Trends and emerging questions in streaming media in 2024

The streaming media industry isn’t just experiencing explosive growth; it’s also undergoing a strategic metamorphosis. As the digital landscape shifts beneath their feet, streaming services are adapting and innovating at an unprecedented pace. This article dives into the strategic changes and emerging challenges that platforms face as they navigate a marketplace teetering on saturation, economic fluctuations, and ever-evolving consumer preferences.

Economic conditions and consumer spending

The economic environment plays a crucial role in determining consumer behavior in the streaming media sector. Fluctuations in disposable income and rising living costs have led viewers to reassess their subscriptions, often favoring essential services over luxury entertainment options. This economic sensitivity forces streaming platforms to strategically adjust their pricing and subscription models to retain user engagement and reduce churn during times of financial uncertainty.

Consumer demand for subscriptions is under increasing pressure from economic externalities

- 6x – Median home price to median household income ratio in the United States

- 11.3% – The percent of disposable income spent on food, a 30-year record high

- 50% – Increase in credit card delinquencies

“Consumers are getting a bill and every month, or every two months or every year – they’re asking themselves a question: ‘Do I really need this, given how much else is going on in my world, and given what’s happening with my budget?’” says David Warren, Principal Director at Subscribed Institute, a Zuora think tank.

And it’s not just the consumer.

Rising costs and strategic challenges

One of the pressing challenges faced by streaming services is the escalating costs associated with content production and licensing. As the appetite for original, high-quality content grows, so does the financial burden on these platforms. The decline in traditional licensing revenue further complicates the economic landscape, prompting services to explore innovative content delivery and financing strategies that balance quality with cost-efficiency.

Zoom out: The squeeze on streamers

- External factors – Increasing production costs, declining licensed content revenue, lack of first-party customer data (this is starting to change; more on this), profitability pressure

- Internal factors – Market saturation, declining disposable income, seasonal viewership, original content from scale players

Insights from the Subscription Economy Index

Recent data from Zuora’s Subscription Economy Index (SEI) provides a revealing snapshot of the industry’s financial health. The report indicates that while traditional publishing media is experiencing stagnation, new media—particularly over-the-top (OTT) services—are witnessing substantial growth. This surge is attributed to consumer migration towards more flexible, content-rich digital platforms that offer a variety of viewing options. Understanding these trends is vital for streaming services aiming to capitalize on shifts in viewer habits and preferences.

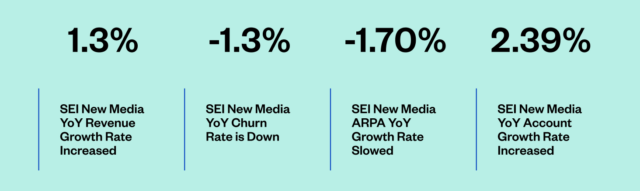

By the numbers: SEI New Media YoY Change in Growth (2022-23)

Source: Zuora/Subscribed Institute

Streamers and gaming companies reduced churn by 1.3%, showcasing effective customer retention strategies such as crackdowns on password sharing. Annual revenue per account (ARPA), however, was down, highlighting the market saturation pressures and challenges introducing new pricing strategies. However, New Media leads the charge in the overall media and entertainment space when it comes to net new subscriber growth – again – likely attributed to converting piggybacking customers into new paying subscribers and specialty content.

Leveraging first-party data for strategic advantage

The strategic use of first-party data has become a cornerstone of successful streaming operations. By collecting and analyzing user data, platforms can tailor their content and marketing strategies to better align with viewer preferences. This targeted approach not only enhances user satisfaction and retention but also optimizes resource allocation, directing investment towards content with the highest potential for success.

“Production costs have gone up and up over the last couple of years. We’re seeing a decline in licensing revenue, whereas in the last few years it was going flat,” Warren says. “Now, we’re seeing it start to dip, and so what a lot of companies are trying to do is they’re saying, ‘We have to get a lot smarter about who our customer is. We may understand the account, but we don’t really understand what’s going on in the household. So how can we start to collect more first-party data and use that not only to inform our marketing, but also to inform our product development?’”

Adapting to market dynamics: Current and future strategies

As the streaming market continues to evolve, platforms are increasingly adopting forward-thinking strategies to stay competitive.

- Scaling through bundling

- Driving premium through specialization

- Offering insight-driven “seasonal” packages

- Launching free ad-supported TV (FAST)

- Hybrid monetization models

So, what’s next?

Such strategies are designed to address the diverse financial capabilities and preferences of a global audience, ensuring wider accessibility and satisfaction. But the frustrating part of this – or exciting, depending on your disposition – is this industry won’t really know for sure until it happens. This is why having access to analytics, tracking it in real time, and possessing the agility to adjust to changes in demand and the greater market is paramount.

Only with that level of focus can streaming media companies not just survive but thrive in this competitive landscape. The ongoing transformation promises to redefine media consumption, offering more personalized, accessible, and engaging content experiences to viewers around the world.