Guides / Usage-Based Pricing is Breaking Your Back Office: Here’s How to Fix It

Usage-Based Pricing is Breaking Your Back Office: Here’s How to Fix It

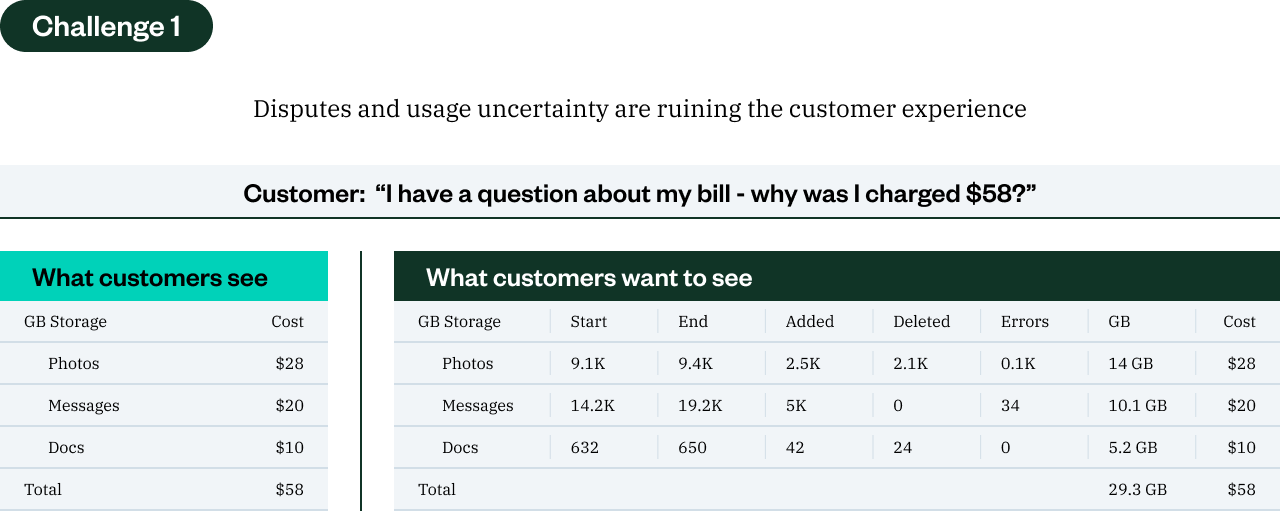

Usage-based pricing is now a strategic imperative, but it’s breaking legacy finance systems. As companies shift to AI-driven, consumption-based, and hybrid models, finance teams face increased operational burden, from billing disputes to reconciliation chaos. In this article, we break down the top challenges—visibility, scalability, and reconciliation—and share best practices for modernizing your quote-to-cash systems so you can support GTM innovation without putting revenue at risk.

For most SaaS companies, usage-based pricing is no longer experimental or optional. More and more, it’s becoming an essential component of modern monetization strategies. From AI-driven services like agentic AI to SaaS and digital platforms, businesses are adopting usage and outcome-based models to stay competitive, drive adoption, and align revenue with customer value.

But while go-to-market teams race ahead with innovative pricing—think token-based AI, prepaid drawdowns, and rollover credits—finance teams are left picking up the operational slack. Most legacy systems simply weren’t built for this level of complexity.

In Zuora’s latest survey of global finance and accounting leaders, 71% of SaaS finance leaders reported breakdowns or major challenges when trying to support usage-based pricing. Nearly all cited forecasting, reconciliation, and compliance risks as top concerns.

These aren’t fringe use cases. They’re strategic imperatives. And they’re putting pressure on finance teams to modernize the quote-to-cash process not just to survive, but to lead.

From visibility gaps to reconciliation struggles, Zuora teamed up with PwC to explore the top challenges and best practices for finance leaders on the leading edge of maximizing the impact usage-based models.

Key takeaways

- Visibility is non-negotiable: Real-time usage data enables accurate billing, dispute prevention, and forecasting.

- Scalability demands alignment and agility: GTM, product, and finance must collaborate to operationalize new pricing models.

- Automation is the only path to efficiency: Manual reconciliation can’t scale. Modern platforms are absolutely essential.

Getting the Lay of the Land

When Gillian joined Vimeo, she encountered challenges that are all too familiar to finance leaders:

- Manual reconciliations and reporting delays. Instead of surfacing insights for the business, finance was often bogged down in spreadsheets and reactive firefighting.

- Inefficiencies in the O2C process. Billing delays, revenue leakage, and the inability to model complex pricing limited finance’s ability to support growth.

- A strategy gap. While the CEO and board expected finance to play a more forward-looking role, legacy systems were holding the team back.

“Too often, finance leaders get pulled into fixing broken systems,” Gillian says. “That distracts us from telling the story in the numbers and shaping the business.”

The frustration wasn’t about a lack of ambition. Finance had a mandate to drive strategy, but the tools in place couldn’t keep up. Manual work drained time and morale, while siloed systems prevented Vimeo’s team from seeing across the entire customer lifecycle.

Best practices:

- Implement real-time metering: Metering platforms bridge the gap between product usage and billing systems, turning raw data into billable metrics.

- Adopt a unified data model: Ensure engineering, deal desk, billing ops, and rev rec teams all see the same information.

- Enable audit trails: Every usage event should be traceable — who used it, when, and how it was priced.

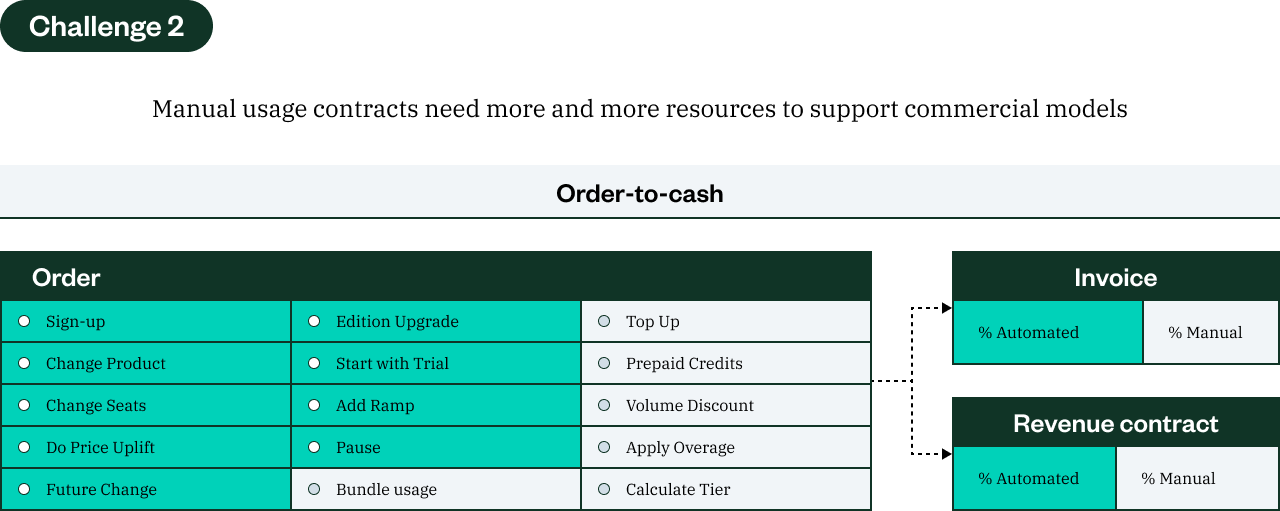

Challenge 2: Supporting complex commercial models and scaling monetization

Usage isn’t just a billing model; it’s a gateway to entirely new business models, especially as AI products accelerate the shift toward outcome-based metrics and pricing and hybrid revenue models. But there’s a paradox — while these models offer the greater flexibility and value that customers are looking for (and thus, increase the opportunity for upsell and expansion), they can also be costly, creating a tremendous amount of downstream work for finance teams. As it is, 82% of SaaS finance and accounting leaders are struggling with the additional operational burden introduced by mixed revenue models. And a staggering 97% report that their order-to-cash technology is unable to handle new, more complex pricing models.

These new monetization structures — top-ups, prepaid drawdowns, post-period true-ups, and bundled usage — often bypass standard billing and revenue flows. This can lead to ad hoc quoting, manual billing schedules, and revenue accounting headaches. We’ve seen that 68% of finance leaders say they are regularly forced to reject non-standard deals due to breakdowns in their O2C processes. Without the right tools, finance teams are pulled into every deal just to make sure the contract is even billable and compliant.

“Usage represents a variety of ways to monetize a different grain of your transactional events,” says Crowell. “Many organizations will start with a simplistic model, but quickly find there is a lot of innovation — by product, by geo, by customer segment.”

Best practices:

- Partner early with GTM teams: Finance needs a seat at the table when new pricing models are being defined to ensure operational viability.

- Design usage-aware quoting systems: A CPQ system that understands usage tiers, drawdowns, and overages helps reduce manual intervention.

- Automate revenue recognition: Configure your revenue system to support dynamic models while maintaining ASC 606 compliance.

It’s not just about enabling the front office, it’s about ensuring the back office is enabled to support what needs to happen in the front office.

— David Crowell

Partner, PwC

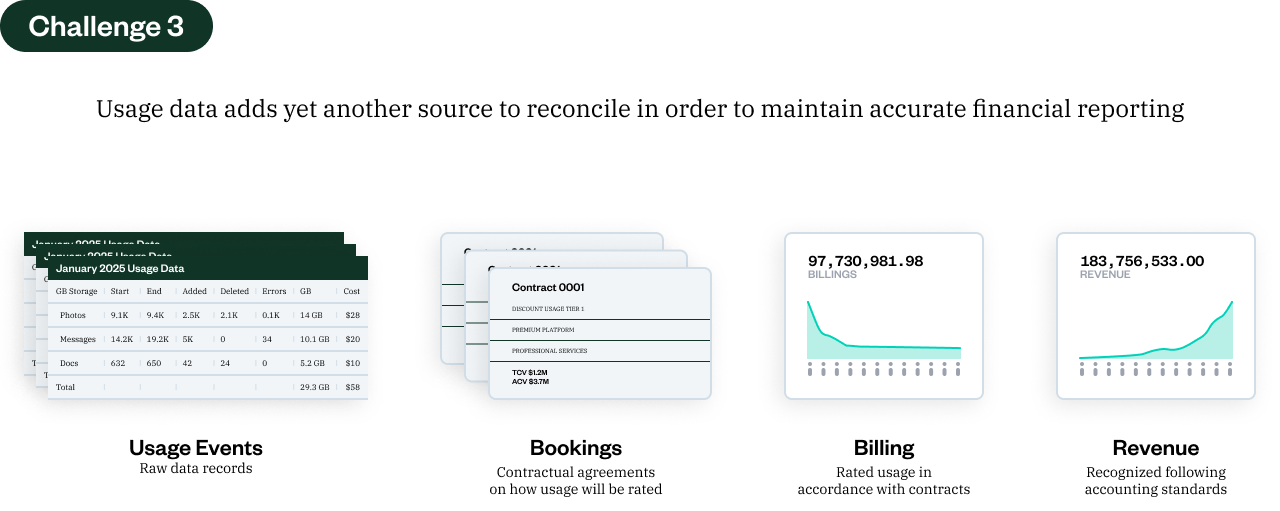

Challenge 3: Reconciliation across disconnected systems

One of the most acute pain points with usage-based pricing is reconciliation. Often, the data that determines revenue timing and billing is scattered across systems: CRM, CPQ, custom logs, billing tools, spreadsheets, and ERP systems.

“Having platforms that support ingestion of high-volume data from multiple sources, with security and timeliness is critical,” notes Crowell. “It enables back-office processes to run with automation and reduces the need for manual journal entries.” Without a unified quote-to-revenue data model, finance teams are left reconciling usage against contracts, usage against invoices, and invoices against revenue schedules—all while racing to close the books. In fact, in a recent survey, nearly every (95%) finance and accounting leader in SaaS identified technology gaps as a barrier to order-to-cash success within their organization.

Many usage models, particularly prepaid or rollover-based, also introduce complications when it comes to determining when performance obligations are satisfied. For example, depending on a company’s particular revenue policies, a prepaid model would require an accounting team to validate the billed usage versus the actual delivery of the service (when the usage was consumed) in order to reconcile rev rec timing. This often requires accrual assumptions, and revenue true-ups that are hard to manage when data is spread across different systems.

“These models may be complex,” Crowell notes, “but they’re tameable with the right strategies and systems in place.”

Best practices:

- Establish a unified system for unified data: All of your systems across order-to-cash, including your CPQ, product catalog, billing system, invoicing, and revenue system, all need to speak the same language, ensuring consistent end-to-end data.

- Build verifiable usage pipelines: Tag each usage event with relevant contract metadata (e.g., product SKU, pricing tier, account ID).

- Ensure finance is involved in product and pricing design: Bringing in finance and accounting teams into pricing discussions earlier helps ensure alignment to policies and helps avoid downstream disruptions.

- Support unbilled usage and usage-based revenue recognition: Tools that track usage before it’s billed help revenue teams stay compliant with ASC 606.

- Automate your revenue subledger: Link usage data to performance obligations and automate recognition rules to reduce reliance on manual true-ups.

Having platforms that support ingestion of high-volume data from multiple sources, with security and timeliness is critical. It enables back-office processes to run with automation and reduces the need for manual journal entries.

— David Crowell

Partner, PwC

Frequently asked questions

1. Why is usage-based pricing creating problems for finance teams?

Because legacy finance systems were built for predictable, recurring models, not dynamic, granular usage. As usage data explodes, it’s hard to track, bill, and recognize revenue accurately across disconnected systems.

2. What’s the biggest risk of not updating finance systems to handle usage?

Revenue leakage, delayed closes, customer disputes, and compliance risk. Without visibility and automation, finance teams become overwhelmed by manual work and can’t scale operations.

3. How can finance teams gain visibility into usage data?

By implementing real-time metering platforms, unifying data models across teams, and ensuring audit trails connect usage to billing and revenue recognition.

4. How does usage monetization impact revenue recognition and ASC 606 compliance?

Usage often affects when performance obligations are satisfied. Without aligned systems, finance must manually validate timing, increasing risk of misstatements or compliance issues.

5. What’s the role of finance in enabling new pricing models?

In short: strategic. Finance should partner early with GTM and product teams to ensure operational viability and build flexible systems that can support innovation without breaking compliance.

Support GTM innovation without breaking the back office

Usage-based pricing is transforming how companies grow, but only if finance teams have the tools to support it. From real-time visibility to automated revenue recognition, modernizing the order-to-cash process is no longer optional.

Finance teams can’t afford to be reactive. The right systems and strategies will turn usage complexity into a competitive advantage and elevate finance from back-office operator to strategic enabler.

Want to go deeper?

Watch the full webinar, featuring David Crowell from PwC and Katherine Shealy from Zuora, to explore these topics in more detail and hear what real finance leaders are doing to adapt.