It used to be accepted wisdom that you don’t mess with your pricing too much. You don’t tweak the tiers.

In a 2015 HBR piece called “The Risk of Changing Your Prices Too Often,” Rice University Professor Utpal M. Dholakia noted that “customer reactions to cavalier pricing actions may make quick fluctuations unproductive at best, and inflict lasting damage to a company’s bottom-line at worst.”

Fair enough. But since that article was published, Netflix has gone from $8 to $25, and they don’t seem to be suffering any lasting damage to their bottom line! In fact, these days most big companies seem to be updating their pricing at least once a year. At the same time, however, they keep flaming out spectacularly – just take a look at Cursor or Instacart or Microsoft.

It’s a conundrum. If you sit still, you’re potentially leaving money on the table, while also telegraphing to your customers that you are essentially a static proposition, a glorified utility. But if you look like you’re trying to soak your list, you’ll get ugly comparisons to Delta or Ticketmaster.

It’s a clash! So what are you supposed to do? Should you stay or should you go?

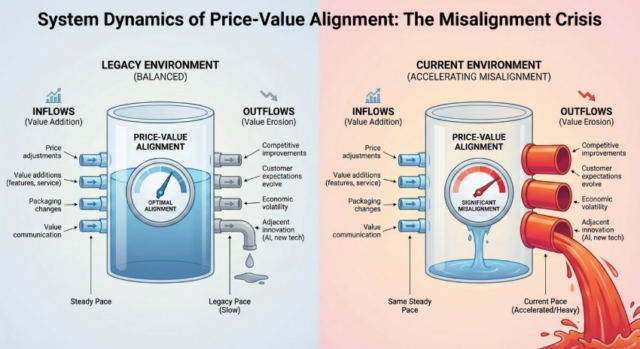

The System Dynamics of Price-Value Alignment

My colleague Amy Konary, the head of our Subscribed Institute, has a useful metaphor for thinking about price-value alignment. Think of it like water in a bathtub. Your goal is to keep it at the right level, the ideal balance between customer benefits and costs. Every day, however, that water is draining out because of:

- Competitors shipping new features

- Customer expectations shifting from what they see elsewhere

- Economic conditions changing what feels “worth it”

- Innovation in adjacent markets resetting reference points

So you restore alignment by adjusting what flows in:

- Changing your price or pricing model

- Adding new capabilities or services

- Improving quality or performance

- Reshaping packaging or scope

For decades, this system worked at a manageable pace. Competitive moves took quarters to materialize. Customer expectations evolved slowly. You could adjust prices annually, maybe add features twice a year, and maintain reasonable alignment.

That approach just doesn’t work anymore. In a world where companies can achieve $100 million in ARR in eight months, today all those outflows have accelerated:

- Competitors ship in weeks, not quarters

- Customers comparison shop continuously, not annually during renewal

- Economic volatility means “affordable” shifts monthly, not yearly

- Adjacent innovation (GPT releases, new automation tools) resets value perception constantly

Please note – it’s not just AI! AI is one accelerant among many: competitive velocity, economic volatility, continuous customer comparison shopping, faster innovation cycles. They’re compounding simultaneously. That’s why this feels different now.

But as we all know, lots of companies still operate their inflows at legacy speeds: annual price reviews, quarterly roadmaps, yearly packaging updates. As a result, their price-value alignment stock is depleting faster than they’re refilling it. Not because they’re doing anything wrong, but because the system dynamics have radically accelerated.

The companies that win aren’t necessarily better at predicting the right price. They’re better at maintaining alignment by adjusting at the speed their market actually moves.

So the answer is clear – when it comes to staying or going, you have to go. But here’s how to avoid flaming out in the process.

First, Map Your Market

You need a solid sense of the dynamics of your own market before you reprice. Map your specific outflows: How fast do competitors move? How often do customer budgets shift? What adjacent innovation affects your value perception? The faster your outflows, the more urgent your need for dynamic inflows.

Also note that you won’t be able to expand internationally without a new pricing scheme, which can often help to inform and optimize your domestic pricing page. Let your markets teach each other.

Think of Repricing as a Product Lever

Pricing is one of the most powerful product activation levers you have. It’s a huge chemistry set to play with: anchor pricing, introductory discounts, cohort trials. And you don’t necessarily have to raise your prices. A smart decrease can drive all kinds of new adoption and retention.

All technology becomes eventually becomes commodified, and that’s fine. Pass down the older functionality to your starter tiers without charging more (but let your customers know about the new stuff they’re getting for free). That’ll help lock in retention and only make your pro tiers that much more valuable.

Start with your new customers. Small, controlled tests (adjusting a tier, adding usage pricing, piloting new packages) can deliver enormous insights.

Make Repricing a Learned Behavior

One reason companies avoid pricing changes is the short-term disruption. Monetizely found that “pricing changes require retraining sales teams and creating new sales collateral,” often causing “a 5–10% temporary dip in sales productivity.”

But that’s what happens when you reprice only once every few years. If a change comes out of the blue after several years of static pricing, then of course it’s going to piss people off.

Make repricing a habitual, learned behavior. If pricing experiments happen regularly, they stop feeling like seismic shifts and start feeling like normal iteration. Continuous repricing builds muscle memory across finance, product, and sales teams. It turns pricing into an organizational capability, not a one-off event.

Navigating the Clash

Ultimately repricing isn’t about chasing revenue; it’s about staying aligned with value, and keeping that water level just right. It’s about learning what customers truly need and what they’re willing to pay for. Ultimately, you reprice in order to understand your customers better.

Yes, price changes carry risks. But static pricing is far riskier. In a fast-moving world, standing still is the most dangerous move you can make. So this year, take a hard look at your pricing page.

If you go, there might be trouble. But if you stay, there will be double.