what form their new GenAI offer will take before even considering pricing or packaging.

As we continue our exploration, we will look at the common schemas—or monetization avenues—for positioning GenAI services within companies’ portfolios.

Each of these avenues offers unique opportunities and challenges, which we will illustrate with real-life examples to guide businesses in making informed decisions about their GenAI integration. In addition, we’ll examine the potential or monetization premium observed within each avenue.

An overview of the 4 GenAI monetization avenues

Assuming that a company’s GenAI value proposition is at least somewhat pre-defined, there are four distinct monetization avenues that businesses can explore to capture value from GenAI capabilities:

- End product

- Value booster

- Add-on

- Super tier

The choice of avenue ultimately depends on the company’s strengths, the nature of its GenAI capabilities, and the needs and preferences of its target customers.

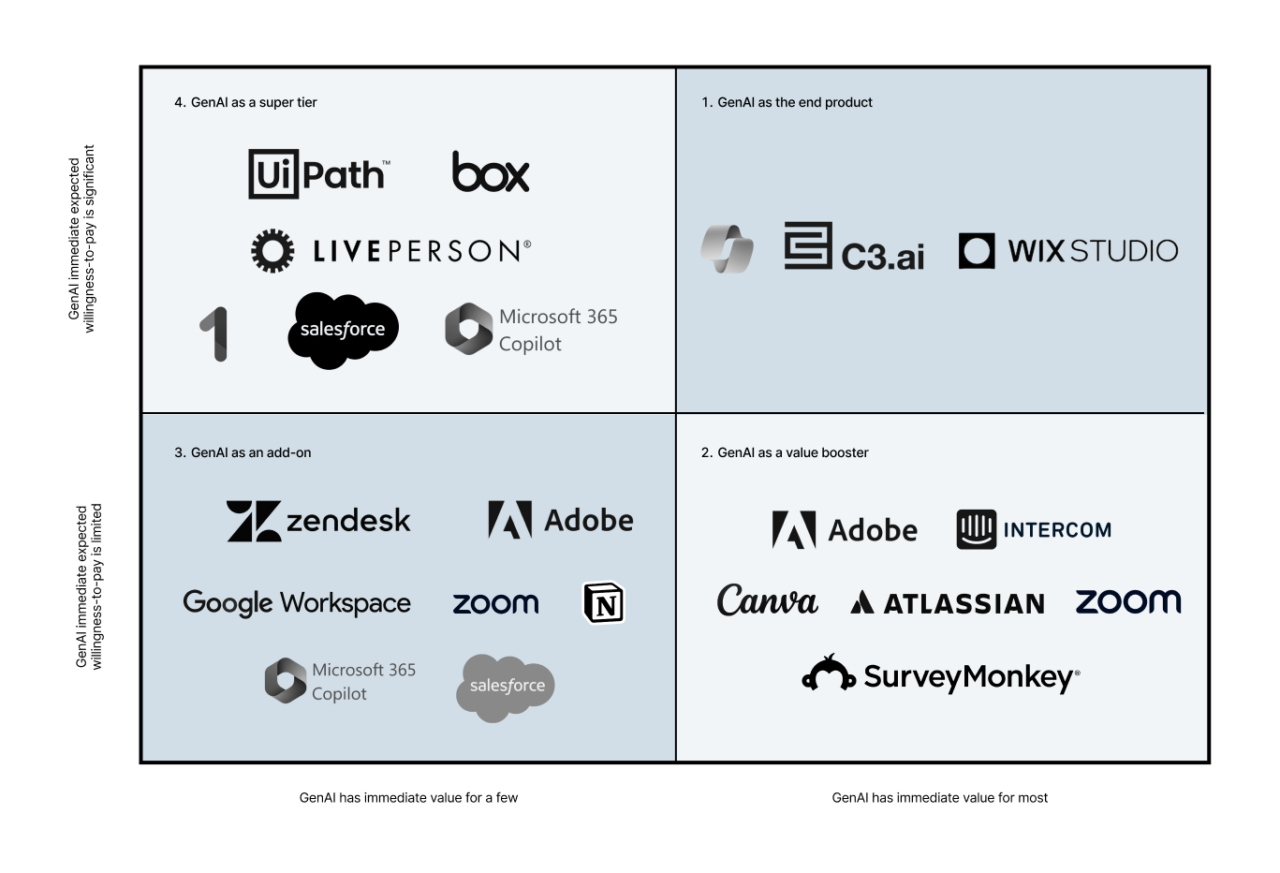

What’s more, one company can employ multiple avenues across and within its portfolio, as the simplified matrix in Exhibit 1 demonstrates. For example, Salesforce monetizes Einstein both as an add-on for existing clients for Sales Cloud and Service Cloud, or bundled within their Einstein 1 plans for potentially new customers.

Exhibit 1: Four GenAI Monetization Avenue Positioning Framework

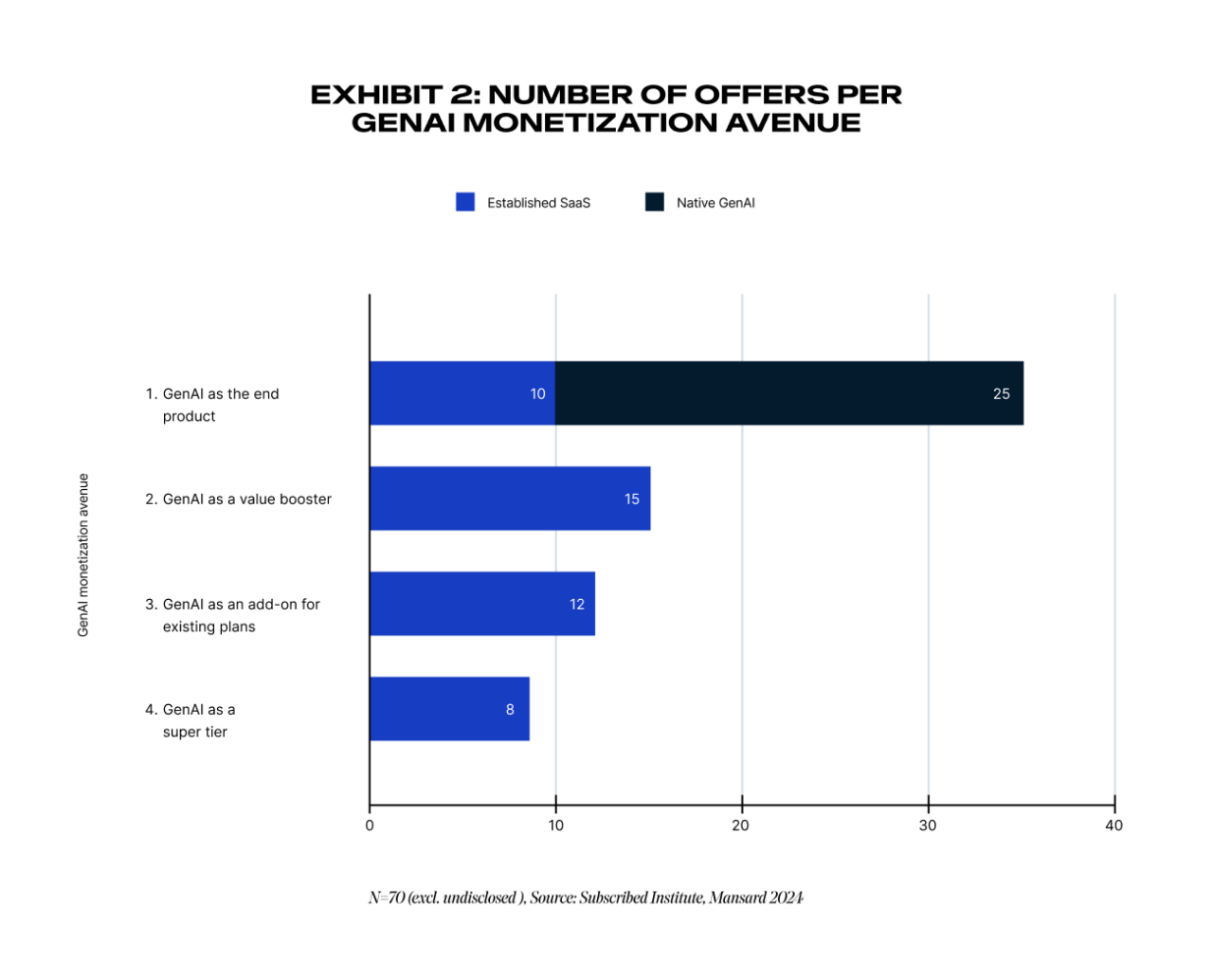

For this analysis, we have grouped the companies into two categories: native GenAI companies, whose flagship products are GenAI, and established, non-native GenAI companies, whose products were not traditionally pure GenAI.

Here, we will mainly focus on how non-native GenAI players enrich their existing portfolio with GenAI offers.

If we examine the distribution of offers across the four avenues, we can see that all offers from pure or native GenAI companies—such as OpenAI, Anthropic, HeyGen or Harvey AI—fall into the GenAI as the end product avenue (Exhibit 2).

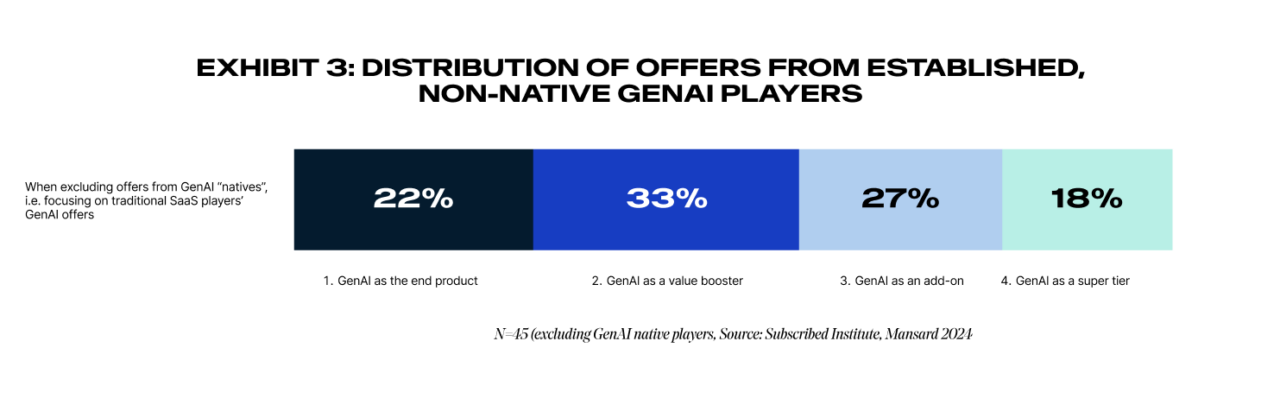

If we look at established, non-native GenAI players, all four avenues are well represented across the board, with GenAI as a value booster in the lead (Exhibit 3).

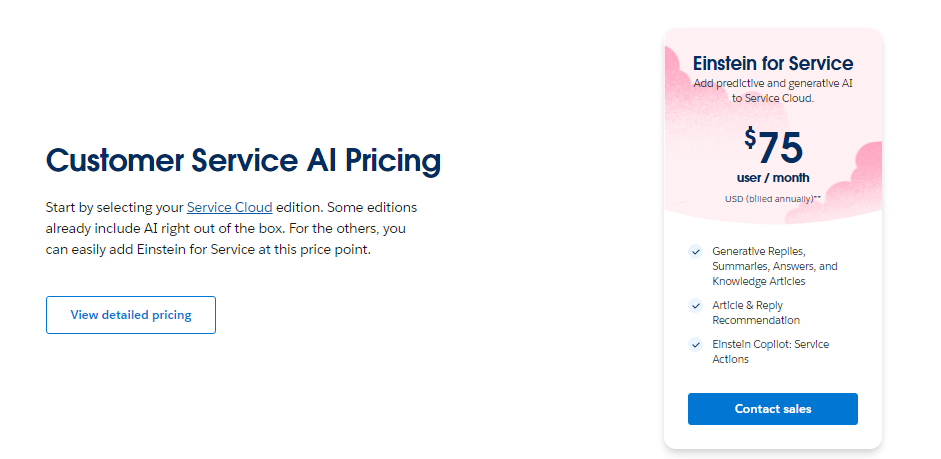

Image: Salesforce Einstein for Service pricing page showing two monetization avenues, as of April 2024

Lastly, companies can move from one avenue to another based on market dynamics—with GenAI as the end product as a potential and aspirational end goal for non-native GenAI companies.

Now that we see the overall picture, let’s deep dive into each individual avenue to define them in detail, illustrate with concrete examples, assess current monetization premiums, and summarize the pros and cons.

Recommendations

With more time and learning, companies will most likely experiment with multiple GenAI monetization avenues. This means that companies should be empowered with the tools and strategies to experiment with and iterate on value metrics, pricing, and packaging.

1. GenAI as the end product

22% of offers in our research

When you think about GenAI, this is probably the avenue that comes to mind. Here, GenAI itself is the primary product offered to customers.

In the case of pure GenAI players, such as OpenAI, this would be their flagship product. For companies with an existing portfolio, like Adobe, pursuing this avenue means creating a dedicated product line (i.e., Firefly) that provides a high-value, standalone GenAI solution or platform that can be directly sold to consumers or businesses.

While it is obviously the sole paradigm for pure GenAI players, this avenue is definitely not the “path of least resistance” for most established players for two main reasons. First, it is more complex to create a GenAI product from scratch versus infusing GenAI capabilities into an existing solution, taking advantage of a well-known process and data set. Second, from a go-to-market standpoint, this avenue is less likely to leverage the existing customer base and contracts.

Despite its inherent complexity, this avenue is used by 22% of the offers we assessed from non-native GenAI companies (Exhibit 3).

Let’s take a look at a few examples.

Wix launched Wix Studio, a GenAI-infused web creation dedicated platform, specifically targeting agencies and freelancers. It is monetized via a 5-tier “good/better/best” packaging model following a flat monthly subscription model.

Microsoft launched a cybersecurity GenAI application called Copilot for Security. Even though it integrates with the broader Microsoft suite, customers can access Copilot for Security as a standalone offer, monetized via a single plan for $5 per “security compute unit.”

Monetization premium potential

Unlike other avenues, assessing the monetization premium for this avenue is irrelevant, given there is no reference point nor precedent. As companies with offers in this avenue continue to finetune monetization, they will be performing a balancing act between cost, adoption, and value that is completely new to the world stage.

Other examples: OpenAI’s ChatGPT Plus/Team/Enterprise, Adobe Firefly, C3 Generative AI, Wix Studio.

| Avenue: GenAI as the end product | |

| Pros | Cons |

| Maximizes GenAI value capture potential | Not the path of least resistance for most established companies |

| Ability to report on GenAI as a product line | |

| Ability to tap into new customers and new segments | |

Recommendations

This avenue is often the most aspirational as it requires a clear and established GenAI value proposition. This is why it’s recommended that established companies usually start with one of the other three avenues.

2. GenAI as a value booster for existing plans

33% of offers in our research

This avenue involves integrating GenAI technologies or capabilities across all levels of a company’s existing plans. It signals a commitment to incorporating GenAI not just for premium plans, but as a systematic enhancement of the value proposition.

This assumes that there is a clear level of readiness and attributable business value for GenAI for all users. Companies implementing this avenue send the message that they want to position themselves as GenAI-native.

Let’s examine some examples.

Zoom now embeds its AI Companion at no additional cost with paid Zoom accounts. This added capability infuses AI across the platform, providing meeting summaries, email drafts, and more. Zoom may be using this avenue as a way to stay relevant and competitive versus companies like Microsoft who are aggressively pushing on all fronts towards GenAI.

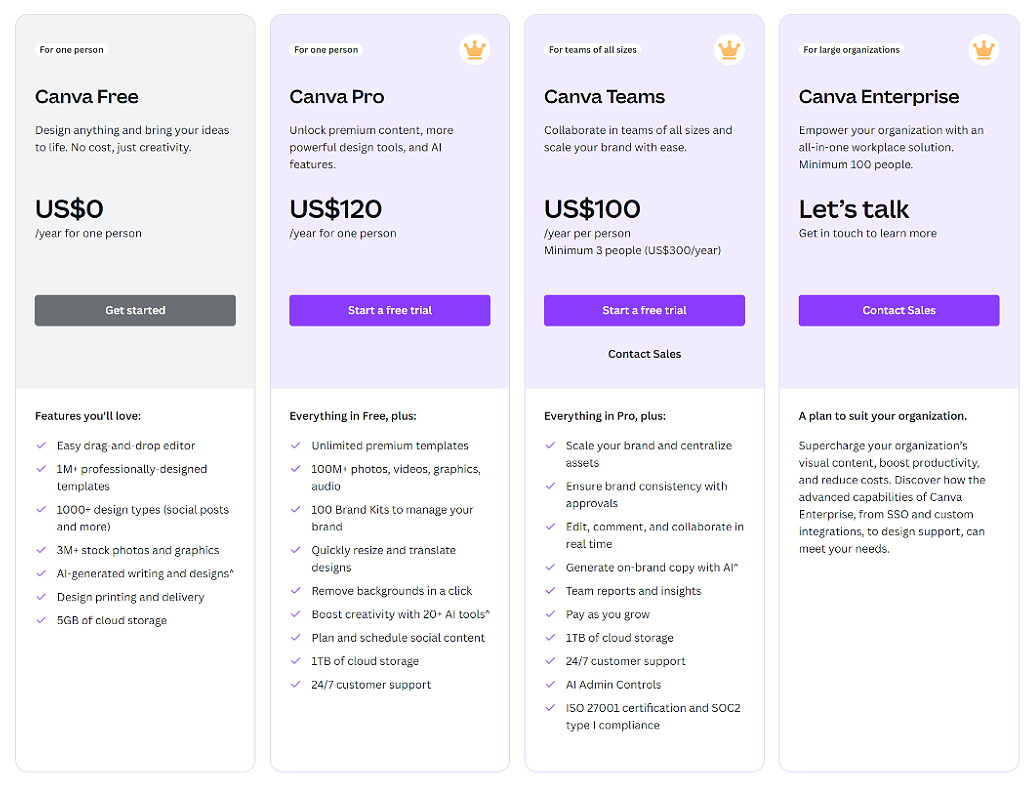

The billion dollar Australian design leader Canva is also a great illustration of the value booster avenue. By embedding AI in their design platform starting in 2019, Canva has significantly enhanced user experience, initially enabling simple features such as background removal.

Their approach to AI reached an inflection point in 2023 with the strategic introduction of AI-powered features branded as Magic Studio, fostering even further real-time collaboration across its six million team accounts. Canva’s AI capabilities are accessible to all its users, including those in the freemium plan, with feature segmentation and volumes depending on their plan.

Image: Canva’s pricing page as of April 2024.

Monetization premium potential

The GenAI as a value booster avenue might seem like the easiest to implement and position to customers. However, in order to successfully monetize this avenue, there are three combinable options to consider.

Thresholding usage

The first tactic is to threshold GenAI utilization with a cap, then monetize customers through overages. Adobe’s GenAI capability called Firefly is a good example. While being sold as a standalone solution (i.e. GenAI as the end product), Firefly is included in several offers of Adobe’s core Creative Suite in the form of included monthly creative credits. Users can purchase additional generative credits by subscribing to a Generative Credits Add-on plan after they reach their monthly credit limit.

Such a monetization tactic can be relevant, as it can help monetize super users who should extract more value (but are driving higher GenAI costs).

Customer service platform Intercom pushed it to the next level, by including its GenAI-powered ChatBot Fin all plans, and while activated on demand, it is charged $0.99 per customer case resolution.

Increasing prices

Some companies may opt to increase the price of all their plans, using the incremental value delivered by GenAI as a justification. Adobe increased the price of some offers by approximately 10%, using Firefly as one of the justifications. However, this could result in customer churn, especially those who do not experience or perceive the value they originally anticipated.

The risk of a negative consumer reaction to increased prices is even more likely, considering the recent price increases in SaaS. Over the last couple of years, software vendors have increased their price points an average of 12% due to inflation. And with consumers and enterprises alike feeling the pressure to cut spending, successful monetization of GenAI through increased prices would be challenging at best.

Monetizing indirectly

Indirect monetization is possible if the utilization of GenAI actually helps maximize the pricing metric of the core package. This might only work in a limited amount of cases and might send mixed signals regarding GenAI value.

Other examples: UiPath, Tableau (Salesforce), Atlassian, and more.

Avenue: GenAI as a value booster | |

Pros | Cons |

Easy to understand for end customers | Assumes proven level of readiness and acceptability across customer base, whereas some users might not be interested and feel overcharged in the future if GenAI is the main reason for price increase |

Easiest to implement and very limited catalog disruption for most companies | Makes value capture of GenAI pricing premium quite indirect and complex (i.e. via price increase of existing plans, through overages when capping GenAI usage, or indirectly if GenAI increases the main pricing metric) |

Fosters GenAI adoption by design | Requires communication and/or migration strategy for existing customers, in the case of pricing increases or plan changes |

Could potentially have a negative impact on gross profit margin if GenAI fails to be monetized | |

Difficult to assess or report the true GenAI monetization premium | |

Recommendations

The value booster avenue is the strategy utilized the most by non-native GenAI companies. But while this avenue may appear attractive, it should be approached with caution due to its potentially risky and dilutive nature as related to monetization. It could be the least straightforward way to capture the GenAI value premium, putting pressure on gross profit margins if monetization tactics fail to deliver.

3. GenAI as an add-on for existing plans

27% of offers in our research

For businesses with established product lines or services, integrating GenAI as an add-on option for existing plans can create new revenue streams. This approach also allows companies to leverage their existing customer base by offering GenAI functionalities that complement or enhance the core service.

Across SaaS, most GenAI offers are still in the adoption phase, however some vendors are witnessing a plateau in the rate of client adoption. By offering GenAI capabilities as an add-on for a subset of early users, companies are more likely to capture customers that can more readily appreciate the value of GenAI.

These customers are more likely to utilize the technology to its full potential and give feedback on their experience to improve the product and validate use cases.

Let’s look at some real-world examples of this avenue in action.

ServiceNow has rolled out Plus add-ons with GenAI capabilities for their IT Service Management, Customer Success Management, and HR Service platforms. These new Plus add-ons extend the Pro and Enterprise versions, with pricing premiums of 60%.

According to ServiceNow’s CFO, their prior experience with AI-infused SKUs indicates that an estimated 90% of the value will be delivered back to the customer. And this strategy appears to be effective, as it has fueled a significant “pull” from their customer base.

Monetization premium potential

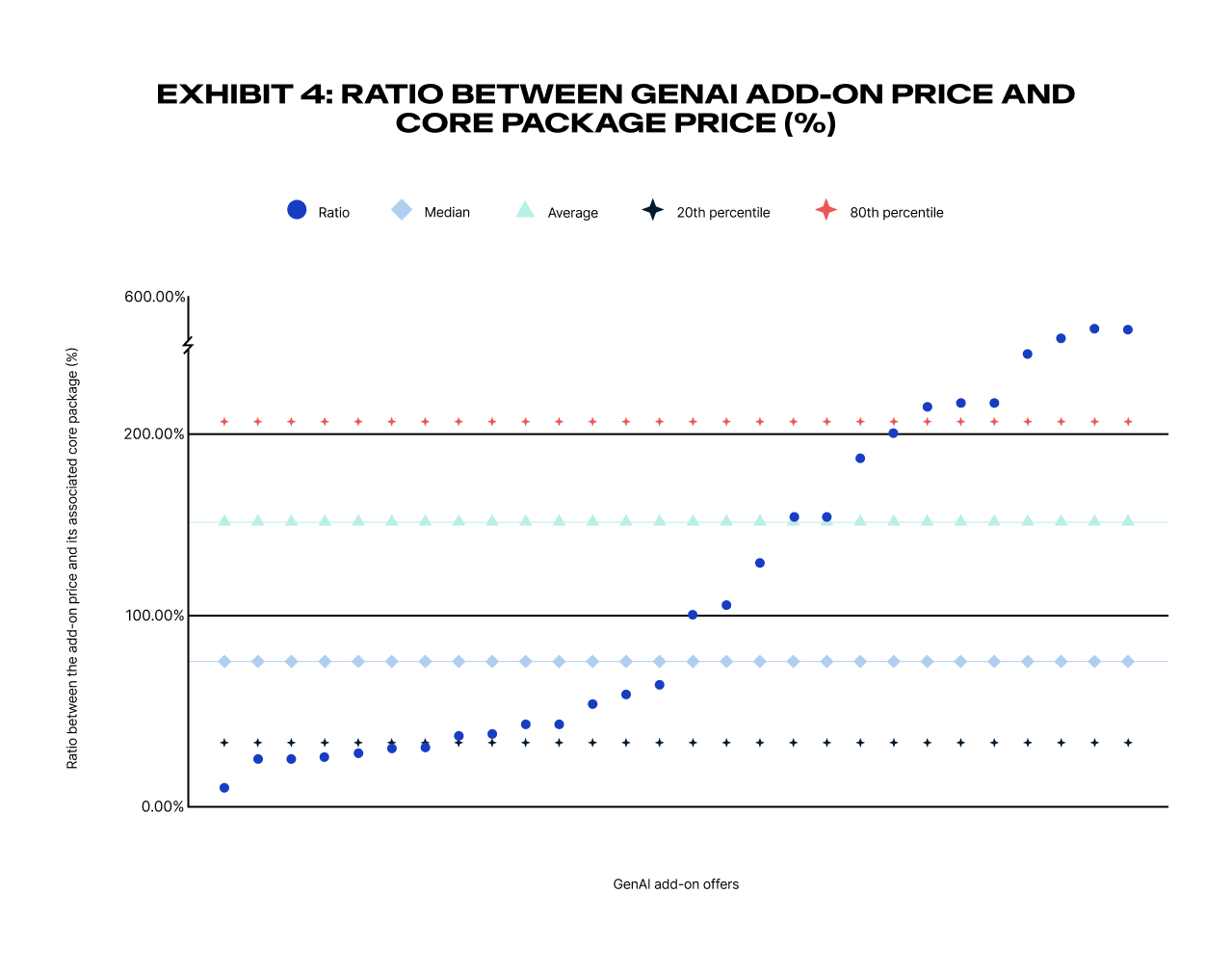

Unlike the two previous avenues, it’s more straightforward to assess the pricing uplift expected by companies, by simply checking the ratio between the add-on and the associated packages.

According to our analysis summarized in the chart below, a GenAI add-on is priced on average at 148% of the core package it is associated with, while the median is 83% (Exhibit 4). Such a spread between the average and the median is explained by the extreme distribution, which is unlike what we typically witness in the SaaS space. As we’ll explore below, there may be good reasons for this anomaly.

Add-on prices typically range between 10% and 50% of the associated core package they are attachable to. Which makes sense, as it strategically balances value perception and affordability, making it both appealing and justifiable to customers.

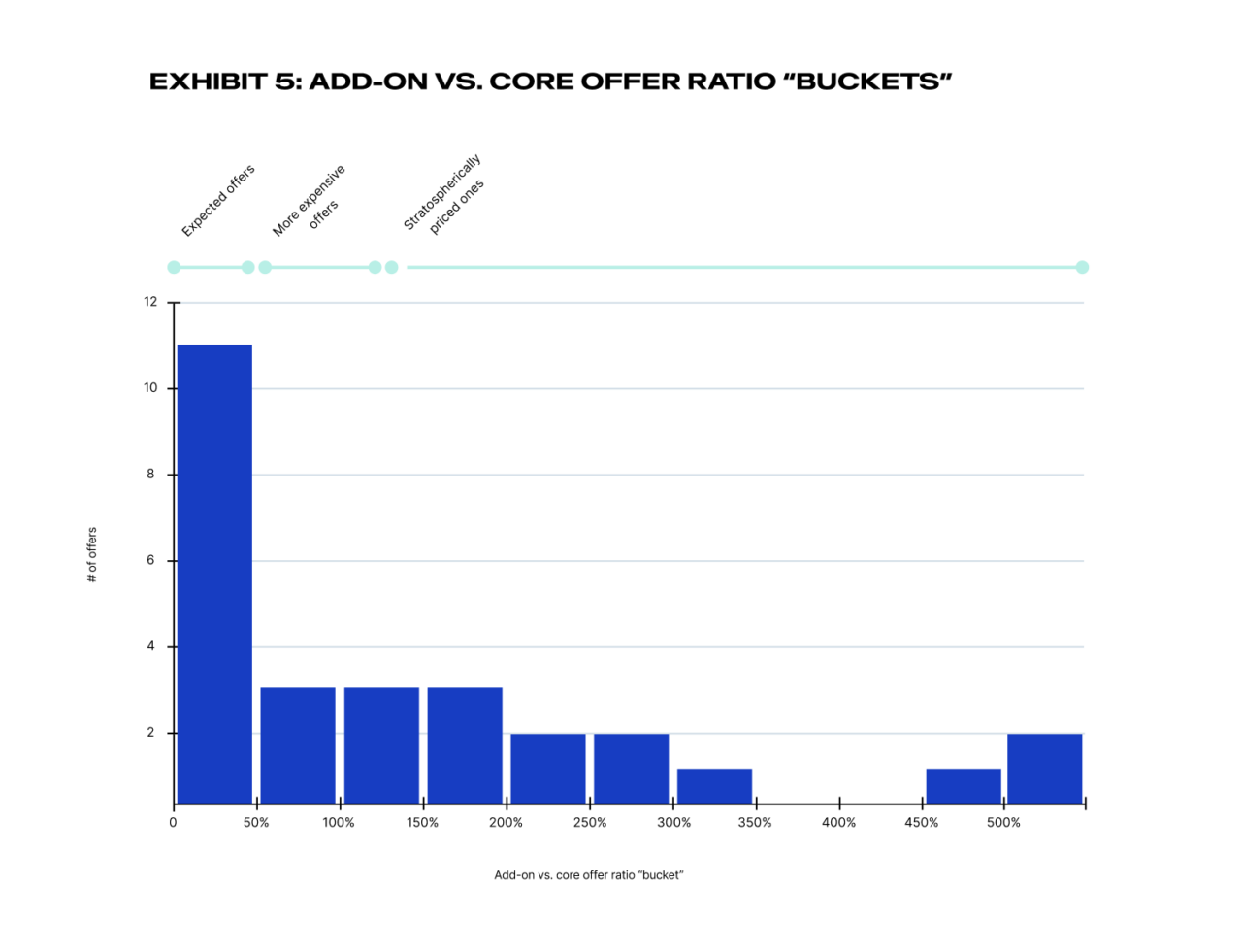

What this analysis reveals is that add-on and core package pricing ratios range from from 13% all the way to a whopping 500%. Contributing factors to this wide distribution may include variability in the expected value of the add-on, use cases, customer/user segments, or pricing strategies.

Grouping the offers by ratio ranges provides a simplified view of the situation (Exhibit 5). Here, we can see a clearly right-skewed distribution, with the vast majority of players falling into the expected 0-50% range.

Salesforce’s Einstein Add-ons for Sales or Service Clouds, for example, fall into the first range. The add-on is priced at $75/month/user, while it can be attached to the Enterprise ($165/month/user) or Unlimited editions ($330/month/user). This translates to 45% and 23% ratios, respectively.

Image: Salesforce’s Service Cloud and Einstein Add-ons pricing page as of April 2024

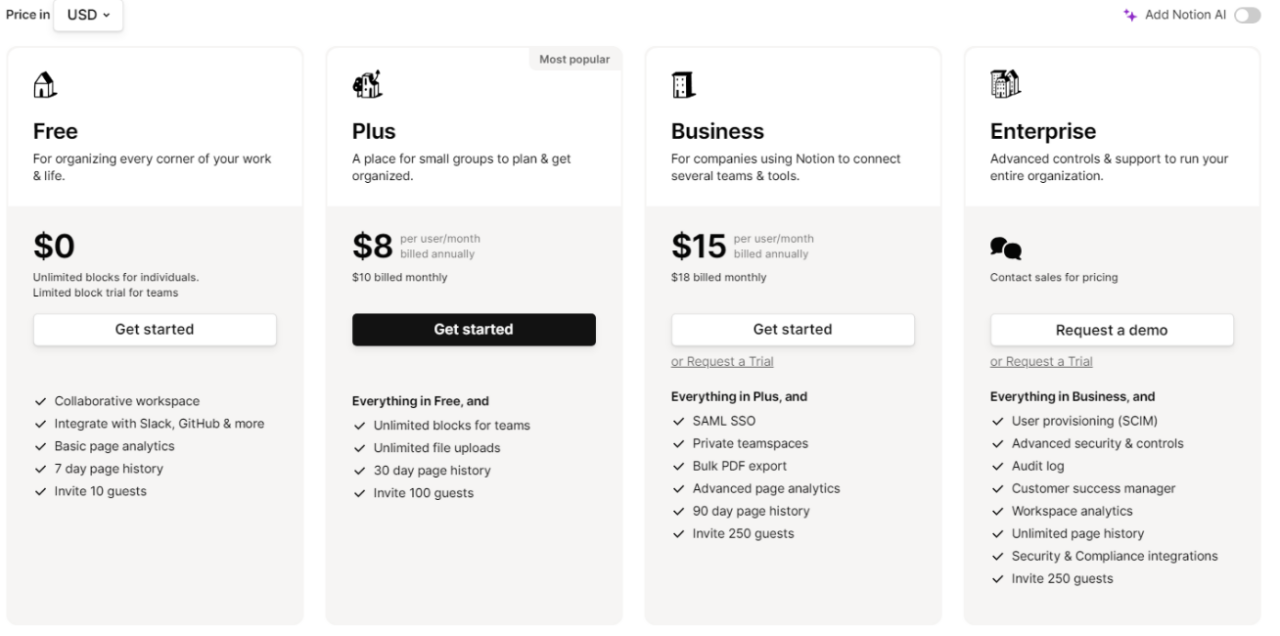

The second largest set, spreading from 50% to 150%, is quite pricey as compared to traditional SaaS add-ons. Alongside the previously mentioned ServiceNow add-on, the Notion AI add-on is a great illustration of this range.

Notion AI augments the user experience by enabling text transformation, simple tasks automation, and generating new content inside your connected workspace. A customer can subscribe to the add-on for $8/month/user across all plans, including the free plan, making the add-on 56% of the Business edition price, and the same price as the Plus Edition (i.e. 100%).

Image: Notion pricing page as of April 2024

The third largest set, ranging from 150% to 500%, is virtually unheard of in the SaaS world. For instance, the Google for Workspace add-ons Gemini Business ($20/month/user) and Gemini Enterprise ($30month/user), are associated with Google Workspace accounts ranging from $6 to $18/month/user, public price.

In this case, it’s worth noting that the add-on offers the ability to use Gemini as a full-blown assistant directly competing with ChatGPT. Its advantage being its direct integration with Google Workspace tools to generate documents, similar to Copilot for Microsoft 365. Combined, these two elements could potentially explain the hefty ratio.

Add-on thresholding trends

Our analysis also indicates variability in add-on utilization capping or thresholding strategies, perhaps indicating that many companies are still exploring best practices. Notion, for example, promotes the unlimited use of its AI capability, associated with a fair usage policy reducing access to AI features in cases of over usage.

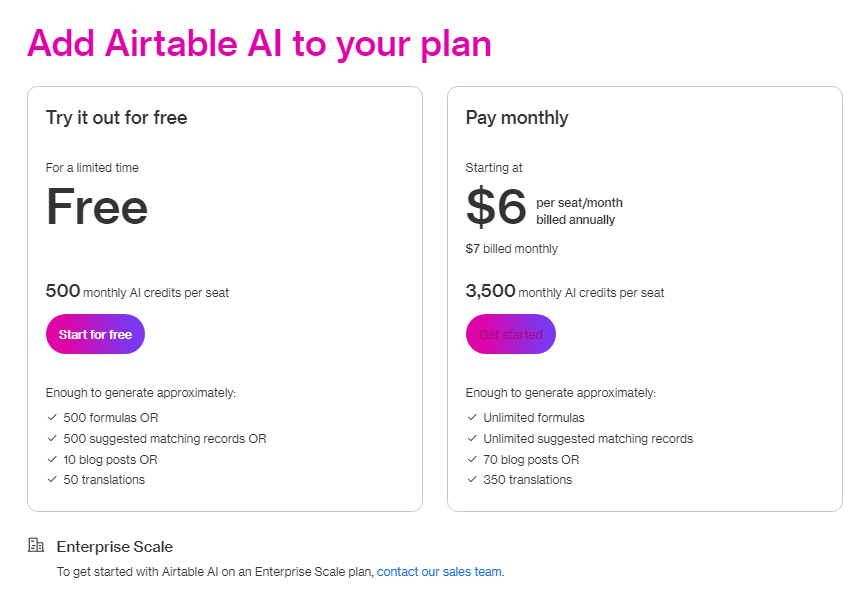

Airtable AI, priced at $6/user/month, on the other hand, clearly includes 3,500 monthly AI credits/seat which Airtable claims is enough to generate 70 blog posts or 350 translations. This strategy enables them to offer an affordable price, while also driving revenue expansion.

Image: Airtable AI pricing page as of April 2024

Assessing add-on sticker shock

For some customer segments, the more extreme add-on pricing ratios could result in a type of sticker shock effect. It’s worth noting three important observations revealed by our analysis that could potentially contribute to this:

- Some companies have decided that the GenAI add-on can be bought on all plans (even the freemium one, as seen with NotionAI). However, others require at a minimum a more advanced tier to subscribe to the add-on (e.g., the Einstein add-on requires an Enterprise or Premium tier Salesforce subscription, at minimum). This could be linked to minimum feature requirements, but could potentially disinhibit adoption.

- All of the companies included in the analysis use pricing metrics based on subscription per user for both the core package and the GenAI add-on package. In the enterprise setting, with hundreds of end users, this could translate to substantial sticker shock.

- The vast majority of offers have only one add-on “package” that can be bought for their various core packages, meaning that the add-on costs the same whether you’re a “bronze” package customer or a “gold” package customer. This could leave customers at every tier questioning the true value of the add-on, if it’s priced the same across the board. Some notable exceptions were ServiceNow with Pro Plus and Enterprise Plus add-ons, or GitHub with Copilot Business and Copilot Enterprise add-ons.

Avenue: GenAI as an add-on | |

Pros | Cons |

Easy to implement, due to limited catalog disruption for most companies | GenAI add-on pricing potentially limited by the core package pricing it is associated to (i.e. it’s challenging to price the GenAI add-on as a multiple of the core package pricing) |

Fosters GenAI adoption by allowing all or most users to subscribe | |

Enables effective value capture by monetizing value of GenAI by focusing on early adopters | |

Prevents the dilution of value of GenAI by not providing it to customers who aren’t yet ready to appreciate it | |

Ability to clearly report on GenAI revenue uplift | |

Other examples: Office 365 Copilot, GitHub Copilot, ZenDesk (with only Professional and Enterprise plans eligible), and more.

Recommendations

GenAI is not a typical SaaS add-on and may justify or even necessitate a higher pricing premium, but the more dramatic ratios between the add-on and core product that we are currently witnessing may come as a surprise to consumers.

To overcome this challenge, companies may investigate different routes to ensure consistency in positioning and value: have more than one GenAI add-on tier, add usage thresholding, or consider using a different pricing metric beyond per user. If there is a strong accompanying reason to capture a significant premium, companies should contemplate launching a super tier, especially if the focus is a higher-value customer segment.

4. GenAI as a super tier

18% of offers in our research

In this avenue, GenAI is used to create a new super tier, i.e. a level up from the current “best” offering.

This approach entails the introduction of a more premium tier, allowing companies to further segment their market. By targeting higher-value customers with the most sophisticated needs and advanced maturity levels, this avenue leverages the higher willingness to pay of an otherwise potentially uncaptured segment.

In contrast to the GenAI as an add-on avenue, the price gap between the best and super tiers is often much more significant than between a tier and its associated add-on. This is because each additional tier is meant to represent a substantial upgrade in features, capabilities, and potential user base size, which justifies a larger price increment.

Monetization premium potential

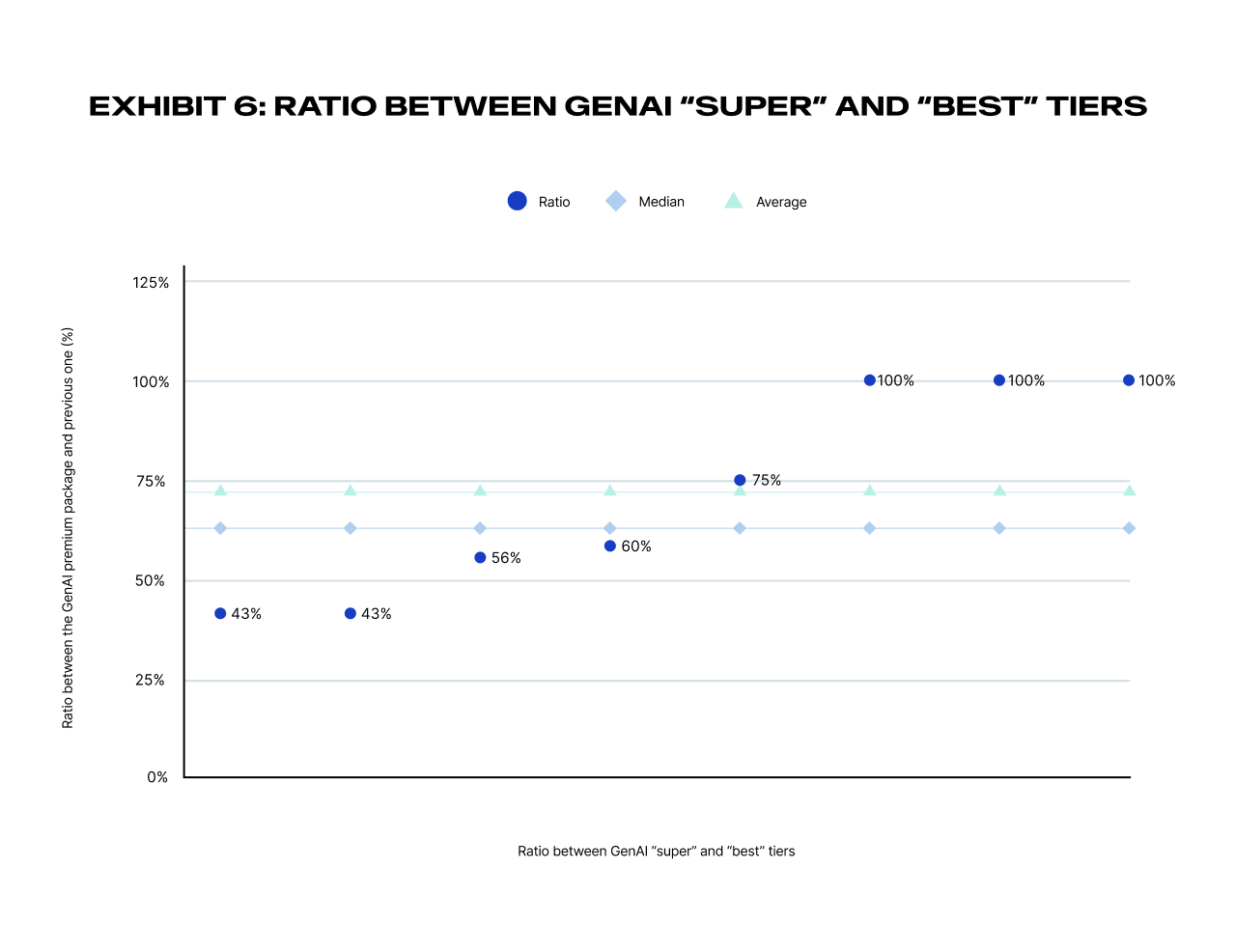

Surprisingly, the data here demonstrates a typical “SaaS-like” ratio between tiers, unlike what is analyzed when GenAI is sold as an add-on (Exhibit 6). The new super tier comes in at a price point that is, on average, 72% more expensive than the tier below with data ranging from 43% to 100% price premiums.

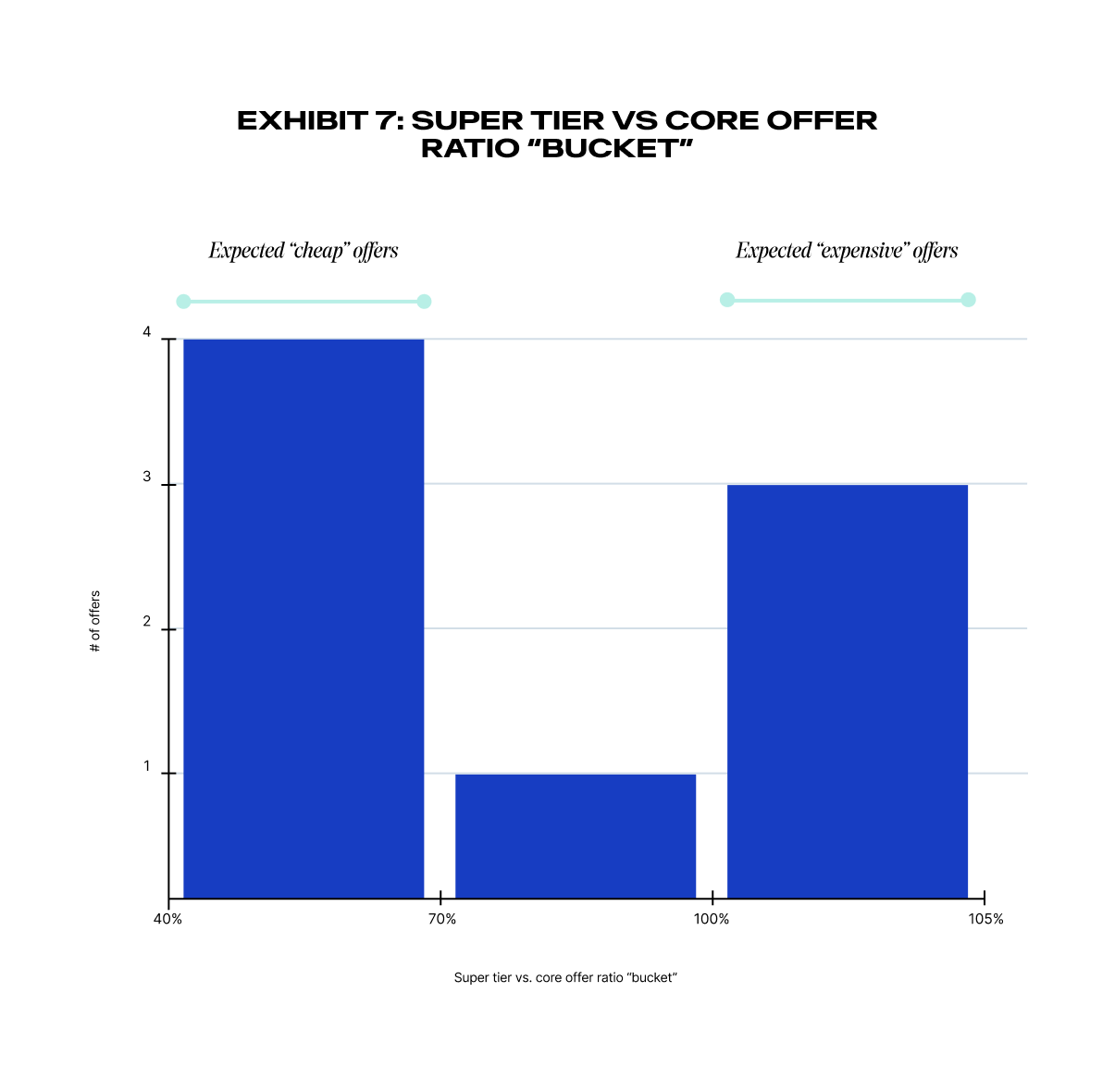

The second visual demonstrates a clear bi-modal distribution with narrow ranges, both sides falling within expected ranges (Exhibit 7). Overall, the average GenAI premium for super tiers is lower than that seen for add-ons, which is an unexpected twist.

A concrete example of this avenue is the Google Gemini version for consumers, accessible via a new Google One “Premium AI” plan priced at $19.99/month. In comparison, the non-AI Google One “Premium” plan is $9.99/month.

From a customer perspective, this represents quite a bargain. For about the price of a standalone ChatGPT Premium license ($20/month), they get Google’s comprehensive cloud suite that includes 2TB storage, advanced image editing, and much more—plus access to an integrated ChatGPT-like assistant.

Another compelling example is Box, which has included its GenAI called Box AI capabilities in the Enterprise Plus plans. Individual users have access to 20 queries/month and 2,000 queries pooled at a company level.

Assessing super tier sticker shock

Even though the sticker shock seems more limited for this avenue, we found similarities with the GenAI as an add-on avenue:

- All of the companies included in the calculation also had their pricing metric based on subscription per user.

- The vast majority of offers have only one single GenAI super tier, demonstrating the complexity to further segment without precedent or first-hand customer insights.

Other example: Salesforce (e.g. “Einstein 1” editions)

Avenue: GenAI as a super tier | |

Pros | Cons |

Easy to understand for end customers | Potentially reduces (by design) the customer target group to those with the highest willingness-to-pay |

Prevents discounting the value of GenAI by focusing on early adopters | Assumes that GenAI is the most advanced level of the offer (which can be a problem if user might need GenAI without the all the features from the most advanced tier) |

GenAI pricing is theoretically less restricted by the existing packages (as compared to the add-on avenue) | |

Prevents the dilution of value of GenAI by not providing it to customers not yet ready for it | |

Ability to clearly report on GenAI revenue uplift | |

Recommendations

This is the avenue that we identified as the least employed, which is likely due to the complexity involved in resegmenting offers. Such efforts are made more challenging by the limited data available to assess value.

Companies launching a GenAI offer in this avenue should focus on a small pool of early adopters to help identify value and use cases in order to fine tune monetization strategies and the product itself. If the data shows that the value of GenAI is appreciated across your customer base (not just high value customers) then consider investing in the add-on avenue.

Mastering GenAI monetization for a competitive edge

Understanding and choosing the right GenAI monetization avenue is crucial for companies aiming to enhance their existing portfolios and achieve a competitive advantage.

Our analysis not only sheds light on how non-native GenAI players are innovatively integrating GenAI into their offerings but also underscores the dynamic nature of these strategies across different industry players.

With changes in market trends, new innovations, and learnings from GenAI product launches, companies will need to continually adapt their monetization and positioning strategies. Success will require ongoing iteration and fine tuning—bundling or unbundling services, for example, or exploring new avenues.

As companies navigate these complexities, the insights provided here serve as a foundational guide to adopting the most effective and sustainable strategies. What we can predict is that the aspirational goal for most SaaS companies will be to establish themselves as AI companies. At this stage, the three other avenues are still necessary and relevant, but we may see that they are transitionary states in an attempt to capture value as adoption ticks up, product development accelerates, and customer value is established.

As we wrap up our exploration of the four monetization avenues for GenAI, it’s clear that the path each company chooses will significantly influence its ability to harness GenAI’s full potential.

Stay tuned for our next installment where we will break down these avenues further, exploring the packaging and pricing metrics that align best with each. And we’ll uncover how companies can navigate the evolving landscape of GenAI monetization to not only survive but thrive in this new era of technological innovation.

This article contains forward-looking statements that involve a number of risks, uncertainties and assumptions, including but not limited to statements regarding the expected benefits and drawbacks of releases of GenAI solutions with different models. Any statements that are not statements of historical fact may be deemed to be forward-looking statements. Actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors. The forward-looking statements in this article are based on current expectations as of the date of this article and Zuora undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. To the extent that this press release also includes market data and certain other statistical information, that information is based on estimates, forecasts, projections, or similar methodologies, and is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances reflected in this information. As stated in the article, the recommendations are a foundational guide, but not intended to be predictions of the future or accurate advice.

Learn more about the author

EMEA Chair, the Subscribed Institute

Principal Director of Subscription Strategy, Zuora

The Subscribed Institute