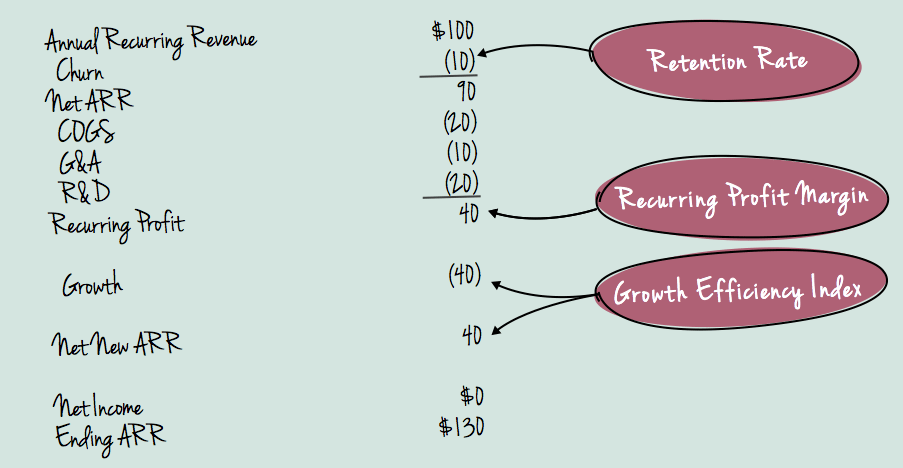

Recurring Profit Margins are simply the difference between your recurring revenues and your recurring costs. Leveraging this SaaS metric is critical. Why? The higher the recurring costs, the less money you have to play with — aka, book as profits or invest in one-time growth expenses. Let’s put it to use, in our example.

You’ve now got $90 to play with. But there’s some natural, recurring business costs that will eat away at that number pretty quickly.

You’re going to spend money to deliver your service so that you can earn the recurring revenue you’ll need to grow your business, aka COGS (Cost of Goods Sold). For a SaaS company, an example of a COGS would be the cost to maintain your data center. Let’s say you spend $20 here.

There’s also, General and Administrative (G&A) costs just to keep the lights on — literally. Things like rent for your office space and paying your finance team. Let’s say you spend $10 here.

And what about Research and Development (R&D). Not typically a recurring cost, but we’ve seen that most companies’ R&D organizations don’t fluctuate wildly over time, unlike departments like Marketing. Let’s budget $20 for your recurring R&D.

I’m sure you’re already ahead of me in the calculations, but these recurring costs have left you with $40, or a 40% recurring profit margin. And then the cycle begins again — now you know how much you can invest back in growth or book in profits for the year.