By Ross Pert, Head of New Business Development at GoCardless

Outside of North America, Europe offers the largest addressable market for subscription businesses. 50% of people in France are moving away from traditional ownership, while in the UK, 78% of consumers now subscribe to a range of products and services. But although this economic shift mirrors the US, the specifics of how to maximize growth in these geographies differ greatly.

Certain payment methods prevalent in Europe not only help businesses maximize acquisition but also help increase the lifetime value of a subscriber by eliminating involuntary churn.

Churn affects all subscription businesses, but there are proactive ways to reduce this. Involuntary churn relates to issues and inefficiencies within the payment process itself and can be significantly reduced, and even prevented, once you understand the root cause.

Credit cards are one of the main factors driving involuntary churn. They have a finite lifespan. The details captured are not permanent and need to be renewed. What’s more, cards can be physically lost or stolen, get rejected by the bank, or encounter credit limits. In turn, these failures ultimately cause churn and eat into growth.

Which European bank-to-bank payment methods suit the subscription economy best?

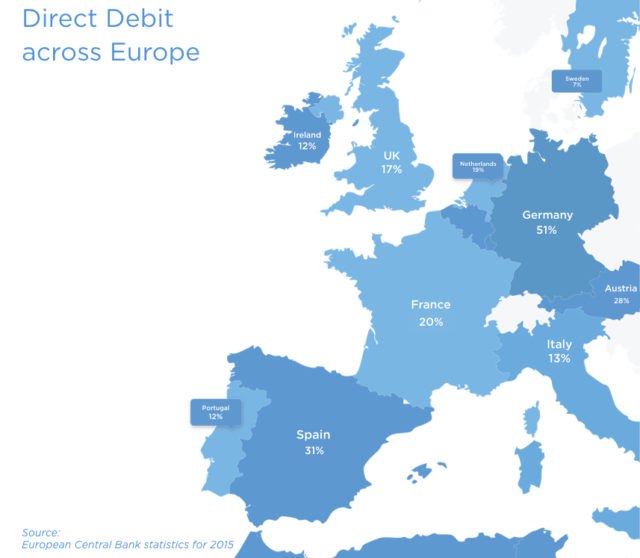

Designed specifically to handle recurring payments, Direct Debit is ideal for the subscription economy. It’s a bank-to-bank payment method, where the customer pre-authorises the merchant to collect payments directly from their bank account. Merchants access Direct Debit via geography-specific schemes. You’ve already heard of ACH in the US. The UK equivalent is Bacs, with SEPA in the Eurozone and Autogiro covering Sweden. Making up 23% of all European non-cash payments (European Central Bank – 2015 Payments Report), it can be vital to success.

The penetration of Direct Debit across Europe

Image Credit: European Central Bank – 2015 Payments Report

The GoCardless and Zuora integration

GoCardless provides a payment solution specifically designed for companies with a subscription business model. We are using bank to bank payments, specifically Direct Debit, to fundamentally support key metrics that drive success in the subscription economy.

The GoCardless functionality is integrated with Zuora to optimize and automate recurring payments. Large US clients like Box.com have used GoCardless to 10x their conversion in Europe whilst a global media company uses the same integration to achieve a payment failure rate of 0.5%.

Bank to bank payment methods like Direct Debit enable businesses to maximize customer acquisition across Europe, prevent involuntary churn and increase LTV. In fact, the GoCardless Churn Calculator found that reducing your monthly churn rate by just 1% can add millions of dollars to your revenue.

Join us for a webinar on May 31st at 10am PDT where we’ll explore the advantages of leveraging local payment methods to maximize customer acquisition and eliminate involuntary churn. Register now!