One System for the Entire Quote-to-Cash Process

Replace disconnected systems with one unified platform that automates quoting, billing, collections, and revenue recognition. Zuora’s Quote-to-Cash software empowers finance teams to accelerate cash flow, eliminate manual errors, and achieve real-time revenue visibility.

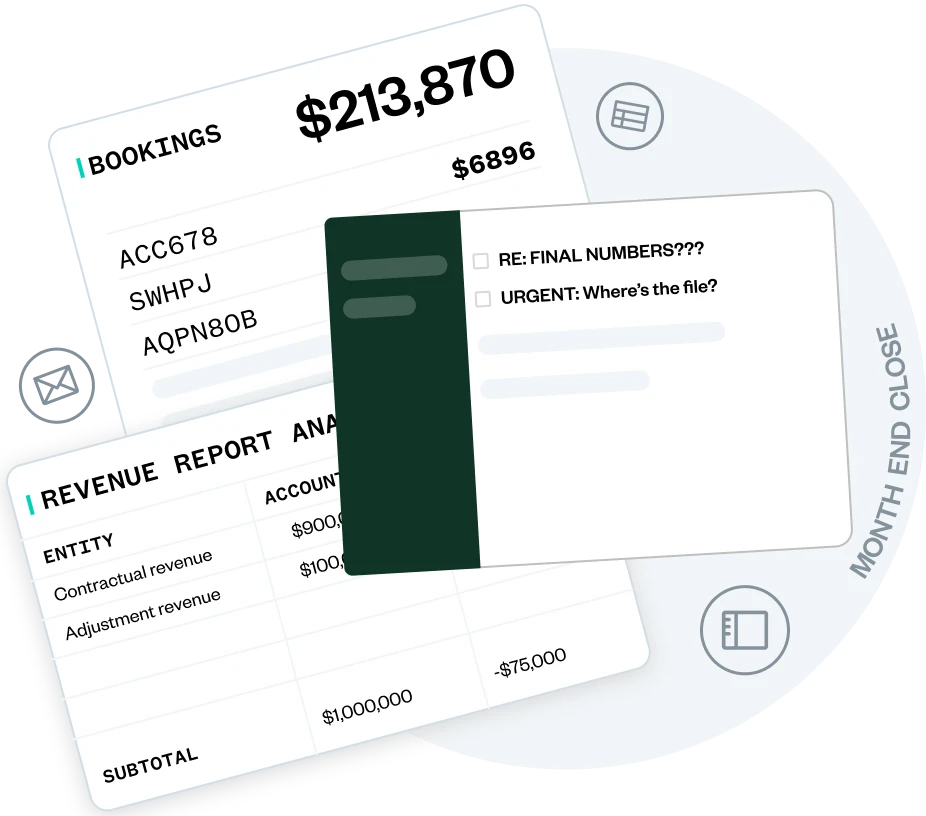

Disconnected systems create downstream chaos

Fragmented quoting, billing, and collections systems cause data gaps, manual reconciliations, and delayed closes — issues that directly impact revenue accuracy and cash flow. Accounting teams lose valuable time fixing mismatched data instead of driving strategy. Zuora’s unified Quote-to-Cash platform eliminates these blind spots, connecting every step from quote to revenue recognition.

Zuora: The Unified Platform for Connected Revenue

Zuora unifies every step of your quote-to-cash process for speed, accuracy, and growth

Eliminate silos and connect your entire revenue lifecycle — from quoting and billing to collections and recognition — in one automated system designed for finance-led efficiency and agility.

Automate every step

Automate approvals, invoices, collections, and revenue schedules. Reduce manual work, eliminate errors, and empower your finance team to do more with less.

Gain real-time revenue visibility

Get a complete picture of revenue performance as it happens. Make data-driven decisions with real-time insights — no waiting for month-end close.

Scale with confidence

Adapt to new business models and pricing strategies instantly. Zuora supports complex deal structures and evolving monetization models without retooling your finance stack.

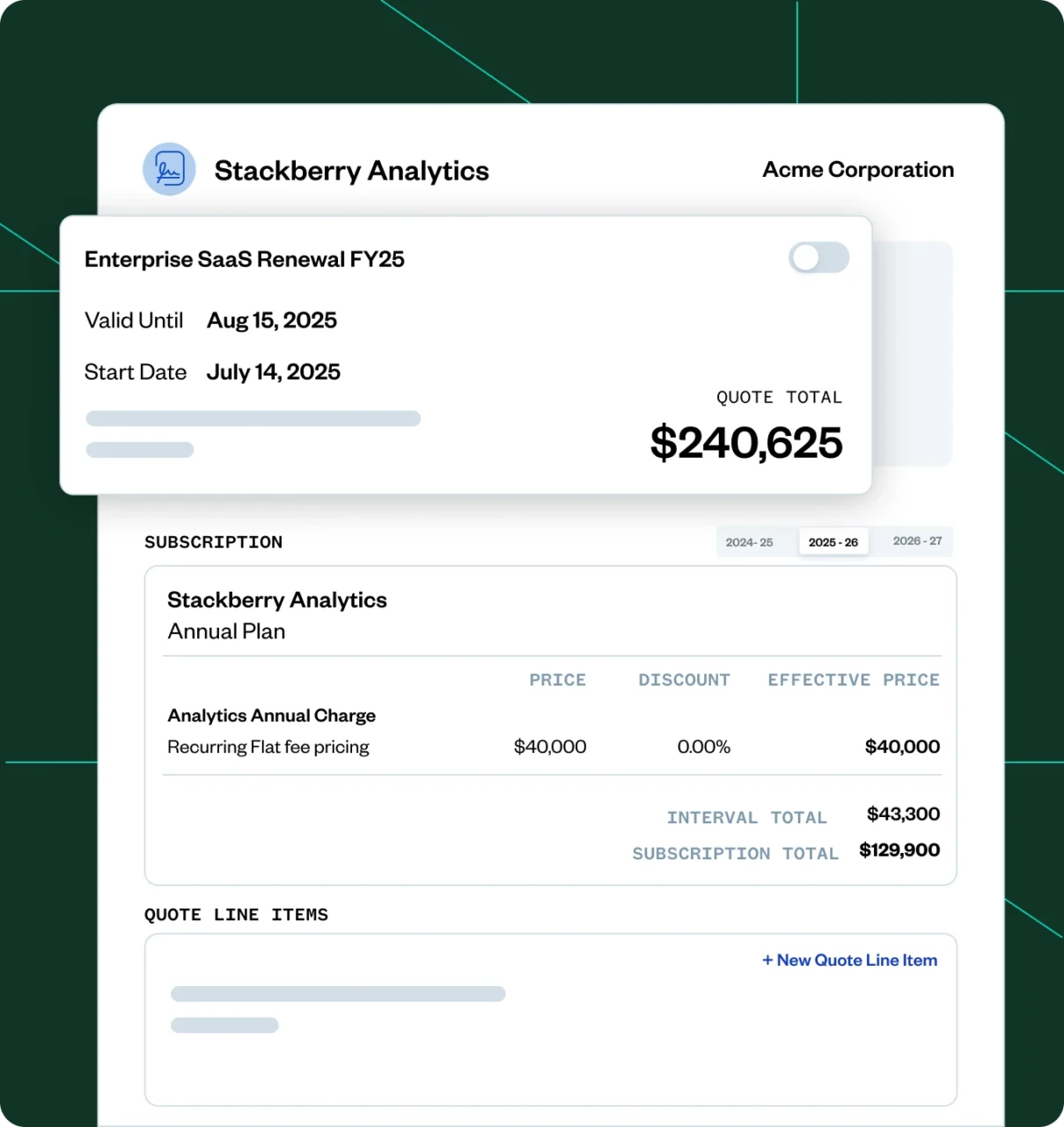

Step 1 of the Quote-to-Cash process — Quoting stage

Get accurate deal terms and seamless handoffs from the start

With Zuora, every quote becomes a precise, error-free order. Products, pricing, amendments, and billing triggers are automatically captured in one system of record — removing manual handoffs, minimizing reconciliation errors, and accelerating order approval cycles.

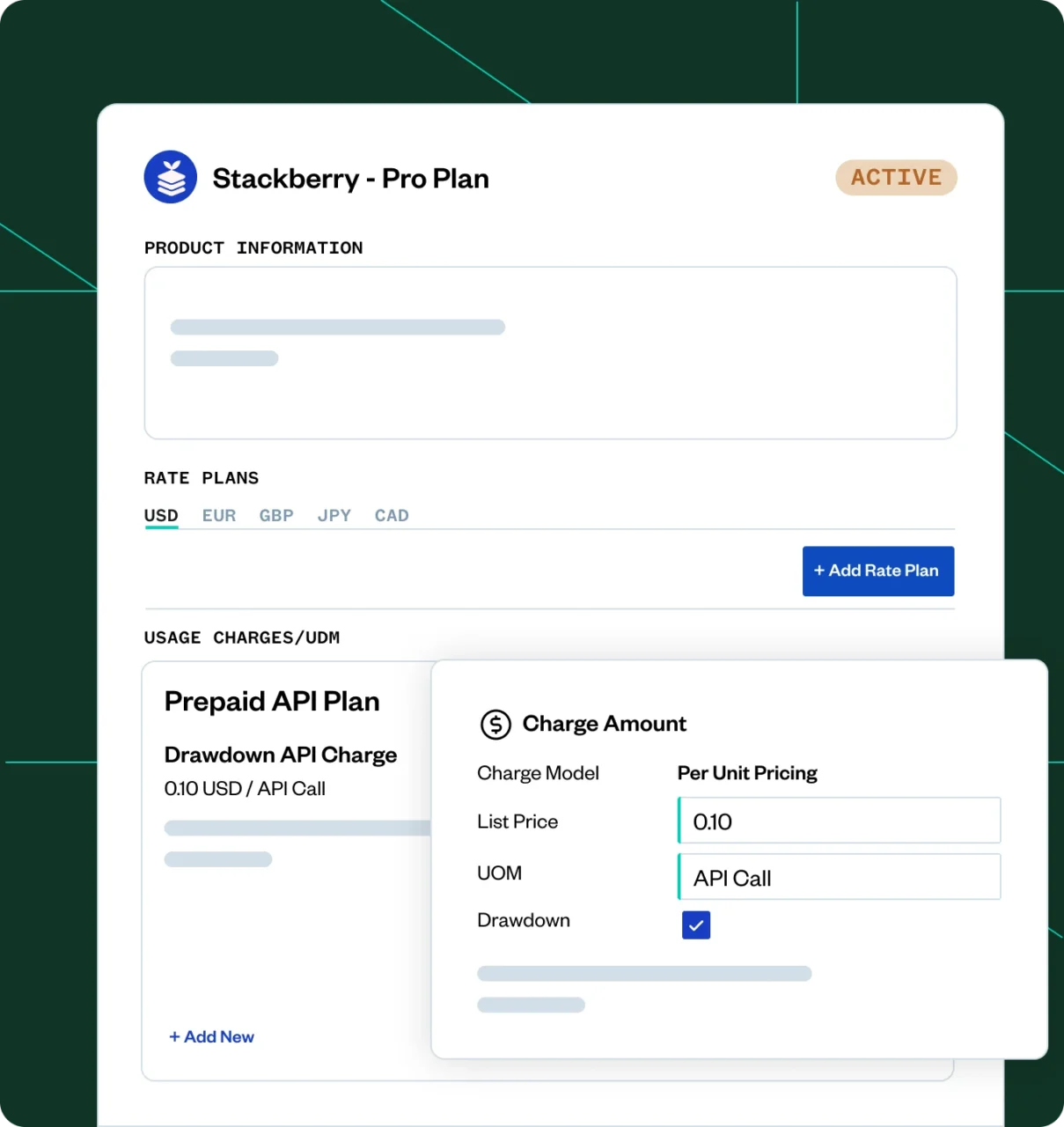

Step 2 of Quote-to-Cash process — Usage tracking and billing

Track usage in real time and bill with precision

With Zuora’s usage engine, you track consumption in near real time and transform it into usage-based charges. Support for modes like tiered, prepaid, overage, and high-water mark models means you can bill accurately no matter how your customers consume. Usage data automatically feeds into billing, ensuring your invoices are precise and reflective of actual behavior.

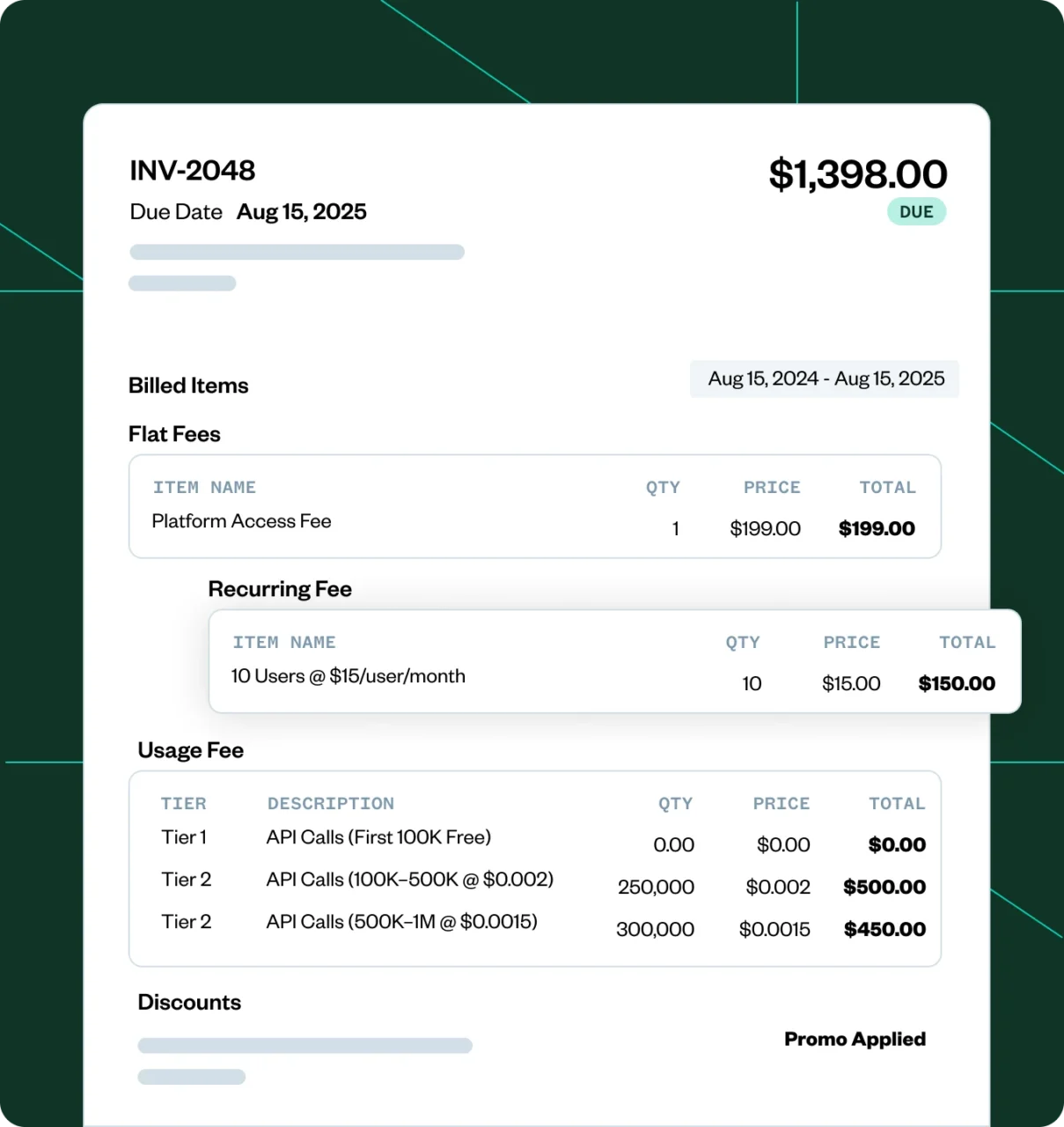

Step 3 of the Quote-to-Cash process — automated billing and invoicing

Automate invoicing across any pricing model — one-time, recurring, or usage-Based

Zuora Billing brings together one-time, recurring, and usage-based charges across your product catalog with full support for flexible pricing, nuanced rating, and tax compliance. Billing runs and invoice deliverables are fully automated, reducing manual work while offering full visibility into the details behind every customer invoice.

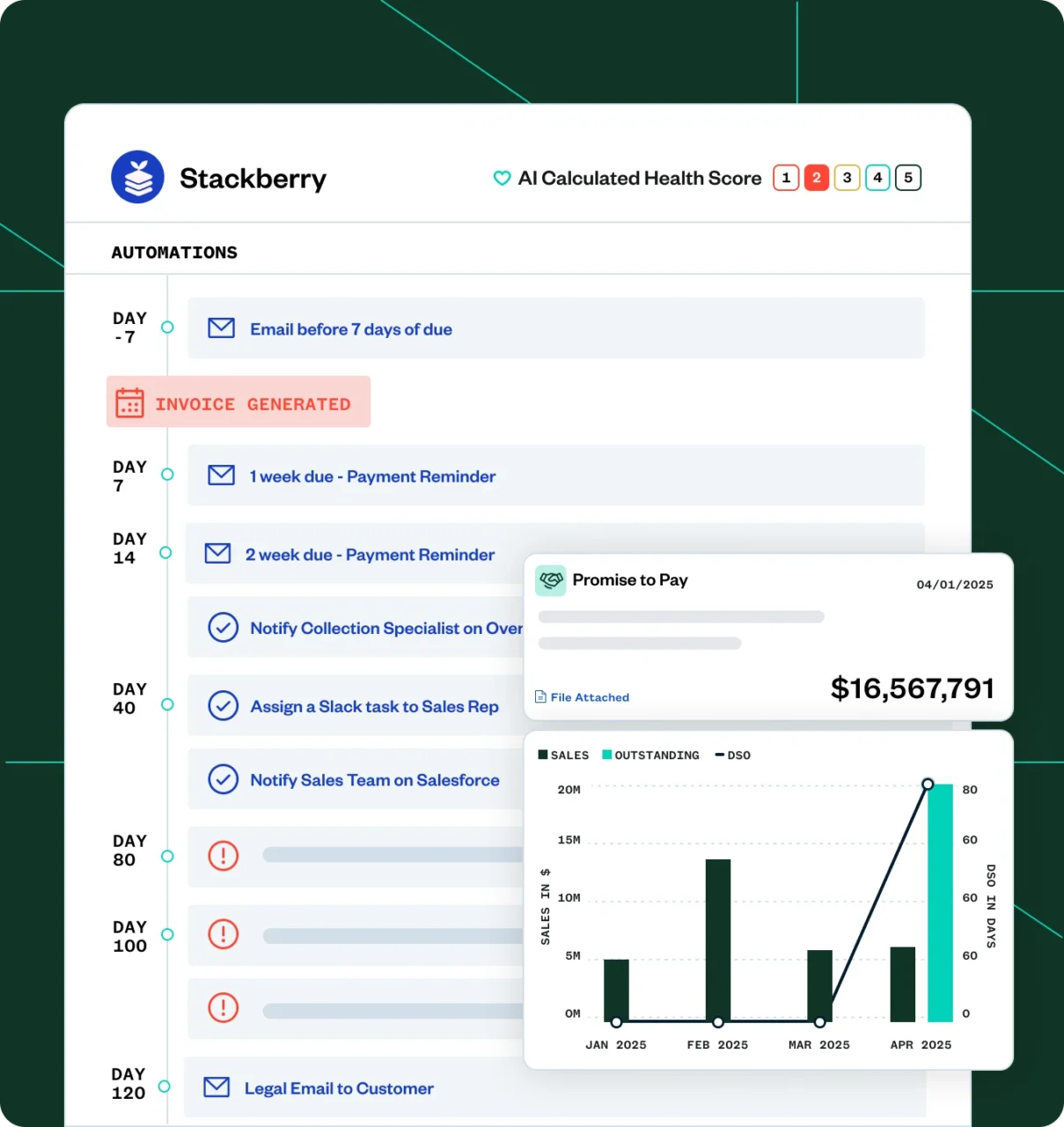

Step 4 of Quote-to-Cash process —

collections automation and cash forecasting

Automate collections and predict cash flow with Ai-powered precision

Zuora Collections uses AI-driven forecasting and intelligent workflows to predict cash flow, and recover more revenue. Smart routing and payment reminders reduce churn risk and accelerate collections. Finance teams gain predictive insight into outstanding balances — replacing manual tracking with data-driven accuracy and complete cash flow visibility.

Step 5 of the Quote-to-Cash process —

automated revenue recognition and

audit-ready reporting

Automate revenue recognition and stay audit-ready in real time

Zuora Revenue automates complex revenue recognition and compliance, generating clear, drillable schedules in real time. Data from billing, usage, and collections flows directly into one finance-grade system, ensuring accuracy across ASC 606 and IFRS 15 standards. Accounting teams gain continuous visibility into recognized and deferred revenue — delivering audit-ready reports without manual reconciliation or delays.

Why leading enterprises choose Zuora

End-to-End Q2C, Not Just RevRec: Zuora connects quoting, billing, collections, and revenue recognition in one platform — automating every upstream process for complete revenue visibility.

Purpose-Built for Hybrid Monetization: Manage any pricing model — usage-based, subscription, one-time, or bundled — in a single finance-grade system built for flexibility and scale.

10x Efficiency for Lean Finance Teams: Automate the busywork and remove reconciliation cycles.

Audit-Ready by Default: Zuora Revenue ensures compliance with ASC 606 and IFRS 15 standards — no public company using Zuora has failed a revenue audit.

After outgrowing spreadsheets, Zoom adopted Zuora as their order-to-cash platform in 2015, before raising Series C. Zoom continues to run their multi-billion dollar business on Zuora today.

Gainsight shortened their monthly close by 30%, halved their audit time, and freed up their finance team to focus on strategy and innovation—all thanks to Zuora Revenue automating recognition and auditing processes.

It’s reassuring to know that with Zuora we can continue to scale our business to meet the needs of our growing global customer base.

Lauren Feeney, Financial Controller, Secureframe

After adopting Zuora, Nutanix created a unified quote-to-revenue process with flexible billing configurations that supported rapid product launches and automated revenue reconciliation, reducing manual tasks and accelerating their close time.

Frequently Asked Questions About Zuora’s Quote-to-Cash Platform

What is Zuora’s Quote-to-Cash solution?

Zuora’s Quote-to-Cash (Q2C) platform connects every step of your revenue process — from quoting and billing to collections and revenue recognition. It automates manual finance tasks, accelerates cash flow, and ensures compliance across your entire revenue lifecycle.

How does Zuora automate the Quote-to-Cash process?

Zuora unifies your front and back-office systems, integrating with CRMs, ERPs, and payment gateways. It automates quoting, usage tracking, invoicing, collections, and revenue recognition so finance teams can manage the entire process in one connected platform.

Can Zuora integrate with systems like Salesforce, SAP, or NetSuite?

Yes. Zuora offers native integrations with leading ERP and CRM systems, including Salesforce, SAP, Workday, and NetSuite. These integrations keep order, billing, and revenue data synchronized across departments in real time.

How does Zuora’s Quote-to-Cash help ensure compliance and audit readiness?

Zuora Revenue automates compliance with ASC 606 and IFRS 15 standards, generating real-time, drillable revenue schedules. No Zuora public company has ever failed a revenue audit — making audit readiness the default, not an afterthought.

What makes Zuora’s Quote-to-Cash software different from other platforms?

Unlike point solutions that handle only billing or collections, Zuora delivers a finance-first, end-to-end automation platform. It eliminates system silos, improves data accuracy, and gives enterprises real-time visibility from quote to revenue — all within one secure ecosystem.

How quickly can finance teams see results after implementing Zuora?

Most enterprises see measurable results within the first quarter — including faster invoice cycles, reduced reconciliation time, and improved forecasting accuracy. With full automation, finance teams can close books faster and shift focus from manual processing to growth strategy.

Can Zuora Quote-to-Cash software handle contract amendments and upgrades mid-term?

Yes, Zuora’s Quote to Cash solution can handle amendments, upsells, renewals, and downgrades are managed natively, and adjustments automatically propagate through billing and revenue recognition.