We recently surveyed almost a thousand finance leaders about their jobs, and the results are sobering. Approximately 80% of the respondents reported that their teams are “swamped” with manual work. And get this – the response was even worse in SaaS, with 97% of respondents saying their teams are tied up with clerical tasks.

Across the board, almost all of the respondents said that they’re being asked to act as strategic business advisors (good), but at the same time, they’re drowning in manual data issues and reconciliation work (bad).

Finance professionals continue to clamor for ever-greater efficiency and automation. Fully three-quarters of the finance and accounting leaders in our report say their systems can’t support the complex pricing structures their businesses need to continually delight customers and maintain their competitive edge.

The more automation we employ, the more complexity we seem to have.

However, there are signs we are about to experience a step change in finance technology. In other words, we’re about to make a big leap, instead of taking another incremental step. To understand this better, let’s take a trip back to the late 19th century, when a new invention changed the face of financial operations.

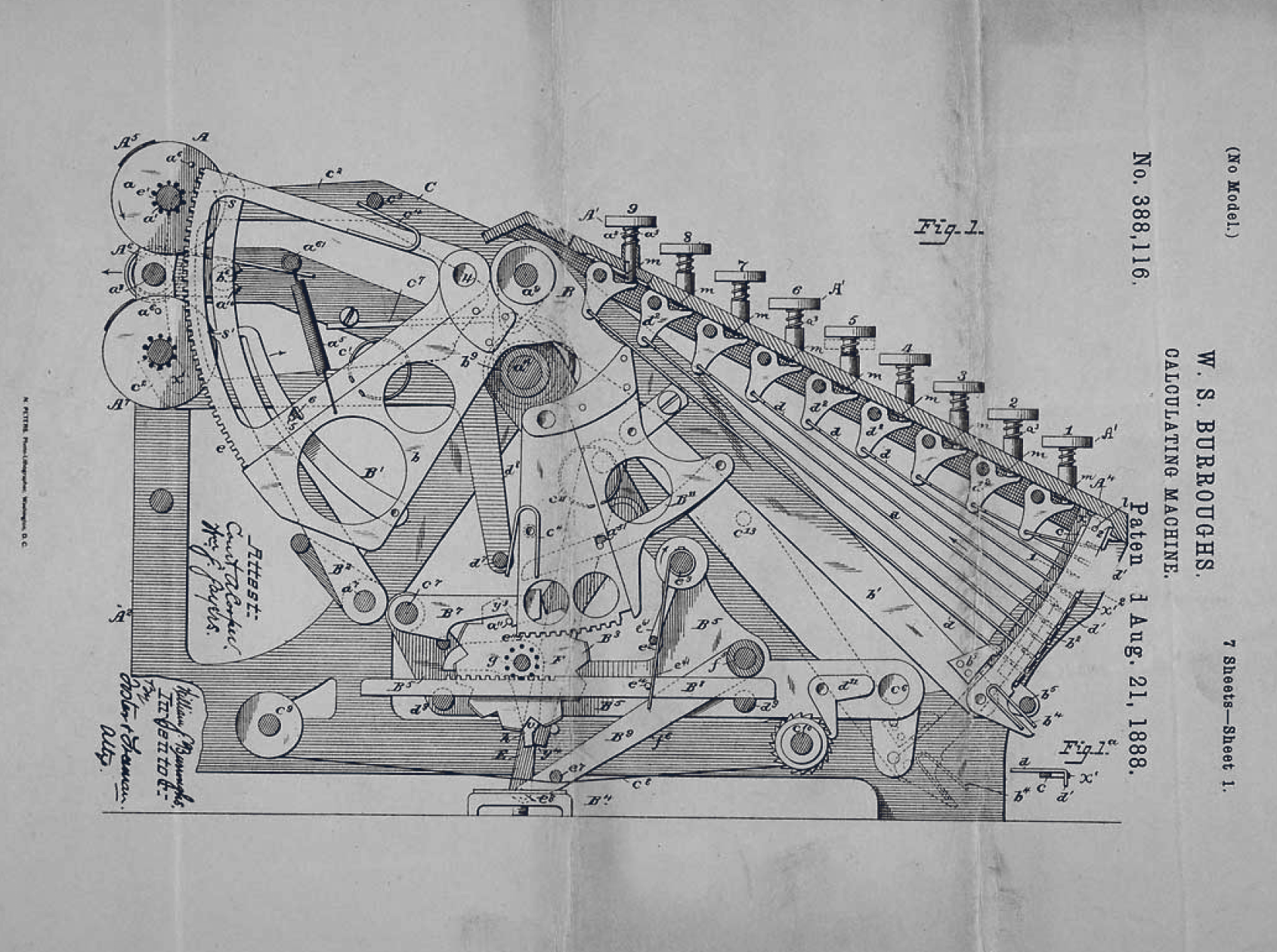

William Seward Burroughs toiled as an ink-and-ledger bank clerk for seven grueling years before submitting the patent for a “calculating machine” in 1885. If that name sounds familiar, it’s because he was the grandfather of the legendary Beat novelist William S. Burroughs.

Burroughs’ machine didn’t just automate addition. Crucially, it also produced printed records (audit trails), drastically reducing calculation errors. The young inventor found his product-market fit relatively quickly. Within five years, his machine was ubiquitous throughout the banking industry.

Imagine all those thousands of ink-stained clerks being introduced to this strange contraption that was about to utterly transform their lives. It was undoubtedly a step change – a significant shift in a system, a sudden leap from one state to another.

It was a quick lurch into the future, the stuff of speculative fiction, much like the material that Burrough’s grandson would eventually write while living on a monthly stipend from the family business.

For the first time in human history, accountants moved from being human calculators to controllers and interpreters of financial information. The monotony of clerical arithmetic moved from gray matter to buttons and levers.

(Incidentally, the women who worked on early NASA missions were called “computers” because they personally calculated all those insanely complicated rocket trajectories, orbital mechanics, and flight paths. They’re depicted in the film “Hidden Figures.”)

In 1953, the Burroughs Corporation entered the digital computer market for the banking industry (yet another step change), and it eventually became one of the “Seven Dwarves” that competed against the monolithic IBM in the 1960s. In 1986, it merged with Sperry Corporation to form Unisys.

From handcranks and operating levers to LANS and mainframes, the Burroughs Corporation chased after financial operations efficiency for a hundred years. That progress didn’t happen incrementally – it was defined by long periods of steady progress punctuated by a handful of sudden jolts forward.

So what’s going to be the next Burroughs Adding Machine? What will the next step-change event be in the infinite pursuit of financial operations efficiency? AI is the instinctive response, but we still don’t know what that will really look like. We’re still in the speculative fiction stage!

But I suspect it will have something to do with an agentic AI that controls and interprets financial information. A digital co-worker, of sorts. Most finance professionals want to play a more active strategic role in their company. AI will be a new partner in that effort.

Maybe, instead of a finance professional configuring a workflow to streamline a particular operation, AI will evaluate an entire dataset and configure (and execute) that workflow accordingly.

Maybe, instead of closing the books at the end of the quarter, AI will record, reconcile and adjust the entries of a company’s entire finances at the end of every day, leaving the quarter-end process a simple reporting exercise.

Maybe, instead of trial-running a new service and pricing plan in a small, out-of-the way market, AI will determine which accounts seem like a likely fit, and execute the trial run across a percentage of your entire customer base.

Leaving us with hours of free time to strategize and speculate and read weird novels. Kidding.

But one thing is for sure – we are about to take a non-linear jump into a brand new state of affairs.