Guides / The CFO’s Guide to Building a Usage-Ready Quote-to-Revenue Engine

The CFO’s Guide to Building a Usage-Ready Quote-to-Revenue Engine

New research shows that usage-based pricing introduces significant operational and financial complexity for SaaS companies, especially when usage data, billing, and revenue processes are fragmented across systems. Finance leaders can overcome these risks by owning the full quote-to-revenue lifecycle and unifying it on a single, purpose-built platform.

If you’re a finance leader in SaaS, you’ve probably been here: The product team is excited about launching a new usage-based feature that will “unlock massive growth potential.” Sales is pushing for more flexible pricing to close that enterprise deal. Marketing is touting consumption models as the future of SaaS monetization (with good reason). Meanwhile, you’re looking at your existing systems and wondering: How exactly are we going to make this work without creating a billing and rev rec nightmare?

If this scenario sounds familiar, you’re not alone. According to recent industry research, 94% of senior SaaS finance leaders report their systems can’t support the complex pricing models the business requires. More concerning? A whopping 71% report breakdowns or major operational struggles when implementing usage pricing, and almost all (95%) say usage pricing makes forecasting significantly harder.

The truth is, while usage-based pricing can be a powerful growth engine—aligning price with value, accelerating customer acquisition, and providing flexibility to serve diverse customer segments—it also introduces operational complexity that can quickly spiral out of control if finance doesn’t take ownership of the entire order-to-cash process.

Key Takeaways

- Fragmented systems create revenue and compliance risks: When usage data, pricing logic, and billing are managed in disconnected systems or by different departments, errors and inconsistencies become inevitable. This fragmentation leads to revenue leakage, billing disputes, and compliance headaches; problems that are amplified in recurring revenue models.

- Finance must have visibility into the entire usage data flow: To mitigate these risks and enable strategic growth, finance leaders need to take ownership of the entire quote-to-revenue process. This means defining and standardizing usage metrics, ensuring pricing logic flows seamlessly from sales to billing to revenue recognition, and validating data at every step.

- A single, usage-aware platform is the way forward: A single, usage-aware platform is the way forward: Finance teams need more than point tools; they need an end-to-end system of record that unifies quoting, billing, collections, and revenue recognition. This eliminates manual handoffs, reduces headcount pressure, and enables accurate, audit-ready reporting from quote to cash.

The Hidden Cost of Fragmented Systems

Here’s what typically happens: Your company starts with a traditional SaaS stack. You have a CRM for pipeline management, CPQ for quotes, a billing system for subscriptions, and perhaps a separate tool for revenue recognition. It works fine for seat-based or tiered pricing. But then usage pricing enters the picture, and suddenly you’re playing a dangerous game of data telephone.

The engineering team builds usage tracking into the product. The billing team tries to figure out how to translate that usage into invoices. Revenue recognition scrambles to apply ASC 606 to variable consumption patterns. Meanwhile, you’re getting questions from the board about forecasting accuracy while sitting on incomplete, inconsistent data that takes weeks to reconcile.

Revenue leakage becomes inevitable. And unfortunately, SaaS businesses are particularly vulnerable because recurring revenue models amplify the effects of any billing errors because they repeat monthly per customer.

When you add usage complexity to the mix, manual billing and invoicing errors, as well as untracked usage on consumption-based models, often become two of the primary sources of revenue loss. The absence of an integrated quote-to-revenue platform will likely force finance and accounting teams to rely on manual reconciliation and patchwork fixes, an approach that simply doesn’t scale.

In fact, research shows that 92% of SaaS finance leaders say their current order-to-cash (O2C) tech stack hinders them from playing a more strategic role in the business. Instead of driving growth strategy, finance teams are stuck firefighting billing discrepancies and manually reconciling spreadsheets.

How Usage Pricing and Custom Deals Can Break the System

While custom deals are necessary and common in B2B SaaS, they often break the traditional quote-to-revenue workflow. Here’s how things can begin to fall apart:

- A sales rep generates a quote (often through CPQ or manually) that lacks financial context, like accounting policy alignment or detailed contract terms.

- An order entry team then manually interprets the quote to create a sales order. This involves defining billing timing and frequency, aligning quoted items to actual catalog products, and configuring ramped components or tiered schedules.

- Finally, the revenue accounting team steps in to manually review contract language, sales orders, and billing data to define performance obligations, determine delivery timing, and apply the correct revenue recognition rules.

Every non-standard contract must pass through this multistep, manual process. And while it’s not uncommon, it isn’t scalable and opens you up to risk and additional costs. Without automation or a unified platform, the risk of errors, delays, and compliance issues skyrockets.

Why Usage Data Visibility is Critical for Finance

The fundamental problem is both technical and organizational. Quote-to-cash process and systems are typically not “owned” by a single division or department, which creates gaps in accountability, integration, and oversight. But finance leaders have a unique vantage point that puts them in the best position to bridge these gaps.

CFOs and Chief Accounting Officers (CAOs) have visibility into every stage of the quote-to-revenue lifecycle: from contract terms to system provisioning, usage events, billing, revenue recognition, and forecasting. That end-to-end visibility means you can identify revenue leakage, spot compliance risks, and ensure pricing logic flows consistently from quote all the way through to cash.

But visibility isn’t enough. You need accurate data you can actually trust.

Without a unified platform, you’ll always be reconciling between systems, departments, and versions of the truth. With an end-to-end solution, finance and accounting speak the same language, work from the same numbers, and close the books without the usual fire drills. Trusting your data isn’t a luxury, it’s the foundation for confident decisions and strategic growth.

The Real-World Impact of Lost Control

Consider these scenarios other finance leaders in SaaS are facing:

Scenario 1: The Custom Pricing Trap

Sales closes a major deal with custom pooled usage pricing, but the logic lives in their spreadsheet, not the billing or order-to-cash solution. When the customer gets invoiced, the numbers don’t match their expectations. The CFO gets an angry call, the Controller scrambles to issue credits, and customer trust erodes.

Even sophisticated SaaS companies can fall into this custom pricing trap. Cloud-based data storage platform Snowflake frequently closes enterprise deals that include custom usage commitments and negotiated rates. While we don’t know all the details, customers have reported receiving invoices that don’t match their expectations or contract terms.

This can happen when the agreed-upon pricing structure is not fully integrated into the order-to-cash system, resulting in disputes and the need for manual credits or adjustments.

Scenario 2: The Data Disconnect

Product launches a cutting-edge usage-based feature to stay competitive in the market. Engineering ships telemetry for the new offering, but the usage events are now siloed into data warehouses, in formats that billing or O2C teams can’t use, and the logic to meter that usage is buried in engineering code. The result? The billing system misses half the charges, revenue recognition flags discrepancies, and you’re explaining variance to auditors. Or, you’re increasing audit scope by being forced to bring loop in the developers who built the custom billing and accounting logic and/or integrations into your accounting system.

In recent years, Stripe customers have publicly reported issues where usage data sent from their product was delayed, incomplete, or not properly ingested by Stripe’s billing engine. This led to customers not being billed for usage in the correct billing cycle, causing cash flow and reconciliation headaches for finance teams. Not only that, incomplete or delayed data could mean finance can’t recognize revenue in the proper period, complicating ASC 606 compliance.

Scenario 3: The Forecasting Black Box

The board wants projections for next quarter’s usage revenue. But you can’t access real-time consumption data, pricing rules live in multiple systems, and there’s no consistent method for aggregating usage patterns. You end up making educated guesses based on historical trends that may not reflect current customer behavior.

Databricks customers, for example, frequently report that costs can quickly spiral out of control when they can’t predict usage patterns. The platform’s complex DBU (Databricks Unit) pricing creates forecasting challenges because costs fluctuate based on workload type, instance size, and cloud provider pricing. Companies struggle with understanding whether workloads are compute-intensive, data-heavy, or require burst capacity. In the end, this can also negatively impact the customer experience by limiting usage visibility and damaging trust.

These aren’t hypothetical problems. They’re operational realities that finance teams face when usage data flows through fragmented systems without clear ownership.

Pricing flexibility has become a competitive differentiator, especially in rapidly evolving markets like AI. If you’re doing pricing the old way through spreadsheets, it will take months to get to the market and you’ll be left behind.

— Sid Sanghvi

Head of Finance Business Applications, Asana

Building a Usage-Aware Quote-to-Revenue Architecture

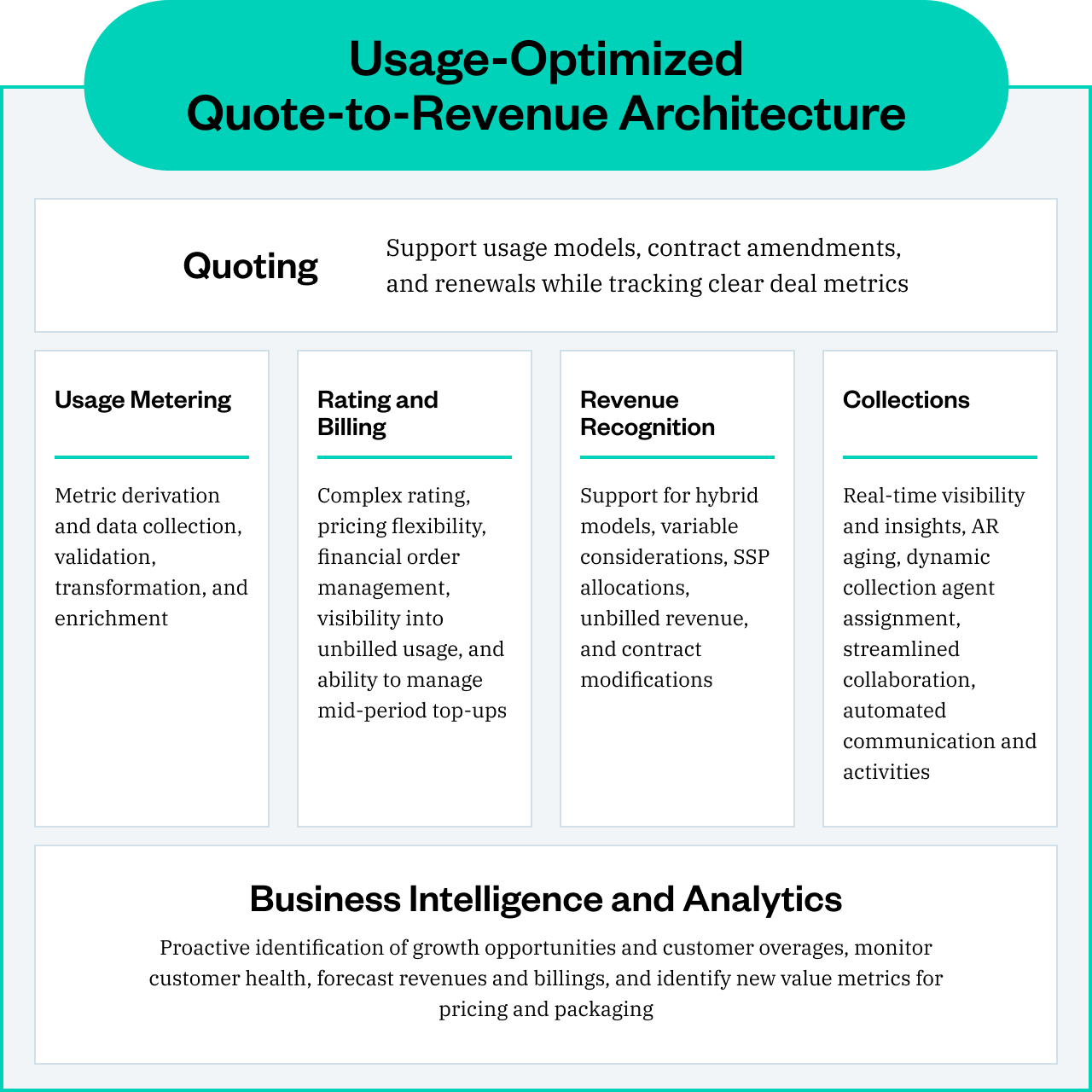

The best way to reduce errors and accelerate monetization is by streamlining the quote-to-revenue process with finance at the center. Modern CFOs need a unified platform that can:

- Accurately model complex pricing during quoting, including tiers, thresholds, and drawdowns

- Seamlessly flow pricing logic from CPQ to billing to revenue recognition

Ingest and validate usage data in real-time at the source - Apply consistent rating logic across billing and revenue systems

- Automate billing, collections, revenue recognition, and compliance workflows

- Provide end-to-end audit trails from usage event to journal entry

- Power real-time forecasting with current consumption trends

The key is integration, not just functionality. Each component must share the same pricing rules, data definitions, and business logic. When sales quotes a usage tier, that same logic should automatically flow to billing engines and revenue recognition systems without manual translation or re-entry.

Forecasting in the Age of Variable Revenue

Let’s address the elephant in the room: forecasting becomes significantly harder with usage-based models. Unlike subscription revenue that provides predictable monthly income, usage revenue fluctuates based on actual customer consumption patterns.

The challenge is timing mismatches. With usage-based pricing, invoices are typically raised after a customer’s consumption period. However, as a SaaS business, you still incur infrastructure and operational costs upfront. This creates cash flow complexity that traditional subscription models don’t face.

Effective usage forecasting requires:

- Customer segmentation based on consumption patterns and usage maturity

- Seasonal adjustments for industries with cyclical demand

- Cohort analysis to understand how usage evolves over the customer lifecycle

- Scenario modeling for unexpected spikes or dips in consumption

- Real-time monitoring to identify trends before they impact quarterly results

Usage forecasting can’t rely on disconnected spreadsheets or delayed data. With a unified, usage-aware system, finance teams gain real-time insights into consumption trends, enabling them to model, predict, and explain revenue with confidence at the board level.

Revenue Recognition Without the Headaches

Usage-based pricing doesn’t just complicate billing—it creates new challenges for ASC 606 compliance. Variable pricing can complicate revenue timing, especially when usage must be estimated, adjusted retroactively, or split across performance obligations.

There are typically two approaches to revenue recognition for usage-based pricing:

- Recognize revenue in the period that usage occurs (most common for pay-as-you-go models)

- Estimate total contract usage and recognize ratably across the contract term

Both approaches require sophisticated systems that can handle complex calculations, maintain detailed audit trails, and provide the documentation auditors require. Companies with usage-based pricing often have multiple IT systems involved in financial reporting, making this a focus area for Big Four auditors.

The key is automation. Manual processes that might work for simple subscription models quickly break down when dealing with variable usage patterns, multiple pricing tiers, and retroactive adjustments. With all billing, usage, and revenue logic centralized in one system, finance and accounting teams avoid conflicting reports and streamline audit prep, making ASC 606 compliance a built-in outcome, not a manual afterthought.

Practical Steps for Taking Control

So, where do you start? Based on conversations with finance leaders who’ve successfully navigated this transition, here’s a practical roadmap:

1. Audit Your Current State

Document exactly how usage data flows through your systems today. Where are the manual handoffs? What pricing logic lives in spreadsheets? Which teams own different parts of the process? Which processes aren’t scaling?

2. Define Ownership Boundaries

Make it clear that finance owns the pricing logic and data validation from quote to cash. Product can define usage metrics, but finance defines how those metrics translate to billable amounts.

3. Establish Data Standards

Create consistent definitions for usage events, pricing tiers, and customer segments. These definitions must be shared across all systems, with no exceptions.

4. Invest in Integration

Whether through a unified platform or carefully orchestrated APIs, ensure that pricing logic flows seamlessly from CPQ through billing to revenue recognition without manual intervention.

5. Build Monitoring Capabilities

Implement real-time dashboards that track usage patterns, billing accuracy, and revenue recognition status. This way, your team can spot problems before they become customer issues.

If you’re dealing with changes on the billing side — usage, consumption, whatever it might be — it’s key to keep SOX and financial statements front and center. If you don’t have it right, eventually the CFO’s going to come and ask, ‘Isn’t this going to be a problem?’ and then you have to rework everything.

— Jane Koltsova

Senior Director, Global Revenue Controller, Formerly of PagerDuty

The Strategic Opportunity

Here’s the thing, while usage-based pricing creates operational complexity, it also creates a strategic opportunity if finance has complete, end-to-end data visibility and operates from a trusted, unified platform. Finance teams that successfully manage usage complexity don’t just avoid problems—they become business enablers.

When you have real-time visibility into customer usage patterns, you can:

- Identify expansion opportunities before sales teams

- Predict churn risks based on declining usage trends

- Optimize pricing strategies with actual consumption data

- Support product decisions with usage analytics

- Provide accurate board reporting on customer health and revenue predictability

Modern monetization isn’t just about pricing models, it’s about operational readiness. The finance teams that win are those who build usage-aware infrastructure before complexity hits critical mass.

Frequently Asked Questions

1. Why does usage-based pricing create so many operational challenges for finance teams?

Usage-based pricing introduces variable revenue streams, complex billing logic, and the need for real-time usage data, all of which strain traditional quote-to-cash systems that were built for predictable, seat-based models. Without tight integration and clear ownership, this complexity leads to errors, revenue leakage, and compliance risks.

2. What are the most common sources of revenue leakage in usage-based SaaS models?

The primary culprits are fragmented systems, manual data handoffs, untracked or delayed usage events, and misaligned pricing logic between sales, product, and finance. These gaps often result in missed or incorrect invoices, credits, and customer disputes.

3. How can finance leaders gain control over the usage data flow?

Finance should own the entire quote-to-revenue process by standardizing usage definitions, integrating pricing logic across all systems, and implementing real-time monitoring and validation. This ensures accuracy in billing, revenue recognition, and forecasting.

4. What are the best practices for forecasting revenue in a usage-based pricing environment?

Successful finance teams segment customers by usage patterns, use cohort and scenario analysis, monitor real-time consumption, and continuously refine their models based on actual data. Investing in integrated systems that provide real-time visibility is critical for reliable forecasting.

5. What steps should we take if our current systems can’t handle usage-based billing complexity?

Start with a comprehensive audit of your current data and process flows, define clear ownership for pricing logic and data validation, establish consistent data standards across order-to-cash, and invest in integration—either through a unified platform or robust APIs—to automate and monitor the entire quote-to-revenue lifecycle

Own the System, Own the Strategy

Usage pricing isn’t going away, it’s accelerating. But the companies that succeed won’t just be the ones with the most creative pricing models. They’ll be the ones whose finance teams can scale it, secure it, and explain it.

If your team is feeling the pain of usage-based complexity, it’s not just a process problem, it’s a system problem. Replacing patchwork point tools with a unified quote-to-revenue platform is how finance leaders regain control, reduce risk, and scale with confidence.

Learn how you can unify your order-to-cash on a single platform.

Zuora’s ability to seamlessly blend seat-based and consumption-based billing models, alongside complex multi-year ramps and diverse global payment methods, is truly essential. It’s purpose-built for the complexities of a modern subscription business, giving us the technical capability to monetize our innovations at speed.

— Sid Sanghvi

Head of Finance Business Applications, Asana