The report below only captures the month of March, for the latest data please go here

The worldwide spread of coronavirus (COVID-19) has had a quick and damaging effect on the global economy. However, amongst operational disruptions, supply chain restrictions, and a global recession, subscription businesses are proving to be resilient. In an analysis of hundreds of subscription-based companies, half have not seen an impact on their subscriber growth, while one quarter are actually seeing subscriber acquisition rates accelerate even faster than before. And, of the remaining companies who are seeing their growth slow, half of those are still growing.

For the past three years, Zuora has published The Subscription Economy Index™ (SEI), a report on the collective health of the Subscription Economy, developed by Zuora’s Chief Data Scientist and widely cited by publications such as Business Insider, Barron’s and CNBC. The SEI has found that subscription revenue grew by more than 350% for the past seven and a half years as recurring revenue-based business models exploded due to digitally enabled, pay-as-you-go services. In fact, the SEI consistently showed subscription revenues to grow 5x faster than S&P 500 Industry benchmarks.

Product ownership is now seen as a thing of the past. What we’re witnessing is The End of Ownership as industry after industry sees their unit sales go down, and consumption of digital services go up. Successful companies today are focused on adapting to this rapid pace of change, deciding to focus on growing and monetizing a loyal customer base versus shipping more products.

While the SEI provides a long-term view to illustrate the sustained and predictable returns of recurring revenue models, this special Impact report focuses on the earliest trends of how COVID-19 has impacted subscriber acquisition rates (“subscription growth”) from March 1-31, 2020 compared to the previous 12 months (February 2019-February 2020).

For existing subscription businesses, the data shows that the recurring revenue built on the loyalty of their customers will help them weather this storm. For all other companies, there is more urgency than ever before to rediscover their customers, shift to subscriptions, and discover the power of the recurring revenue model.

Redpoint Ventures Partner Tomasz Tunguz said: “The Zuora team is ahead of the trends on in the Subscription Economy, and their analysis into COVID-19’s impact on it is largely consistent with our own analysis.” Download a PDF of the report here.

Or download specific industries versions of the report:

Media Subscription Impact Report: COVID-19 Edition

SaaS Subscription Impact Report: COVID-19 Edition

IoT Subscription Impact Report: COVID-19 Edition

Key Findings

Subscription companies prove their resilience.

Subscription companies prove their resilience.

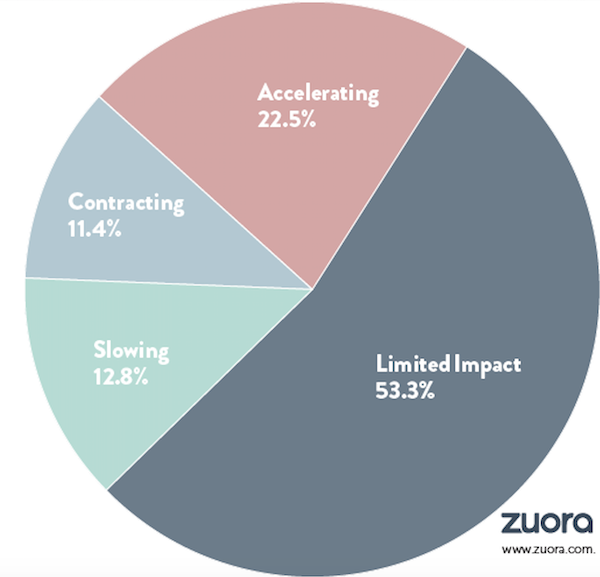

Overall, the COVID-19 Subscription Impact Report found that 53.3% of companies have not seen a significant impact to their subscriber acquisition rates. Meanwhile, 22.5% of companies are seeing their subscription growth rate accelerate, 12.8% of companies are seeing slowing growth, but are still growing, and the remaining 11.4% of companies are starting to see subscriber churn outpace their subscriber acquisition rates. Of the companies Accelerating, Slowing, and Contracting, we found trends across industries:

- Accelerating: OTT Video Streaming, Digital News & Media, E-Learning, Communications Software

- Limited Impact: B2B & B2C Software, Information Services

- Slowing: Consumer IoT, Business IoT Services, Software for Small Businesses, Memberships

- Contracting: Travel & Hospitality, Sports Related Services

The following industry analysis focuses on the < 50% of companies that are seeing an impact (acceleration, slowdown, contraction) and how these companies are responding. It does not include the industries seeing limited impact.

Accelerating: Companies in this segment saw an increase in growth rate by more than 25%.

- OTT Video Streaming

- The subscription growth rate for OTT Video Streaming companies grew 7x in March 2020 compared to the growth rate over the previous 12 months.

- As people shelter-at-home, streaming services for entertainment have seen a spike in subscription growth with a huge surge in new sign-ups. Many OTT Video Streaming services are offering an extended free trial period to make content available to a broader audience.

- Digital News & Media

- The subscription growth rate for Digital News and Media subscriptions grew 3x.

- With news changing day-by-day, there is an increase in demand for up-to-date information, resulting in sign-ups for digital news subscriptions. Many news websites are temporarily taking down their paywall to offer a subset of news for free.

- E-Learning

- The growth rate for E-Learning subscriptions grew 2.9x during this time period.

- With schools closed, parents and school districts are turning to new digital offerings to continue schoolwork and education.

- Telco & Utilities

- The subscription growth rate for Telco and Utilities grew 1.75x.

- With social distancing in place, consumers and businesses alike seek additional communication for their personal and professional lives. Telco & Utilities companies are seeing a surge in internet traffic and an increase in sign-ups for subscription offerings.

- Communications Software

- While software companies have seen a limited impact in general from COVID-19, the subscription growth rate for Communication Software grew 1.4x.

- With people working from home, SaaS offerings that allow remote teams to work together have seen a spike in subscription growth. These include video conferencing, document sharing, developer collaboration, and other communication tools.

As the COVID-19 crisis shifts consumer behavior and market demands, companies in the “accelerating” segment have had to quickly scale their systems to meet higher demands. Additionally, many companies began offering free trials or testing new acquisition tactics to capture a wider audience and draw the attention of new subscribers.

Slowing: Companies in this segment are still growing, but saw a slow down in growth rate by more than 25%.

- Business IoT Services

- Though the subscription growth in March 2020 was only half the rate compared to the previous 12 months, companies in the Business IoT services segment are still growing.

- With office buildings vacant, construction sites empty, and machinery work paused, business and industrial IoT services are seeing a decline in sign-ups and an increase in cancellations.

- Consumer IoT

- While Consumer IoT companies have a high baseline growth rate, their subscription growth in March 2020 was one-third of the rate compared to the previous year.

- Connected devices for consumers range from automobiles to home thermometers. With shelter-in-place orders issued around the world, consumers are not rushing to buy such services and these companies are seeing a decline in subscription sign-ups.

- Software for Small Businesses

- Software for Small Businesses continued to grow in March 2020, though the subscription growth for this segment was only half the rate compared to the previous 12 months.

- As small businesses such as restaurants, salons, dentist offices, and others struggled to stay open, software offerings that cater to those companies are also seeing a halt in sign-ups and an increase in cancellations.

- Memberships

- While the subscription growth rate of Membership subscriptions in March was two-thirds the growth rate of the previous 12 months, companies in this segment continued to grow.

- With shelter-in-place orders issued and businesses reduced to essential services, consumers are canceling their memberships for gyms, clubs, classes, and various lifestyle subscriptions.

While the growth rate of companies in this segment has “slowed”, these companies are still growing. To adjust to COVID-19, they are focused on retaining existing customers by quickly sending out customer communications and offering adjustments, such as temporarily pausing a subscription or issuing credits, for subscribers most impacted.

Contracting: Companies in this segment saw a slow down in growth rate by more than 25% and had a contraction in subscriptions in March 2020.

- Travel & Hospitality

- The subscription growth rate for services related to Travel and Hospitality fell meaningfully in March 2020 compared to the growth rate in the previous 12 months.

- With travel paused, subscriptions such as hotel memberships and flight-related services are seeing a halt in sign-ups and an increase in churn. Luxury services such as non-commercial flights have seen less impact.

- Sports Related Services

- With professional and amateur sports leagues paused around the world, COVID-19 has impacted companies tied to sports events, such as OTT sports streaming services. These companies are seeing a large decline in sign-ups and are challenged to retain customers.

While “contracting” companies are impacted by COVID-19 and not signing on new subscribers right now, they still have a large existing subscriber base. With a hyperfocus on renewing existing customers, these subscription companies have a better chance of maintaining the recurring revenue base they already have today.

Business Response

As the COVID-19 crisis continues to affect the economy, subscription businesses prove their resilience in this recession by focusing on a set of strategies to retain existing subscribers and grow customer lifetime value (LTV). Unlike product-focused companies, subscription-based companies are able to quickly adjust for the current climate to retain customers.

In working closely with Zuora customers and the wider subscription community, four common subscription business responses have emerged:

1. Subscription companies are able to focus on optimizing for long-term customer lifetime value.

Subscription businesses are inherently more flexible than traditional product centric business models that are dependent on new, one-time sales. With a subscription business model, companies maximize for long-term customers rather than immediate cash to create a predictable revenue stream. Given the COVID-19 economic impact on various industries, a number of subscription companies have seen a spike of subscribers who cannot pay on time, which results in the need for large volumes of adjustments, credits, and refunds. Instead of focusing on maximizing cash to keep the business afloat during these uncertain times, subscription businesses can focus on retaining their customers past this pandemic and maximizing customer lifetime value.

EXAMPLE Given the struggles that restaurants are facing, a company that provides software for restaurant reservations issued full credit memos for its customers in the month of March. While the company will not collect against any invoices for the month, they are using an act of goodwill to build trust and loyalty with subscribers.

2. Companies that provide the option to pause subscriptions build trust and reduce overall churn.

As the COVID-19 pandemic rippled through many countries, many companies saw an increase of customer requests to suspend subscriptions.

Our research shows that companies that offer customers the flexibility to change their subscriptions see a significantly lower churn rate (<20% churn rate) compared to companies that do not offer that option (>30% churn rate). Our research also tells us that companies that offer customers the option to suspend and resume their subscription services have a 5% lower annual churn rate compared to peers.

EXAMPLE As flight travel stopped around the world, an inflight internet service provider proactively paused subscriptions during the month of April, a gesture that builds trust and demonstrates customer empathy.

3. Subscription companies facing headwinds in the current market are able to quickly pivot by creating new product bundles, introducing new pricing plans, and offering new promotions.

Within days, many subscription companies announced pricing discounts or free trials to help their customers adjust to the COVID-19 situation. Because subscriptions are not tied to any single product, companies have the flexibility to quickly adjust pricing plans to do right by their customers.

EXAMPLE With small businesses struggling to stay open, an auto information services company that serves dealerships proactively reduced pricing for all existing customers by 50% by mid-March.

4. Accelerating companies offer free trials as goodwill for the current crisis and as a tool to reach broader audiences amidst a crowded market.

As noted above, several segments such as OTT Video Streaming, Communication Software, and eLearning are seeing an Accelerated subscription growth rate due to COVID-19. Many of these companies have offered their content for free, or for extended free trials, to help consumers through the pandemic. By offering such trials or creating new pricing bundles during this time, these companies are also able to take advantage of the increase in demand by broadening the funnel and quickly capturing the time and attention of new subscribers.

EXAMPLE With shelter-in-place orders issued, a guitar learning application extended their 14-day subscription trial period to 3-months to help people develop a new hobby during their time at home.

EXAMPLE To enable teams working from home, a B2B software company quickly created a “Remote Work Bundle” that groups multiple offerings into one subscription, free of charge for the first 6 months.

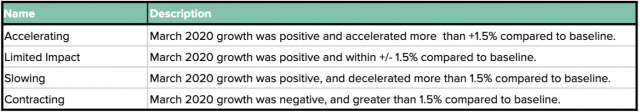

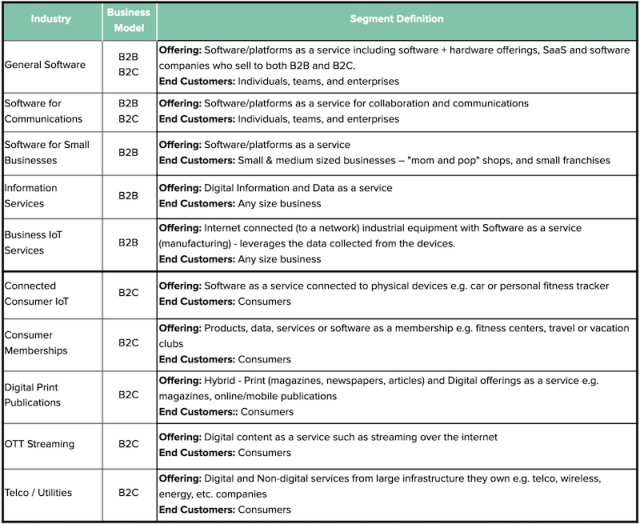

Appendix

Methodology: Our goal was to understand how the month of March, during which companies began reacting to COVID-19, has impacted the rate of net new subscription acquisition within an anonymized set of Zuora customers. In order to achieve this, we compared the net subscription growth of >700 companies before and after the Western onset of COVID-19. The comparative metrics we use are (a) the annual subscription growth rate for February 2019-February 2020 and (b) the implied annual growth rate from March 2020 data. After establishing these comparative metrics, we categorized each customer based on whether their March 2020 growth increased, decreased, or stayed close to their historical growth rate. We also examined industry growth rates by looking at industry groupings with at least a dozen companies and using the median growth rate for each group of customers. This is not the same methodology used for the Subscription Economy Index report. This analysis only included Zuora Billing customers who have been live for at least 6 months.