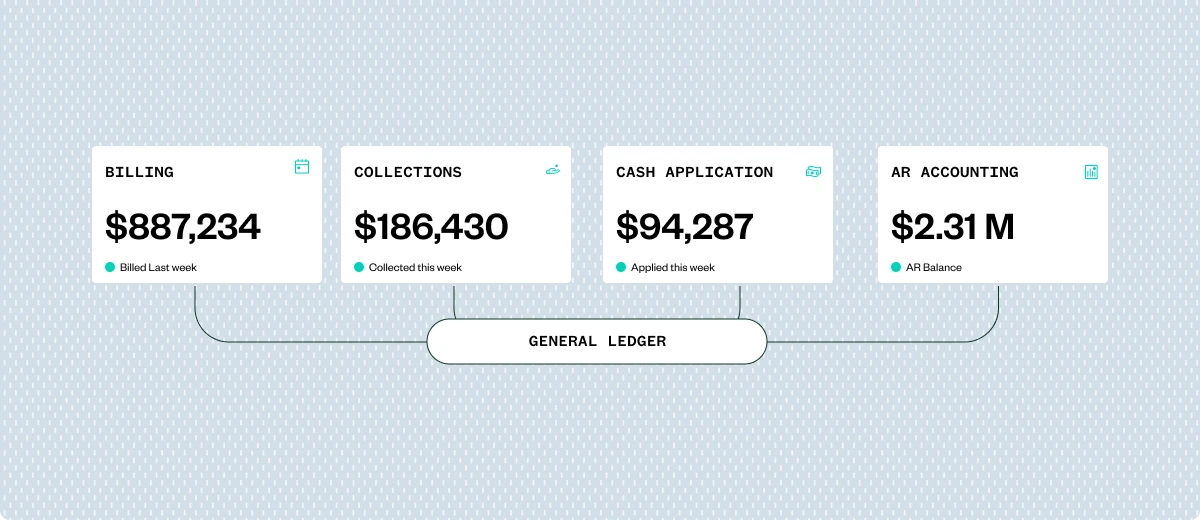

The Connected Accounts Receivable Automation Platform

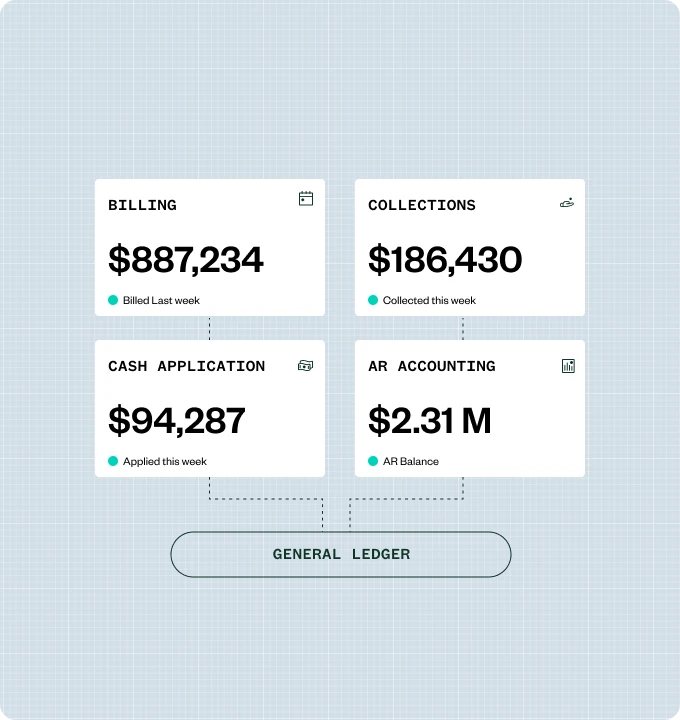

Replace patchwork systems with a single AR subledger that unifies billing, collections, cash application, and AR accounting—delivering real‑time cash visibility, audit‑ready control, and a clean handoff to revenue accounting.

The Monetization Platform of Choice for Teams Worldwide.

AR without the gaps

Close faster with real‑time control

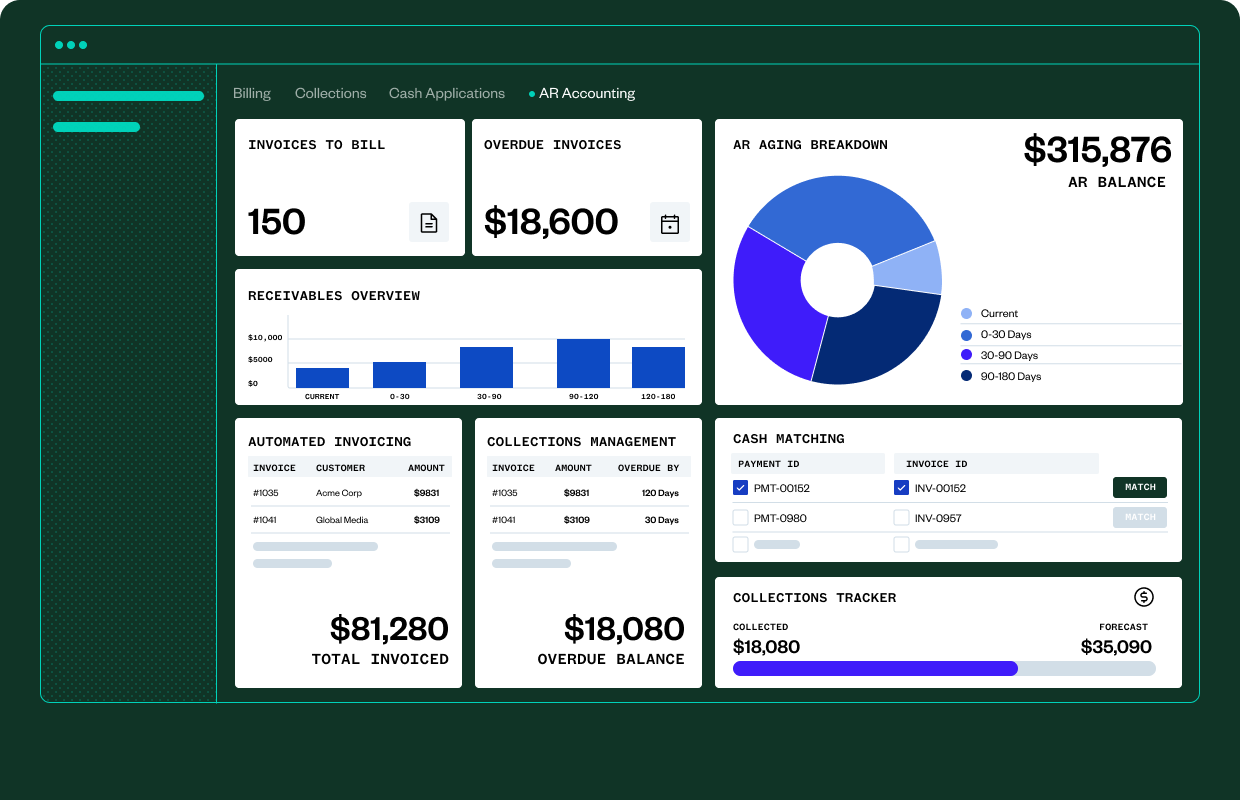

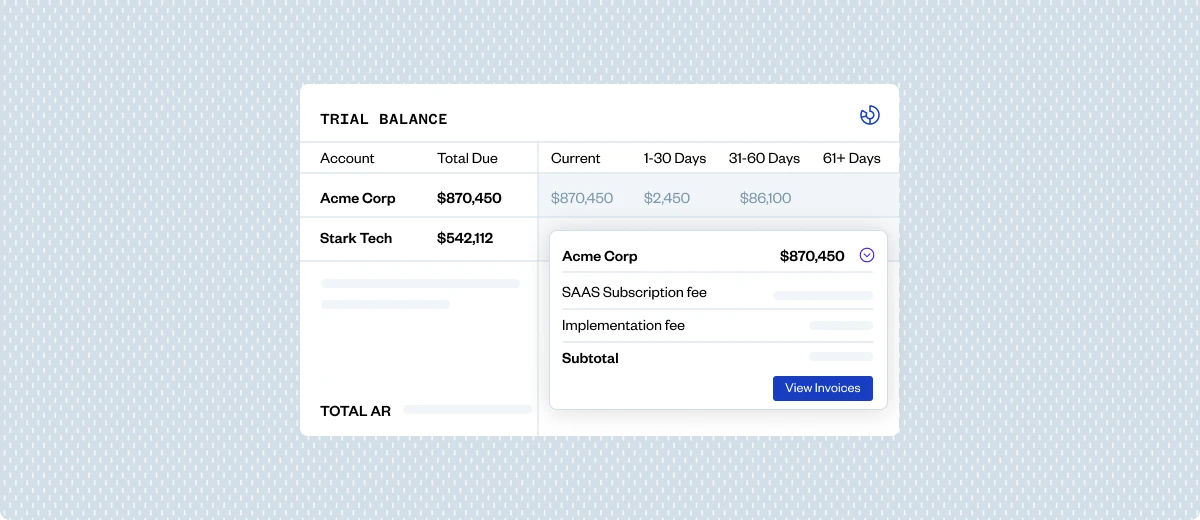

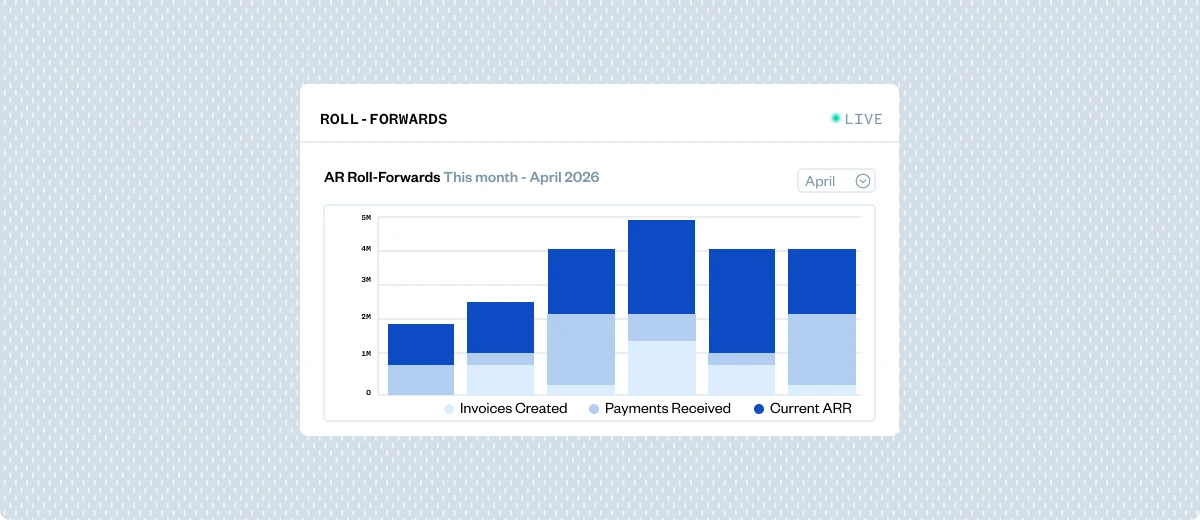

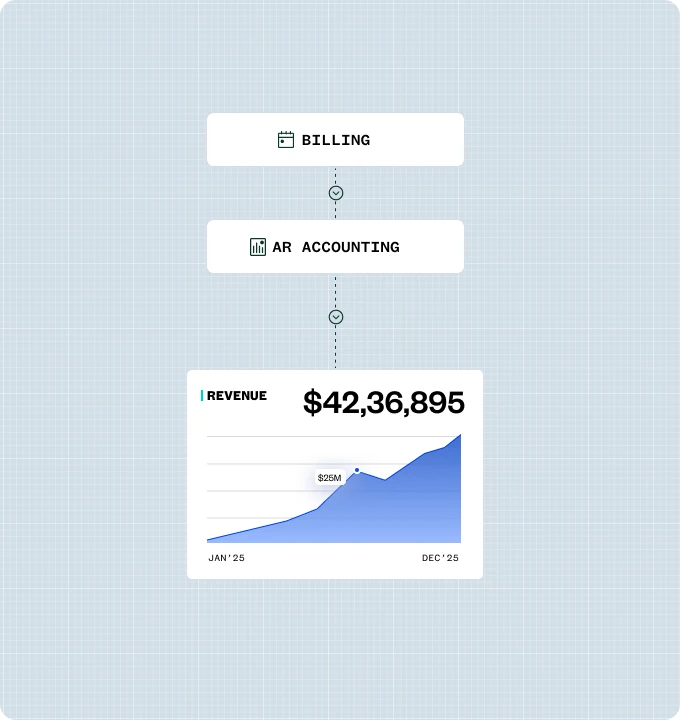

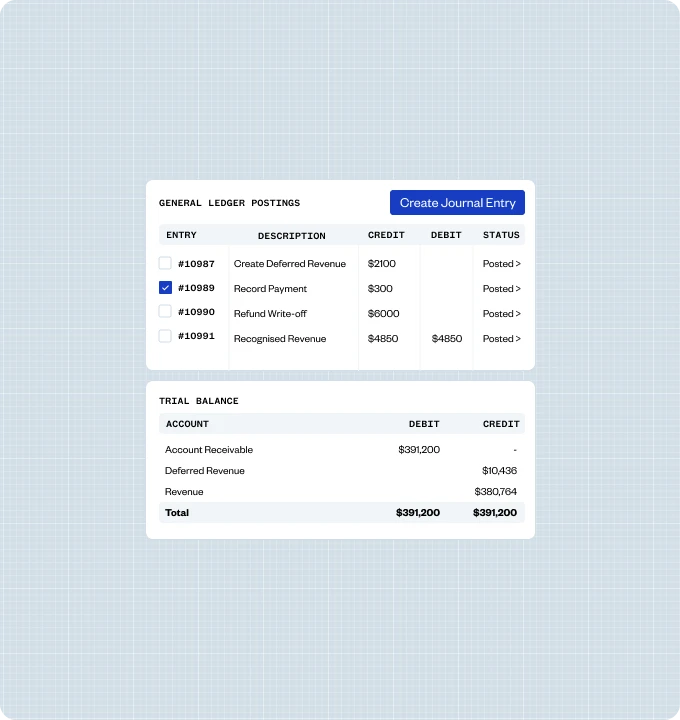

Live AR trial balance and roll‑forwards, policy‑driven accounting, and auditable journals that feed your GL.

See cash as it moves

Track aging and cash movement continuously, not just at close—from invoice to revenue recognition.

Fewer reconciliations

One receivables layer across billing, collections, cash application, and AR accounting reduces data drift and batch delays between tools.

One solution: From invoice to cash to close

1

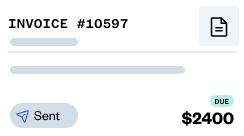

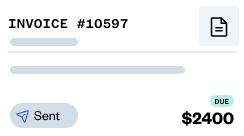

Billing & Invoices

Accurate, usage-aware invoices that flow cleanly into receivables and revenue.

3

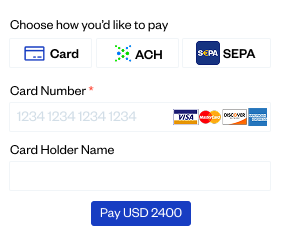

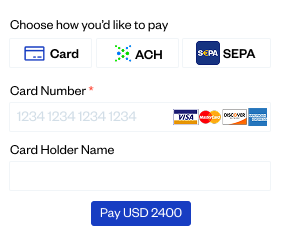

Payments

Flexible rails and gateways with smart retries and reconciliation mapped to the right customer and invoice.

5

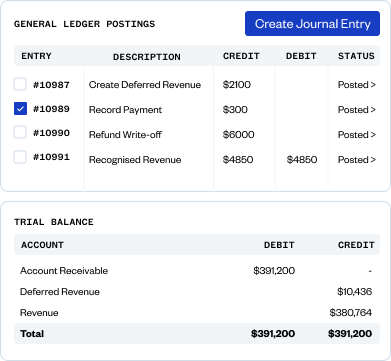

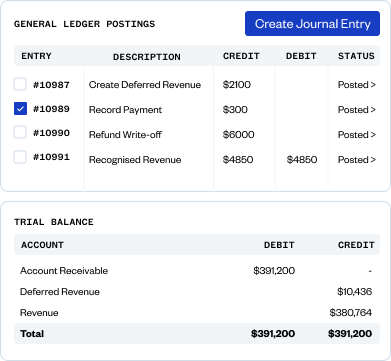

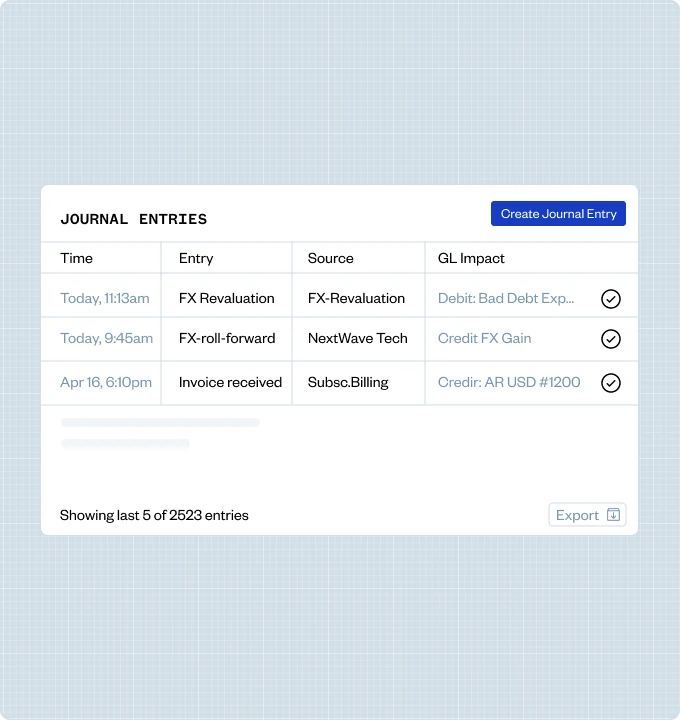

AR Accounting

Real-time trial balance, roll-forwards, write-offs, FX gains/losses, and auditable journals into your GL.

2

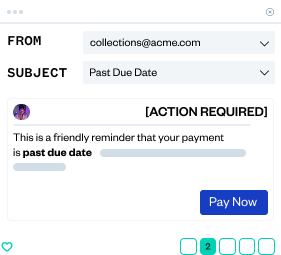

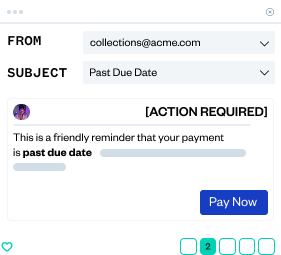

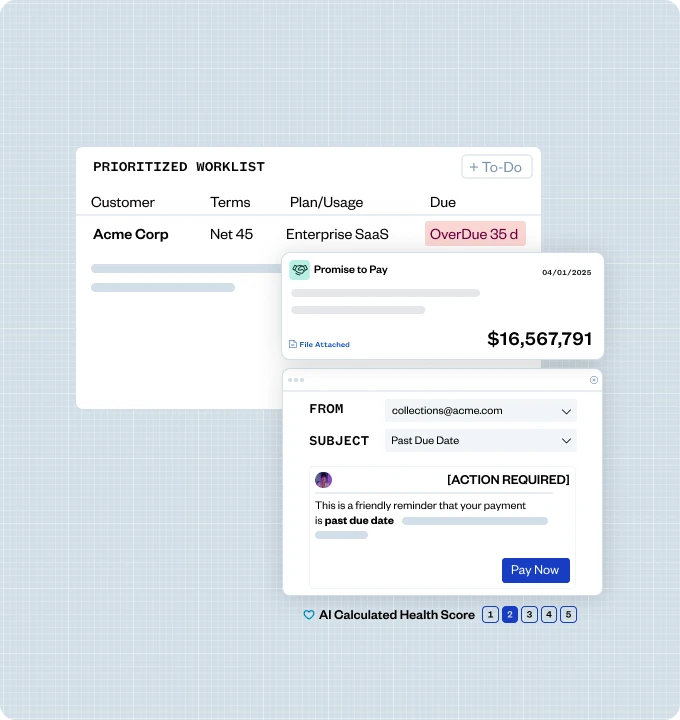

COLLECTIONS

Intelligent dunning, prioritized outreach, disputes, and promise-to-pay tracking tied to invoice state.

4

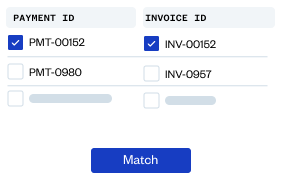

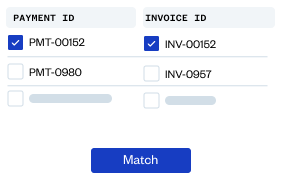

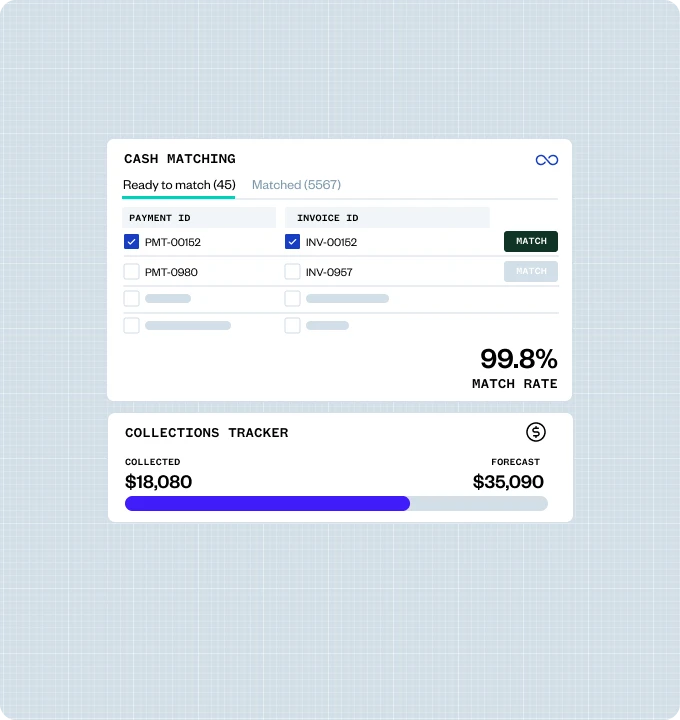

Cash Application

Automated matching for cards, ACH, bank files, plus AI-assisted suggestions and fast settlement of open items.

One solution: From invoice to cash to close

1

Billing & Invoices

Accurate, usage-aware invoices that flow cleanly into receivables and revenue.

2

COLLECTIONS

Intelligent dunning, prioritized outreach, disputes, and promise-to-pay tracking tied to invoice state.

3

Payments

Flexible rails and gateways with smart retries and reconciliation mapped to the right customer and invoice.

4

CASH APPLICATION

Automated matching for cards, ACH, bank files, plus AI-assisted suggestions and fast settlement of open items.

5

AR ACCOUNTING

Real-time trial balance, roll-forwards, write-offs, FX gains/losses, and auditable journals into your GL.

The single system difference

End-to-End Accounts Receivable Platform

One vendor for Billing and AR with a clean handoff to Revenue.

One vendor for Billing and AR with a clean handoff to Revenue.

One vendor for Billing and AR with a clean handoff to Revenue.

One vendor for Billing and AR with a clean handoff to Revenue.

One vendor for Billing and AR with a clean handoff to Revenue.

Standalone AR Tools

Receivables-only suites with heavy integration requirements to reach billing and revenue.

Dashboards only, not a live AR subledger; batch latency hides cash movement until month‑end.

Manual tie‑outs and late adjustments to align revenue with AR settlement detail.

One vendor for Billing and AR with a clean handoff to Revenue.

“Looking ahead, Zuora isn’t just a billing or revenue system; it’s a critical enabler for Asana’s future. As we plan multi-org expansion into new global markets and explore even more innovative monetization models, Zuora provides the flexible, reliable foundation that ensures we can scale efficiently without compromising financial control or compliance.”

Sid Sanghvi, Head of Finance Business Applications at Asana

Read Case study

“During close, I used to spend a lot of time in the evenings, working until 12:00 or 1:00 in the morning. I do not need to do that anymore. I have three kids, and I used to work while they were sleeping — I’m sleeping much better myself now.”

Stephanie Thorin, Senior Manager of Revenue Accounting at Hudl

Read Case study

Live AR subledger with built‑in controls

- Get a live AR trial balance and roll‑forward views with policy‑driven accounting for write‑offs and FX, plus auditable journals that post cleanly to your GL.

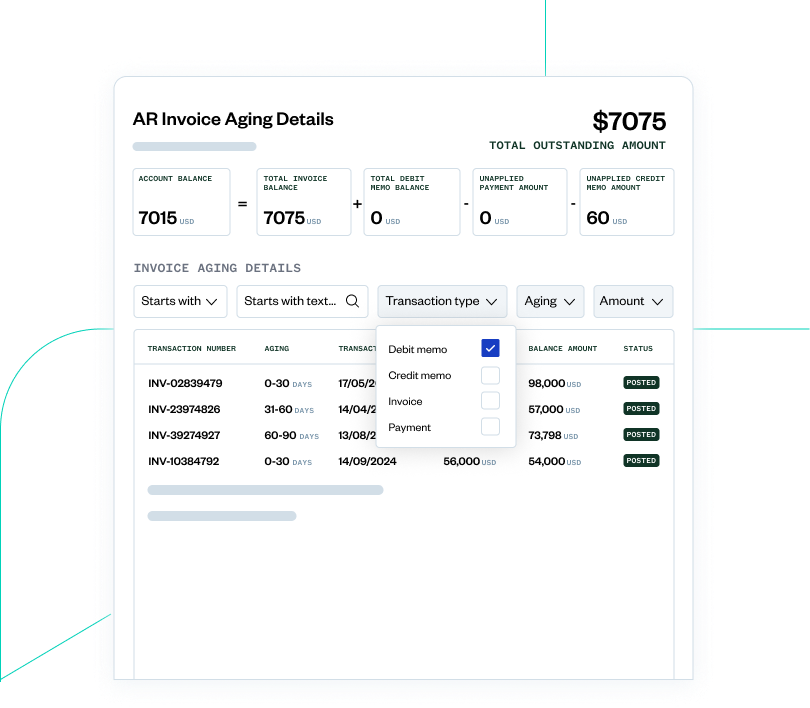

- Track aging and cash movement continuously, not just at close.

- Enforce accounting policy at the source with traceable entries across entities and currencies.

Seamless revenue handoff

- Detailed invoice and payment data flows from Billing through AR into Revenue, eliminating manual tie‑outs.

- Preserve line‑level detail for ASC 606 and cut late reclasses at month‑end.

- One audit trail from the first invoice to recognized revenue.

Unified receivables data model

- Billing, collections, cash application, and AR accounting operate on a single model to remove reconciliation gaps and batch delays.

- Align invoice state with collections and matching logic to keep finance data consistent from source through the GL.

Subscription- and usage-aware collections

- Prioritized worklists, dunning, disputes, and promise‑to‑pay logic that understand plan, term, usage, and entitlement context.

- Smarter retries and routing tied to the actual invoice state to improve predictability of cash.

AI‑guided cash application

- Automate matching across cards, ACH, and bank files with AI suggestions for remittance edge cases.

- Speed settlement to open items with subscription/usage context and handle short‑pays, partials, and multi‑invoice remittances with clear exceptions.

- Improve match rates across global rails and gateways.

In‑place activation for Billing customers

- Turn on Collections and Cash Application as modular capabilities — no re‑platforming required.

- Realize immediate lift from shared invoice and payment context on the path to a single AR subledger.

Frequently Asked Questions About

Zuora AR Automation Software

What is accounts receivable software?

Accounts receivable software helps finance teams manage invoicing, collections, payments, and accounting processes in one place. Modern solutions automate these workflows to speed up cash collection, improve visibility, and ensure accuracy across the full receivables lifecycle.

What is accounts receivable automation?

Accounts receivable automation uses AI and rule-based workflows to match payments, post journal entries, and manage collections automatically. This reduces manual effort, eliminates reconciliation errors, and accelerates the financial close.

How does Zuora’s accounts receivable software work?

Zuora’s accounts receivable software unifies billing, collections, payments, and AR accounting in a single platform. From invoice creation to cash application and close, every transaction is connected — giving finance teams automated accuracy, real-time visibility, and continuous compliance.

What problems does Zuora AR Automation solution solve?

Zuora AR automation solution helps finance teams eliminate manual reconciliations, reduce compliance risk, and shorten close cycles. With automation and integrated data, AR leaders gain continuous visibility into invoices, payments, and trial balances — without jumping between disconnected systems or spreadsheets.

What are the key features of Zuora’s accounts receivable software?

The key features of Zuora’s account receivable software are:

- Automated invoicing and collections workflows

- AI-powered payment matching and cash application

- Real-time AR dashboards with trial balances and roll-forwards

- Audit-ready journal entries and accounting automation

- Seamless integration with Zuora Billing, Payments, and Revenue for a unified Order-to-Cash process

How is Zuora’s accounts receivable software different from other AR tools?

Zuora’s accounts receivable software is different from other AR tools. Unlike standalone invoicing or payment products, Zuora connects the entire receivables journey — from order to close — on one data model. This eliminates reconciliation gaps, gives accountants real-time accuracy, and feeds directly into Zuora Revenue for automated recognition.

How does Zuora AR Automation improve visibility for finance teams?

Zuora AR automation provides continuous, real-time reporting with live trial balances, roll-forwards, and collection insights. Controllers and CFOs can instantly see cash positions, outstanding balances, and journal status — instead of waiting for month-end.

Does Zuora’s AR automation support compliance and control in AR?

Yes, Zuora’s AR subledger supports compliance and control in AR. Every transaction in Zuora is traceable, validated, and audit-ready. The platform enforces consistent accounting rules and segregation of duties, helping finance teams stay compliant with internal controls and external standards like ASC 606 and IFRS 15.

Who uses accounts receivable automation software like Zuora?

Zuora’s accounts receivable automation software is used by Controllers, CFOs, and accounting leaders who want to reduce manual workload, improve accuracy, and close faster. It’s ideal for SaaS, subscription, and hybrid business models managing large volumes of invoices and payments.

How does Zuora’s AR automation software connect with revenue recognition?

Zuora’s AR automation software seamlessly connects with revenue recognition. A single data model links detailed invoice and payment data from AR directly into Zuora Revenue. This enables accurate, automated revenue recognition and eliminates the manual reconciliations most accounting teams face between billing and revenue systems.

What’s the best accounts receivable software?

The best accounts receivable software offers full automation across billing, payments, collections, and accounting; real-time visibility into receivables; and seamless integrations with revenue and ERP systems. Zuora AR Automation includes all these capabilities, helping companies close faster with confidence.

How do I get started with Zuora AR Automation?

Getting started with Zuora’s AR automation is very easy. Simply request a demo or talk with a Zuora AR automation expert. Implementation typically includes connecting your billing and payment systems, configuring workflows, enabling cash application automation, and integrating with your general ledger and revenue systems.

AR that keeps up with your business.

Replace disconnected workflows with a single subledger for billing, collections, payments, and accounting.