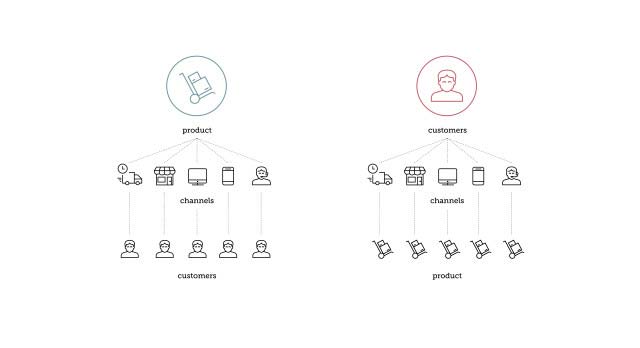

Why are so many large companies so inefficient when it comes to delivering a great customer experience? Because most of them are built backwards. Large corporations and OEMs are traditionally organized around product lines. This has a traditional logic to it. It allows management to have a direct line of sight into development cycles and sales performance, and thus provides for clear team ownership accountability.

But while this product-based approach has some benefits in terms of assessing core transactional issues, it comes at a tremendous cost. It creates a siloed organization that lack any kind of coordinated vision. It fosters internal competition for customers. And it contributes to a myopic mindset that blindsides management to sudden changes in the marketplace. Unfortunately, most of the time this structure also works. It doesn’t work particularly well when it comes to consumers like you or myself, but in some cases it can still ship units and keep board rooms happy. It is a functional but mediocre way of conducting business.

However, there is nothing more dangerous than successful mediocrity.

The new buyer - in search of ideal customer outcomes

Today’s buyers have changed. The golden era of post-war corporate dominance, when this original product-based management structure was created, was enabled by a relatively passive consumer base. This is clearly not the case anymore. Consumers now have the ability to price, critique and purchase anytime, anywhere. They increasingly value access, not ownership.

Enterprises need to re-organize themselves to reflect those changes. Companies have to integrate an rigorous focus on customer insight, satisfaction and success. A focus on ideal customer outcomes has to inform every aspect of the production cycle.

Instilling customer insight into the framework of your company

But while everyone publicly concurs that customer focus is enormously important, no one seems to be doing anything about it. How do you make the systemic changes needed to instill customer insight into the framework of your company?

First, it’s time to get rid of stand-alone business units. No more product groups with dedicated sales, marketing, and back-office support. Products are important, but they should not be dictating the way companies are structured.

Second, product divisions with dedicated profit and loss targets should be replaced by customer segment teams that are just as financially accountable.

Third, companies should be searching for new customer needs to address, not new features to implement. Foster institutional expertise in the people buying your products before you start designing new products for them.

Finally, the overall strategy of the organization should be how to create the best solution for the customer, not how to ship the best product.

This point is best illustrated by the above diagram. Traditional corporations on the left are concerned with shipping their product through channels to sell to anonymous customers. Progressive companies start with their customer’s wants and needs first then focus on their preferred news and purchasing channels, and then let those factors inform the design and implementation of their product.

The Age of the customer

I’m certainly not alone in my thinking. Forrester Research, which tracks roughly 85% of the global GDP, thinks we’re at the beginning of a new 20-year business cycle that they call “The Age of the Customer.” Similarly, the Kellogg School of Management has released a paper called “The Rise of the Consumer-Focused Enterprise” noting a broad, systemic shift in capital models pivoting towards serving a newly empowered generation of customers.

Zuora calls this the “Subscription Economy,” or the transformational shift towards ongoing services over stand-alone products. It’s happening right now, and management teams have to make some changes.